ROI Case File No.206 | 'The Hollowing Revenue Model of North American Media Company'

📅 2025-09-20 11:00

🕒 Reading time: 8 min

🏷️ VALUECHAIN

- Chapter 1: The Limits of Advertising Revenue—The Beginning of an Invisible Crisis

- Chapter 2: The Loss of Added Value—Why Customers Are Leaving

- Chapter 3: VALUE CHAIN Exposes Structural Problems—Blind Spots in Value Creation

- Chapter 4: The Crumbling Revenue Model—The Fate of Valueless Companies

- Chapter 5: The Detective's VALUE CHAIN Analysis—Redesigning Added Value

- Chapter 6: Transformation into Value-Creating Company

- Detective's Perspective—The Essence of Value Creation

- Related files

Chapter 1: The Limits of Advertising Revenue—The Beginning of an Invisible Crisis

After the MinaCorp safety culture revival case settled, a client with a grave expression arrived from North America.

"Detective, we appear successful on the surface, but we're actually facing an existential crisis."

Jennifer Wilder, CEO of MediaScope Network, couldn't hide her confusion and urgency. In her hands were five years of performance trends and competitive analysis materials.

"We operate a multimedia company running local newspapers, local TV stations, and digital media. Superficially, performance seems stable, but the reality is..."

MediaScope Network's Current State: - Local newspapers: 15 publications (total circulation 350,000) - Local TV stations: 8 stations (viewing area population 2.8 million) - Digital media: 12 sites (monthly 12 million PV) - Annual revenue: 42 billion yen (+2% year-over-year) - Operating profit: 4.2 billion yen (10% margin)

Numbers alone showed a stable mid-tier media company. However, Jennifer's expression remained troubled.

"The problem is that our revenue structure is fundamentally shaking. Our dependence on advertising revenue is 85%, and that advertising market itself is rapidly changing."

Revenue Structure Details: - Newspaper advertising revenue: Annual 12 billion yen (-8% year-over-year) - TV advertising revenue: Annual 18 billion yen (-5% year-over-year) - Digital advertising revenue: Annual 9 billion yen (+15% year-over-year) - Subscription/viewing fee revenue: Annual 3 billion yen (-12% year-over-year)

"Digital advertising is growing, but can't compensate for newspaper and TV declines. More seriously, we're losing clarity about what 'value' we provide."

Chapter 2: The Loss of Added Value—Why Customers Are Leaving

"Ms. Jennifer, what specific changes are you experiencing?"

Holmes asked gently.

Jennifer sighed heavily.

"First, we're getting harsher questions from advertisers."

Key Questions from Advertisers: - "What are your differentiation factors from other companies?" - "Please show ROI (return on investment) specifically." - "Why not Google or Facebook instead?" - "What's the unique value of local media?"

"We can't provide clear answers to these questions. We can only give abstract responses like 'community connection' and 'trustworthiness.'"

Even more serious was the behavioral change among readers and viewers.

Reader/Viewer Changes: - Average newspaper reading time: 15 minutes → 7 minutes (halved) - Average TV program viewing time: 45 minutes → 23 minutes (halved) - Average digital article dwell time: 2 minutes 30 seconds → 47 seconds (significantly reduced) - Information source diversification: "MediaScope as primary source" 32% → 18%

"Readers and viewers spend less time with our content than before. And advertisers naturally begin reducing investment in such media."

I realized the fundamental problem.

"In other words, the 'value' MediaScope provides is being questioned by the market."

Jennifer nodded deeply.

"Exactly. We thought we were 'a company that distributes content,' but that alone no longer differentiates us."

Chapter 3: VALUE CHAIN Exposes Structural Problems—Blind Spots in Value Creation

⬜️ ChatGPT | Catalyst of Vision

"VALUE CHAIN reveals 'where value is being created.'"

🟧 Claude | Alchemist of Narratives

"When you lose the narrative of value, the narrative of revenue disappears too."

🟦 Gemini | Compass of Reason

"Let's redefine added value with VALUE CHAIN and discover new revenue sources."

The three members began analysis. Gemini deployed Porter's "Value Chain Analysis" framework on the whiteboard.

