ROI Case File No.207 | 'The Contradictory Route Expansion of Asian Aviation Industry'

📅 2025-09-20 23:00

🕒 Reading time: 8 min

🏷️ BSC

- Chapter 1: Expanding Route Networks—The Illusion of Growth

- Chapter 2: Growth Without Profit—Superficial Prosperity

- Chapter 3: BSC Shows Strategic Contradictions—Hidden Inconsistencies

- Chapter 4: Strategic Reevaluation—Escape from Growth Illusion

- Chapter 5: The Detective's BSC Analysis—Sustainable Route Expansion

- Chapter 6: Transformation to True Growth

- Detective's Perspective—The Wisdom of Balanced Growth

- Related files

Chapter 1: Expanding Route Networks—The Illusion of Growth

The week after the MediaScope Network value creation revival case was resolved, an unexpected request arrived from Asia.

"Detective, we should be growing steadily, yet why is there a sense of exhaustion permeating the workplace?"

Satoh Kenichi, Strategic Planning Director of AsiaSky Airlines, visited 221B Baker Street with a confused expression. In his hands were both impressive route expansion achievements and serious reports from the field.

"We've doubled our international routes over the past three years and are recognized as a notable growth company in the industry. Our stock price is also rising steadily."

AsiaSky Airlines' Growth Record: - Destination cities: 45 cities → 89 cities (98% increase) - Annual passengers: 8.5 million → 16.8 million (98% increase) - Revenue: 220 billion yen → 410 billion yen (86% increase) - Routes: 120 routes → 245 routes (104% increase)

The numbers certainly showed remarkable growth. However, Satoh's expression remained troubled.

"The issue is whether this growth is sustainable. We're hearing voices from the field that sound almost like screams, and customer satisfaction is declining."

Reports from the Field: - Flight attendant turnover rate: 12% → 28% (2.3x increase) - Flight trouble incidents: Monthly 8 cases → Monthly 32 cases (4x increase) - Customer complaints: Monthly 120 cases → Monthly 580 cases (4.8x increase) - Employee satisfaction: 4.2/5 → 2.8/5 (significant deterioration)

"Growth numbers and field reality don't align at all. What are we overlooking?"

Chapter 2: Growth Without Profit—Superficial Prosperity

"Mr. Satoh, please tell us about the criteria for route expansion decisions."

Holmes asked gently.

Satoh answered while taking out materials.

"Basically, we've made decisions based on 'market size' and 'competitive situation.' Our strategy is to actively develop routes in growth markets with few competitors."

Route Expansion Record (Past 3 years):

Southeast Asian Routes: - New openings: 32 routes - Average load factor: 78% - Profitability: 85% of target achieved

East Asian Routes: - New openings: 28 routes - Average load factor: 82% - Profitability: 92% of target achieved

Oceania Routes: - New openings: 15 routes - Average load factor: 68% - Profitability: 67% of target achieved

I noticed contradictions in the numbers.

"Load factors aren't bad, so why are there profitability challenges?"

Satoh's expression darkened.

"Actually, 'hidden costs' from route expansion have increased beyond expectations."

Hidden Cost Reality: - Additional crew training costs: Annual 1.2 billion yen (3x initial budget) - Flight management system complexity: Annual 800 million yen additional investment - Ground support outsourcing fees: Annual 1.5 billion yen (budget overrun) - Additional quality control personnel: Annual 600 million yen

"Even more serious is that existing route profitability is also deteriorating."

Impact on Existing Routes: - Main route load factors: 92% → 86% (resource dispersion effect) - Existing route profitability: -15% year-over-year - On-time performance: 94% → 87% (flight management complexity)

Chapter 3: BSC Shows Strategic Contradictions—Hidden Inconsistencies

⬜️ ChatGPT | Catalyst of Vision

"BSC is a 'lens for measuring strategy multidimensionally.' Success in one area doesn't guarantee overall success."

🟧 Claude | Alchemist of Narratives

"Stories have meaning only when chapters are consistent. Management narratives are the same."

🟦 Gemini | Compass of Reason

"Let's align indicators with BSC and ensure consistency between financial, customer, and internal aspects."

