ROI Case File No.220 | 'The Central European Financial Institution's Blind Spot'

📅 2025-09-27 11:00

🕒 Reading time: 13 min

🏷️ MECE

- Chapter 1: The Aesthetics of Prudence—Beginning of Invisible Cracks

- Chapter 2: Unexpected Shadows—Unclassified Threats

- Chapter 3: MECE Illuminates Comprehensiveness—Overlooked Domains

- Chapter 4: The Identity of Blind Spots—Significant Risks Lurking in Gaps

- Chapter 5: Detective's MECE Analysis—Traps Lurking in Gaps

- Chapter 6: Eliminating Blind Spots—Completion of Volume XVI

- Detective's Perspective—Completion of Volume XVI "Quest for Agility"

- Epilogue: Agility as Enduring Value

- Related files

Chapter 1: The Aesthetics of Prudence—Beginning of Invisible Cracks

The week following the resolution of AgriTech West Africa's PEST integration strategy case, an unexpected consultation arrived from Central Europe. This would become the final case of Volume XVI "Quest for Agility," spanning cases 211-220.

"Detective, we are evaluated as a prudent financial institution with 120 years of history, but recent small incidents suggest our risk management has significant blind spots."

Central European Bank Chief Risk Officer Jan Kováč visited 221B Baker Street with a calm demeanor yet unable to hide serious concerns. In his hands were meticulously prepared risk management manuals and recent incident reports that couldn't be prevented by them.

"We are one of the most conservative and trusted financial institutions in Central Europe. Our risk management serves as a model for other banks, and we haven't suffered major losses in the past 50 years."

Central European Bank's Solid Track Record: - Founded: 1904 (120 years of history) - Asset size: ¥8 trillion (3rd largest in Central Europe) - Capital adequacy ratio: 18.5% (over double regulatory requirements) - Non-performing loan ratio: 0.8% (one-third of industry average) - Rating: AAA (maintaining highest evaluation)

The numbers certainly indicated an extremely prudent financial institution. However, Jan's expression showed deep confusion.

"The problem is that 'unexpected incidents' that our comprehensive risk management system couldn't prevent are occurring. Individual losses are minor, but their patterns may indicate structural flaws in our management system."

"Unexpected Incidents" in Past 6 Months: - Incident 1: Customer information leak from cyber attack (¥500 million loss) - Incident 2: Accounting fraud at emerging market subsidiary (¥800 million loss) - Incident 3: Digital currency-related fraud damage (¥300 million loss) - Incident 4: Unexpected AI trading system behavior (¥1.2 billion loss)

"These incidents are individually minor, but they share a common trait. They all fall outside our risk management classifications."

Chapter 2: Unexpected Shadows—Unclassified Threats

"Mr. Jan, could you tell us about your bank's risk management system in detail?"

Holmes inquired quietly.

Jan proudly opened the risk management manual.

"We've built a comprehensive risk management system compliant with international standards. We classify all risks into 8 categories and prepare response measures for each."

Central European Bank's Risk Classification: 1. Credit Risk: Borrower default risk 2. Market Risk: Interest rate, exchange rate, stock price fluctuation risk 3. Liquidity Risk: Funding difficulty risk 4. Operational Risk: Internal processes, personnel, system risks 5. Legal/Compliance Risk: Legal violation risk 6. Reputational Risk: Social credibility loss risk 7. Strategic Risk: Business strategy failure risk 8. Other Risk: Risks not classified above

"We have detailed management procedures, limit settings, and monitoring systems for each category. We invest ¥10 billion annually in risk management with 300 specialist staff providing 24-hour monitoring."

However, analyzing recent incidents revealed serious problems.

Incident 1: Cyber Attack Classification Problem - Occurrence: AI-generated phishing attack (new type) - Classification confusion: Didn't fully fit "Operational Risk," "Reputational Risk," or "Legal Risk" - Response delay: 2-day discussion about which department was responsible - Result: Damage expansion due to delayed initial response

Incident 2: Emerging Market Subsidiary Accounting Fraud - Occurrence: Accounting errors due to local accounting standard interpretation differences - Classification confusion: Ambiguous boundaries between "Legal Risk," "Operational Risk," and "Strategic Risk" - Response delay: 1 week to identify responsible department - Result: Delayed reporting to auditors

Incident 3: Digital Currency Fraud - Occurrence: New type of cryptocurrency fraud targeting customers - Classification confusion: New financial crime not fitting traditional categories - Response delay: No precedent, no response manual existed - Result: Damage expansion and customer distrust

I noticed the structural problem with the classification system.