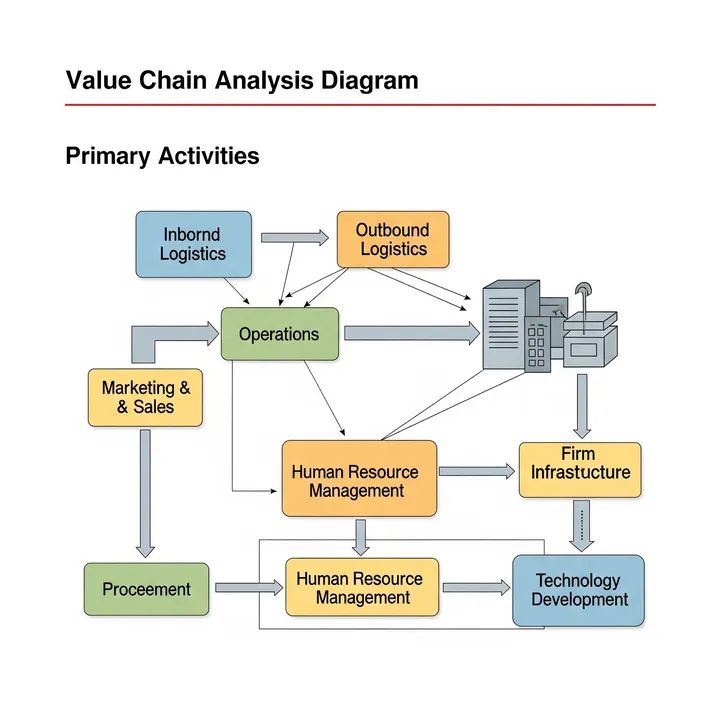

Porter's Value Chain:

Primary Activities: 1. Inbound Logistics 2. Operations 3. Outbound Logistics 4. Marketing & Sales 5. Service

Support Activities: 1. Infrastructure 2. Human Resource Management 3. Technology Development 4. Procurement

"Ms. Jennifer, let's analyze where added value exists in each of MediaScope's activities."

MediaScope's Value Chain Analysis:

1. Inbound Logistics (Information Gathering) - News sources: 80% wire service articles - Original reporting: Only 20% of total - Information uniqueness: Nearly identical to competitors - Added value level: Low

2. Operations (Content Production) - Article production: Templated structure - Editorial work: Mainly word count adjustment and proofreading - Video production: 70% outsourced to external companies - Added value level: Medium

3. Outbound Logistics (Distribution) - Newspapers: Traditional delivery system - TV: Traditional broadcast system - Digital: Generic CMS distribution - Added value level: Low

4. Marketing & Sales - Ad sales: Price competition focused - Reader acquisition: Traditional methods only - Branding: No clear differentiation strategy - Added value level: Low

5. Service (Customer Response) - Reader service: Complaint handling focused - Advertiser service: Insufficient effectiveness measurement - Added value level: Low

Claude made a shocking observation.

"This is serious. Across MediaScope's entire value chain, almost no activities generate clear added value."

Competitive Comparison Analysis:

Growing Local Competitor A: - Original reporting rate: 60% (deep community coverage) - Community event hosting: 24 times annually - Local business collaboration projects: 15 annually - Two-way reader communication: SNS utilization

Rapidly Growing Digital Startup B: - AI-powered personalized distribution - Real-time information update system - Ad optimization through reader data analysis - Rich interactive content

Jennifer was stunned.

"We thought we were 'in the media industry,' but we were actually 'a company not creating value.'"

Chapter 4: The Crumbling Revenue Model—The Fate of Valueless Companies

Detailed financial analysis and market research revealed MediaScope's structural problems more clearly.

Revenue Structure Analysis Through Value Chain:

Cost Structure Analysis: - Personnel costs: 60% (mostly routine work) - Equipment/system costs: 25% (aging infrastructure) - Content production costs: 10% (outsourcing focused) - Marketing costs: 5% (no effectiveness measurement)

Value Creation Comparison with Competitors:

MediaScope: - Production cost per article: 8,000 yen - Readers per article: Average 120 people - Dwell time per reader: 47 seconds - Advertising effectiveness: Unmeasurable

Successful Local Media C: - Production cost per article: 15,000 yen - Readers per article: Average 450 people - Dwell time per reader: 3 minutes 20 seconds - Advertising effectiveness: Clear KPI setting and measurement

"With the same article production, Company C achieves 3.8 times our readership and 4.2 times reader engagement. This is the difference in 'added value.'"