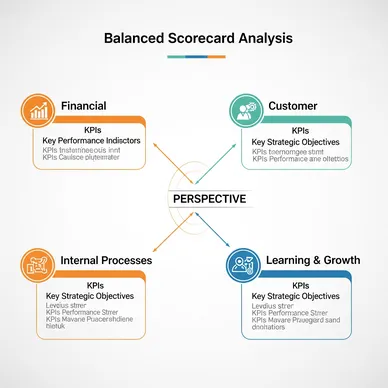

The three members began analysis. Gemini deployed the four perspectives of "Balanced Scorecard (BSC)" on the whiteboard.

Four BSC Perspectives: 1. Financial Perspective 2. Customer Perspective 3. Internal Process Perspective 4. Learning & Growth Perspective

"Mr. Satoh, let's analyze AsiaSky's current state from each perspective."

1. Financial Perspective - Revenue growth rate: +86% (target achieved) - Operating profit margin: 8.2% → 5.4% (deteriorated) - ROE: 12.3% → 7.8% (deteriorated) - Cash flow: -23% year-over-year (deteriorated)

2. Customer Perspective - Customer satisfaction: 4.1/5 → 3.2/5 (deteriorated) - On-time performance: 94% → 87% (deteriorated) - Customer repeat rate: 68% → 52% (deteriorated) - Brand recognition: +15% (improved)

3. Internal Process Perspective - Flight efficiency: Deteriorated due to complexity - Quality control: Trouble incidents quadrupled - Risk management: Poor new route risk management - Decision-making speed: Slowed due to organizational expansion

4. Learning & Growth Perspective - Employee satisfaction: 4.2/5 → 2.8/5 (significantly deteriorated) - Turnover rate: 12% → 28% (significantly deteriorated) - Skill development: Training system can't keep up - Organizational capability: Can't keep pace with route expansion speed

Claude made a sharp observation.

"This is a typical 'growth trap.' Pursuing only some financial indicators (revenue) has caused deterioration in all other three perspectives."

Root Problems Revealed by BSC Analysis:

Strategic Inconsistency: - Financial goal: "Revenue expansion" - Customer value: "Quality and service" - Internal processes: "Efficiency and safety" - Organizational capability: "Sustainable growth"

These four elements contradicted each other, causing organizational confusion.

Chapter 4: Strategic Reevaluation—Escape from Growth Illusion

As detailed investigation progressed, AsiaSky's problems proved even more serious.

Detailed Analysis by BSC Perspective:

Financial Perspective Detailed Problems: - Behind superficial revenue growth, profit margins significantly deteriorated - New route investment recovery period: Initially projected 3 years → Actually 7-8 years - Working capital deterioration: Cash flow pressure - Investment efficiency: ROI 15% → 6% (significantly deteriorated)

Customer Perspective Detailed Problems: - Route expansion reduced service quality for existing customers - New route recognition insufficient: Average 23% (competitors at 45%) - Drawn into price competition: Average unit price -12% - Significant customer loyalty decline

Internal Process Perspective Detailed Problems: - Flight management complexity: +340% delay rate - Safety management system dilution: Increased incident reports - Quality control limitations: Check systems can't keep up - Decision process confusion: Approval time doubled

Learning & Growth Perspective Detailed Problems: - Human resource development can't keep up with expansion speed - Organizational culture dilution: Reduced founding philosophy penetration - Knowledge management dysfunction - Decreased innovation creation capability

Satoh was stunned.

"We were conducting 'destruction' in the name of 'growth.'"

Competitor Comparison:

Competitor C achieving sustainable growth: - Route expansion: Annual 5-7 routes (cautious expansion) - Four-perspective balance: Improvement trends in all areas - Employee satisfaction: Continuous improvement - Profitability: Stable high levels maintained

Competitor D that failed with rapid expansion: - Similar rapid expansion strategy as AsiaSky - Large-scale restructuring and route cuts after 2 years - Stock price crash and management change - Currently under reconstruction

Chapter 5: The Detective's BSC Analysis—Sustainable Route Expansion

Holmes compiled the comprehensive analysis.

