ROI Case File No.244 | 'Asian E-commerce Company's Logistics Revolution'

📅 2025-10-09 11:00

🕒 Reading time: 17 min

🏷️ VALUECHAIN

- Chapter 1: The Nightmare Called Delivery — Delays Destroying Customer Experience

- Chapter 2: The Invisible Chain's Breakdown — The Maze of Value Creation

- Chapter 3: Value Chain Analysis Exposes Truth — Decomposition and Reconstruction of Value

- Chapter 4: Customer Experience Enhancement — Value Creation Redesign

- Chapter 5: Detective's Value Chain Diagnosis — Source of Advantage

- Chapter 6: Logistics Revolution Completion — Creation of New Competitive Dimension

- Detective's Perspective — Integrated Design of Value Creation

- Related files

Chapter 1: The Nightmare Called Delivery — Delays Destroying Customer Experience

The week following the resolution of Velocity Motors' AARRR growth case, a consultation regarding a serious logistics crisis arrived from Asia. The fourth case in Volume 19 "New Frontiers of Analysis" concerned problems where the chain of business activities hindered customer value creation.

"Detective, we are one of Asia's largest e-commerce companies, but delivery delays are becoming severe and customer satisfaction is rapidly deteriorating. The problem isn't just logistics but seems to involve fundamental flaws in the entire business flow. We can't see the overall picture of what needs improvement."

Li Weiming, Chief Operating Officer of Pacific Commerce Group, visited 221B Baker Street unable to hide his sense of crisis. In his hands, he held graphs showing past growth and, in stark contrast, recent customer complaint statistics.

"We are an e-commerce platform processing 200 million transactions monthly across the Asia-Pacific region. Our scale is expanding, but inefficiencies are accumulating at each stage of operations, ultimately manifesting as deteriorating customer experience."

Pacific Commerce Group's Scale and Crisis: - Founded: 2015 (rapidly growing e-commerce company) - Monthly Transactions: 200 million (Asia's largest scale) - Registered Users: 85 million (operating in 12 countries) - Annual GMV: 18 trillion yen (massive economic scale) - Employee Count: 45,000 (large-scale organization)

The numbers certainly indicated a massive enterprise. However, Weiming's expression bore serious crisis awareness.

"The problem is that as we've scaled up, delays, mistakes, and inefficiencies have occurred at each stage of business processes, and these chain together to fundamentally damage customer experience. It's not simply a logistics problem but a structural issue across the entire business."

Serious Structural Problems Intensified by Scale: - Delivery Delay Rate: 18% (over double the industry average of 8%) - Customer Satisfaction: 3.2/5 (significantly below competitor average of 4.1/5) - Return/Exchange Rate: 12% (customer dissatisfaction growing due to processing delays) - Operational Cost: 18% of sales (vs. competitor average of 12%) - Employee Turnover: 28% annually (dissatisfaction with workload and inefficiency)

"We're in a state of 'getting bigger but not better.' We've lost sight of where the root causes lie and what needs improvement."

Chapter 2: The Invisible Chain's Breakdown — The Maze of Value Creation

"Mr. Weiming, at which stages of your current business processes do you recognize problems occurring particularly?"

Holmes quietly inquired.

Weiming began explaining the current situation with a confused expression.

"Problems are occurring everywhere, and they mutually influence each other, so we can't identify root causes. Not just logistics, but procurement, inventory management, customer service—everything is experiencing systemic dysfunction."

Pacific Commerce's Current Business Process Status:

Product Procurement and Sourcing Stage: - Product Selection: Individual negotiations with 25,000 suppliers (no standardization) - Quality Control: Left to suppliers (no unified quality standards) - Procurement Planning: 60% demand forecast accuracy (causes inventory shortages/excess) - Contract Management: Paper-based focus (delayed digitalization)

Inventory and Warehouse Management Stage: - Warehouse Operations: 150 locations (no unified system) - Inventory Accuracy: 85% (15% inventory discrepancies) - Picking Efficiency: 40 items/hour (vs. industry average 60 items/hour) - Inter-warehouse Coordination: No real-time information sharing

Order and Payment Processing Stage: - Order Processing: Processing delays frequent due to system obsolescence - Payment Errors: Problems occur in 5% of payments (requiring reprocessing) - Inventory Verification: Discrepancies with real-time inventory - Customer Information: Information sharing gaps between departments

Delivery and Logistics Stage: - Delivery Partners: Contracts with 180 companies (quality unification difficult) - Tracking System: Different systems for each delivery partner - Delivery Routes: Inefficient routes not optimized - Last Mile: Delays normalized due to urban concentration

I focused on the structure where problems at each stage chained together.