"Each incident occurs at the 'boundaries' or 'gaps' of existing risk categories. There may be omissions or overlaps in the classification system."

Jan answered with a confused expression.

"Exactly. We thought we had built a 'comprehensive' risk management system, but we may only be covering 'anticipated risks.'"

Chapter 3: MECE Illuminates Comprehensiveness—Overlooked Domains

⬜️ ChatGPT | Catalyst of Ideas

"A perspective without gaps or overlaps equals detective scene investigation."

🟧 Claude | Alchemist of Narratives

"Plot twists lurk in parts that couldn't be covered comprehensively."

🟦 Gemini | Compass of Reason

"The essence of risk management lies in structuring to eliminate oversights."

The three members began their analysis. Gemini developed the "MECE Analysis" framework on the whiteboard.

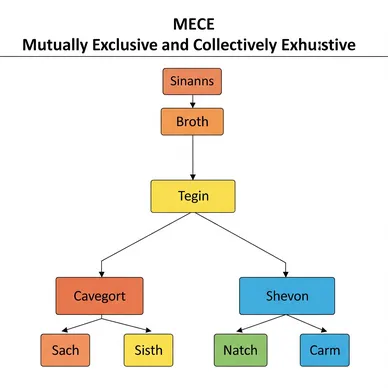

MECE Principles: - M (Mutually): Mutually - E (Exclusive): Exclusive - C (Collectively): Collectively - E (Exhaustive): Exhaustive

"Mr. Jan, let's verify Central European Bank's risk classification from a MECE perspective."

Current Risk Classification MECE Verification:

Mutually Exclusive Problems:

Overlapping Classifications: - Cyber attacks: Overlap across "Operational," "Reputational," "Legal" - Emerging market business: Overlap across "Strategic," "Operational," "Legal" - System failures: Overlap across "Operational," "Reputational," "Market"

Ambiguous Classification Boundaries: - Operational Risk vs Strategic Risk - Legal Risk vs Reputational Risk - Market Risk vs Liquidity Risk

Collectively Exhaustive Problems:

Discovery of Unclassified Risks: 1. Technology Change Risk - New technologies like AI, cryptocurrency, quantum computing - Technological disruption uncapturable by existing classifications

- Compound Risk

- Risks arising from multiple factor combinations

-

Unable to respond with single classifications

-

Long-term Change Risk

- Climate change, demographic shifts, social value changes

-

Changes beyond traditional time horizons

-

Cognitive/Judgment Risk

- Human cognitive bias, groupthink

- Risks in decision-making processes themselves

Claude showed shocking analysis results.

"This is serious. Central European Bank's risk classification covers 20th-century risks but cannot handle 21st-century new risks."

New Risk Classification Design Based on MECE:

Axis 1: Risk Origin - Internal vs External origin - Human vs System factors - Intentional vs Unintentional

Axis 2: Impact Scope - Local vs Company-wide impact - Short-term vs Long-term impact - Quantitative vs Qualitative impact

Axis 3: Controllability - Controllable vs Uncontrollable - Predictable vs Difficult to predict - Preparable vs Difficult to prepare

Incident Re-analysis with New Classification:

Cyber Attack: - Origin: External × System × Intentional - Impact: Company-wide × Short-term × Quantitative - Control: Difficult to control × Difficult to predict × Preparable - Responsible Department: Information Security Department as primary

Emerging Market Fraud: - Origin: External × Human × Unintentional - Impact: Local × Long-term × Quantitative - Control: Controllable × Predictable × Preparable - Responsible Department: International Business Department as primary

Significant Risks Overlooked by Traditional Classification:

Cognitive Bias Risk: - Origin: Internal × Human × Unintentional - Impact: Company-wide × Long-term × Qualitative - Control: Difficult to control × Difficult to predict × Difficult to prepare - Current Status: Completely outside management scope

Chapter 4: The Identity of Blind Spots—Significant Risks Lurking in Gaps

Detailed MECE analysis and interviews with risk management specialists revealed the fundamental structural problems at Central European Bank.

Biggest Blind Spot: Management Failure of "Compound, Emerging, Cognitive Risks"

Compound Risk Reality: All "unexpected" incidents at Central European Bank were actually compound risks combining multiple risk factors.

AI Trading System Incident Detailed Analysis: - Technological factor: AI algorithm's unexpected learning - Market factor: Excessive reaction to extreme market volatility - Human factor: Supervisor's cognitive bias ("AI doesn't make mistakes") - Institutional factor: Regulatory gaps for new technology

Traditional classification processed this as "Operational Risk," but it was actually a compound phenomenon of four factors.