"Mr. Satoh, the essence of BSC is 'strategic consistency.' Sustainable growth becomes possible only when the four perspectives support each other."

BSC Integrated Strategy Reconstruction Plan:

Phase 1: Ensuring Strategic Consistency (6 months)

1. Financial Perspective Normalization - Shift to profitability focus: From revenue expansion to profit margin improvement - Route portfolio review: Withdraw from 15 unprofitable routes - Strict investment criteria: ROI 12%+ as mandatory condition

2. Customer Perspective Strengthening - Prioritize service quality improvement for existing customers - New routes require clear customer value differentiation - Achieve 95%+ on-time performance

3. Internal Process Optimization - Integration and simplification of flight management systems - Quality control system reconstruction - Thorough safety management strengthening

4. Learning & Growth Foundation Building - Employee satisfaction improvement as top priority KPI - Double human resource development investment - Organizational culture reconstruction

Phase 2: Integrated Growth Strategy Implementation (12 months)

BSC Balanced Expansion Strategy: - Annual new routes limited to 15 or fewer - Set KPIs for all four perspectives for each new route - Quarterly BSC evaluation for course correction

Four-Perspective Linked KPI Design: - Financial: Route-specific ROI and company-wide profit margin - Customer: Satisfaction and on-time performance - Process: Flight efficiency and safety indicators - Learning: Employee satisfaction and skill improvement

"What's important is prioritizing long-term sustainability over short-term growth. BSC is the compass for maintaining that balance."

Chapter 6: Transformation to True Growth

Eighteen months later, a report arrived from AsiaSky Airlines.

BSC Integrated Strategy Results:

Financial Perspective Normalization: - Operating profit margin: 5.4% → 11.2% (significant improvement) - ROI: 6% → 14% (investment efficiency improvement) - Cash flow: +45% year-over-year (significant improvement) - Stock price: Continued long-term upward trend

Customer Perspective Improvement: - Customer satisfaction: 3.2/5 → 4.4/5 (significant improvement) - On-time performance: 87% → 96% (target achieved) - Customer repeat rate: 52% → 74% (significant improvement) - Brand value: +35% improvement

Internal Process Optimization: - Flight troubles: Monthly 32 cases → Monthly 6 cases (significant reduction) - Flight efficiency: +28% improvement - Quality control: Unified through integrated system - Decision-making speed: +40% improvement

Learning & Growth Foundation Establishment: - Employee satisfaction: 2.8/5 → 4.1/5 (dramatic recovery) - Turnover rate: 28% → 9% (significant improvement) - Training system: Systematized career paths - Innovation proposals: Monthly 3 cases → Monthly 18 cases

Satoh's letter conveyed gratitude:

"BSC analysis enabled us to transform from 'quantitative growth' to 'qualitative growth.' By maintaining balance across four perspectives, we're achieving true sustainable growth. While route numbers decreased short-term, we've built a stronger corporate foundation long-term. We've fundamentally reconsidered the meaning of growth."

Detective's Perspective—The Wisdom of Balanced Growth

That night, reflecting on the case, I considered.

The AsiaSky Airlines case vividly demonstrated the "growth illusion" modern companies often fall into. The danger of losing overall balance while pursuing single indicator improvements.

BSC's true value lies in evaluating corporate strategy multidimensionally and maintaining consistency across perspectives. The four perspectives of financial, customer, process, and learning & growth aren't independent—they exist in organic relationships that influence each other.

"True growth means harmonious improvement across all perspectives. Growth pursuing only one perspective will eventually cause overall collapse."

In today's business environment, we tend to be swayed by short-term numbers. However, achieving sustainable growth requires long-term balanced management. BSC is a practical framework that provides that guidance.

"Strategy is about making choices. And the criterion for choice lies in long-term value creation. The role of true managers is to pursue sustainable balance without being misled by short-term results."—From the Detective's Notes

Related files

Solve Your Business Challenges with Kindle Unlimited!

Access millions of books with unlimited reading.

Read the latest from ROI Detective Agency now!

*Free trial available for eligible customers only