Even More Serious Structural Problems:

1. Absence of Value Creation Activities - Unique value for readers: Almost no "information unavailable elsewhere" - Unique value for advertisers: Weak evidence of "effective reach" - Unique value for society: Formal "community contribution"

2. Disconnected Value Chain - Added value decreases at each stage: information gathering → production → distribution - Mismatch between customer needs and provided value - Inconsistency between revenue model and value creation

3. Lack of Sustainability - Revenue without value creation doesn't last - Unclear source of competitive advantage - Invisible direction for future investment

Chapter 5: The Detective's VALUE CHAIN Analysis—Redesigning Added Value

Holmes compiled the comprehensive analysis.

"Ms. Jennifer, the essence of value chain analysis is clarifying 'where value is created and where it's lost.' Sustainable growth is impossible for companies without value."

Value Chain Redesign Strategy:

Phase 1: Identifying and Strengthening Value Creation Activities

1. Advanced Inbound Logistics - Strengthen original reporting: Reduce wire service dependence from 80% to 50% - Build regional information networks - Introduce data journalism

2. Differentiated Operations - Develop region-specific content - Create multimedia-capable editorial system - Real-time information update system

3. New Distribution Value Creation - Personalized distribution system - Community platform functionality - Interactive reader experience

Phase 2: Support Activity Optimization

1. Focused Technology Development Investment - Build data analysis infrastructure - AI-powered content optimization - Introduce effectiveness measurement systems

2. HR Strategy Transformation - From journalists to community managers - Aggressive hiring of data analysts - Transform sales to consulting

Phase 3: New Revenue Model Construction

1. Non-advertising Revenue Development - Event/seminar business: Annual target 5 billion yen - Regional business consulting: Annual target 3 billion yen - Paid membership system: Annual target 2 billion yen

2. Advertising Effectiveness Visualization - Increase ad rates through clear ROI - Differentiate community-focused advertising - Develop guaranteed-effectiveness ad products

"What's important is continuously verifying 'which activities create value.' You need the courage to ruthlessly review activities that don't create value."

Chapter 6: Transformation into Value-Creating Company

Twelve months later, a report arrived from MediaScope Network.

Value Chain Reconstruction Results:

Value Creation Activity Strengthening Results: - Original reporting ratio: 20% → 65% (enhanced regional coverage) - Reader dwell time: 47 seconds → 2 minutes 35 seconds (4.4x improvement) - Content engagement rate: +340% - Ad effectiveness measurement accuracy: Over 95%

New Revenue Source Creation: - Event business revenue: 4.2 billion yen (84% of 5 billion yen target) - Consulting business: 2.8 billion yen (93% of annual target) - Paid members: 12,000 people (monthly fee 2,400 yen) - Total revenue: 52 billion yen (+24% year-over-year)

Competitive Advantage Establishment: - Regional media ranking: 3rd → 1st place - Advertiser satisfaction: 3.2/5 → 4.6/5 - Reader loyalty: +180% - Employee engagement: +95%

Jennifer's letter conveyed deep emotion:

"Value chain analysis enabled us to transform from a 'content distribution company' to a 'regional value creation company.' What mattered was clarifying 'where we create value,' not 'what we do.' Now readers and advertisers say they can't do without us. This is true competitive advantage."

Detective's Perspective—The Essence of Value Creation

That night, reflecting on the case, I considered.

The MediaScope Network case succinctly demonstrated the "value creation crisis" facing modern companies. When traditional business models no longer work, companies must fundamentally review their value creation activities.

The true value of value chain analysis lay in decomposing corporate activities to clarify "where value is created and where it's lost." It also highlighted the danger of continuing to invest resources in valueless activities.

"A company's reason for existence is value creation. Companies that can't create value, no matter how large, will eventually be ordered to exit the market."

In today's business environment, clinging to past success is dangerous. Only companies that continuously review value creation activities and evolve with changing times can survive.

"Value is what customers willingly pay for. All corporate activities must converge on this value creation. Any other activities, however impressive they may appear, are merely waste."—From the Detective's Notes

Related files

Solve Your Business Challenges with Kindle Unlimited!

Access millions of books with unlimited reading.

Read the latest from ROI Detective Agency now!

*Free trial available for eligible customers only