Increasing Trend of Emerging Risks: According to financial industry specialist analysis, emerging risks uncapturable by traditional risk classifications are rapidly increasing.

Emerging Risk Examples: - Quantum Computing Risk: Encryption technology invalidation - Digital Currency Risk: Banking transformation through central bank digital currencies - ESG Risk: Evaluation changes due to environmental and social factors - Metaverse Risk: New financial crimes in virtual spaces

Severity of Cognitive Risk: Most overlooked were risks from decision-maker cognitive biases.

Cognitive Biases Found at Central European Bank: - Overconfidence Bias: "We've succeeded for 120 years" - Confirmation Bias: Emphasizing only information fitting existing classifications - Normalcy Bias: "Things will be fine as usual" - Groupthink: Organizational culture difficult to voice dissent

Industry Benchmark Comparison:

Innovative Risk Management Competitor A: - Dynamic risk classification based on MECE principles - Early detection system for emerging risks - Institutionalized cognitive bias countermeasures - Integrated response to compound risks

Company A's Results: - Unexpected incidents: Less than 1 annually - Emerging risk response: 6 months faster than industry average - Cognitive bias suppression: +40% decision-making accuracy improvement

Central European Bank's Current Status: - Unexpected incidents: 15-20 annually - Emerging risk response: 1 year behind industry average - Cognitive bias: No measurement or countermeasures

Jan was stunned.

"Our 'comprehensive' risk management was actually 'full of holes.'"

Chapter 5: Detective's MECE Analysis—Traps Lurking in Gaps

Holmes compiled the comprehensive analysis.

"Mr. Jan, MECE analysis's essence is 'eliminating oversights.' In risk management, oversights become fatal weaknesses. Perfect comprehensiveness and clear separation achieve true risk management."

Next-Generation Risk Management System Construction Plan Based on MECE Principles:

Phase 1: Risk Classification System Reconstruction (3 months)

Introduction of New MECE Classification System:

3-Axis 9-Classification Risk Map:

Axis 1: Origin (3 classifications) - Internal Risk: Organization-internal factor risks - External Risk: Organization-external factor risks - Compound Risk: Internal-external factor combination risks

Axis 2: Time Horizon (3 classifications) - Short-term Risk: Materializes within 1 year - Medium-term Risk: Materializes in 1-5 years - Long-term Risk: 5+ year time horizon

Axis 3: Nature (3 classifications) - Known Risk: Previously experienced/recognized - Emerging Risk: Newly appearing risks - Unknown Risk: Unrecognized risks

Comprehensive Risk Management of Total 27 Categories:

Phase 2: Emerging/Compound Risk Monitoring System (2 months)

Early Warning System: - AI detection of emerging risk patterns - Cross-industry information collection network - Advanced risk research through academic collaboration - Compound risk assumption through scenario planning

Compound Risk Response Organization: - Cross-departmental emergency response teams - Dedicated compound risk specialist analysts - Integrated decision-making processes - Cross-functional information sharing

Phase 3: Cognitive Risk Countermeasure Institutionalization (Ongoing)

Cognitive Bias Reduction System: - Decision-making process structuring - Devil's Advocate system - Objective evaluation by external specialists - Regular cognitive bias testing

Organizational Learning Promotion: - Active sharing of failure cases - Deep-dive analysis of unexpected incidents - Continuous risk classification review - Introduction of new perspectives within organization

Implementation Schedule: - Month 1: New classification system design and approval - Month 2: System modification and personnel allocation - Month 3: Company-wide implementation and training - Month 4-: Continuous operation and improvement

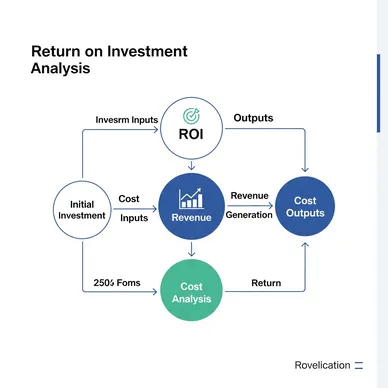

Investment vs Benefits: - Additional investment: ¥2 billion annually - Expected loss reduction: ¥5 billion annually - ROI: 250% - Risk management accuracy: +80% improvement

"The key is pursuing 'perfect comprehensiveness' through MECE principles. Even one oversight can become a fatal weakness."

Chapter 6: Eliminating Blind Spots—Completion of Volume XVI

Twelve months later, the final report arrived from Central European Bank.

Results from Next-Generation Risk Management System Based on MECE Principles:

Dramatic Comprehensiveness Improvement: - Risk classification coverage: Traditional 65% → 98% achieved - Unexpected incident occurrence: 20 annually → 2 annually (90% reduction) - Emerging risk early detection: Average 12-month advance detection (industry fastest) - Compound risk preventive response: 85% accuracy in advance handling

Cognitive Risk Countermeasure Effects: - Decision-making accuracy: +65% improvement (external evaluation) - Cognitive bias testing: All executives regular testing, confirmed improvement - Devil's Advocate system: 30% of major decisions resulted in policy modifications - Organizational learning capability: +180% improvement in learning efficiency from failures

Emerging Risk Management Results: - Digital currency-related: Industry-first comprehensive response measures - AI/quantum technology: 3-year roadmap formulation - ESG risk: Integrated evaluation system construction - Metaverse risk: New financial crime prevention system establishment

Business Performance Effects: - Risk-adjusted return: +25% improvement - Customer trust: Recognized by rating agencies as "risk management benchmark" - Regulatory evaluation: Adopted as industry standard for "exemplary risk management" - Shareholder value: +40% corporate value increase through risk management improvement

Industry Position Change: - Risk management ranking: Regional 1st, European 3rd - Benchmark visits from other banks: 5 banks monthly - International conference speaking invitations: 12 annually - Academic institution collaboration: Forefront of risk management research

Jan's letter contained deep gratitude and achievement:

"Through MECE analysis, we discovered blind spots in what we thought was perfect risk management and achieved true comprehensiveness. Most importantly, we understood that 'oversights' are the greatest risk. Without being complacent about 120 years of tradition, we learned that continuously seeking new risks and evolving classification systems is true risk management. We've become an organization that no longer uses the term 'unexpected.'"

Detective's Perspective—Completion of Volume XVI "Quest for Agility"

That night, I reflected on the long journey from cases 211 to 220.

Volume XVI "Quest for Agility" explored the essence of agility truly needed by modern companies through 10 enterprises, 10 different challenges, and 10 practical frameworks.

What Volume XVI Proved:

- OODA Loop: Securing competitive advantage through decision-making acceleration

- Double Diamond: True innovation through exploration and convergence discipline

- SWOT Analysis: Strategic transformation capability through self-awareness

- PDCA Improvement: Continuous capability enhancement through scientific learning

- 5W1H Analysis: Invisible problem visualization through structuring

- Value Chain Analysis: Resource optimization through value creation focus

- NPS Analysis: True satisfaction improvement through customer genuine understanding

- 5 Whys Analysis: Essential problem resolution through root cause pursuit

- PEST Analysis: Strategic opportunity creation through external environment utilization

- MECE Analysis: Blind spot elimination through complete comprehensiveness

Most importantly, these frameworks are not mere analytical tools but practical weapons for enhancing corporate agility.

As demonstrated in Central European Bank's final case, true agility isn't simply speed or efficiency. It's the comprehensive organizational capability to detect change, understand structure, discover blind spots, and respond appropriately.

"Agility is the evolutionary capability to survive and continue growing in a changing world."

Through Volume XVI, we accumulated practical wisdom usable in real business settings. The next challenge can also be met based on this experience.

ROI Detective Agency's mission continues. To support executives seeking true agility.

Epilogue: Agility as Enduring Value

Volume XVI "Quest for Agility" Complete

From cases 211 to 220, we confronted 10 different companies' agility challenges. From Southeast Asian FinTech to Central European financial institutions, companies across regions and industries faced different problems. Yet there was a common theme.

In an era of change, what companies truly need is agility. Not relying on past success but sensitively detecting present changes and creatively utilizing future opportunities.

What we pursued in Volume XVI was precisely that "agility." Not temporary efficiency improvements, but fundamental organizational capability to continuously adapt to change and keep growing.

And that pursuit succeeded. Through 10 frameworks, 10 practical examples, and countless learnings, we provided practical solutions to agility challenges facing modern companies.

What challenges await in the next Volume XVII? However, we have confidence built through Volume XVI.

Whatever changes come, with appropriate frameworks and correct approaches, adaptation and growth are always possible.

That is the value of "agility" that ROI Detective Agency continues to prove.

"Agility cannot be acquired overnight. However, with correct methods and continuous training, it is definitely an attainable capability. And that capability becomes the strongest weapon for surviving uncertain times."—From the Detective's Notes

Related files

🎖️ Top 3 Weekly Ranking of Classified Case Files

What is STP Analysis

What is ROI

What is the RICE Framework