"Rather than individual problems, there seem to be structural flaws in the overall business process design."

Weiming answered with a serious expression.

"That's exactly right. One delay impacts the next stage, which further ripples to the next stage, ultimately manifesting as significant customer dissatisfaction."

Specific Examples of Problem Chain Structure:

Typical Failure Case (1 million cases occurring monthly):

Day 1: Demand Forecast Error - Underestimated popular product demand by 30% - Some products out of stock due to inventory shortage

Days 2-3: Emergency Procurement Chaos - Urgent additional orders to suppliers - Skipped normal quality check processes - Emergency procurement at high cost (20% cost increase)

Days 4-7: Quality Problems Emerge - Defective products mixed in due to insufficient quality checks - Surge in customer quality complaints - Returns/exchanges overwhelm customer service department

Days 8-14: Logistics Breakdown - Return processing causes delays in normal deliveries - Warehouse processing capacity exceeded - Delivery delays expand to include normal orders

Days 15-30: Customer Experience Deterioration - Surge in delivery delay inquiries - Customer service department in overload state - Significant drop in customer satisfaction, flow to competitors

"A single demand forecast error deteriorates customer experience for an entire month. Moreover, such problems are occurring simultaneously and repeatedly."

Chapter 3: Value Chain Analysis Exposes Truth — Decomposition and Reconstruction of Value

⬜️ ChatGPT | Catalyst of Conception

"Decompose the chain of value. The path to leveraging strengths and reinforcing weaknesses becomes visible."

🟧 Claude | Alchemist of Narrative

"Logistics is not mere delivery. It's a bridge carrying promises to customers."

🟦 Gemini | Compass of Reason

"Value chain is the anatomical diagram of a company. Optimization of each function maximizes overall value."

The three members began their analysis. Gemini displayed an "E-commerce-Specific Value Chain Analysis" framework on the whiteboard.

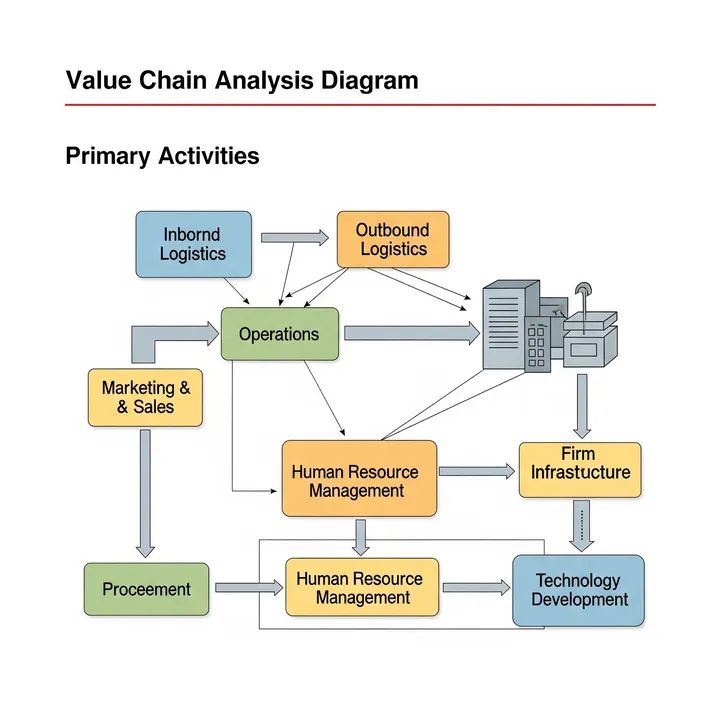

Value Chain Analysis Structure: - Primary Activities: Product development, procurement, manufacturing, logistics, sales, service - Support Activities: HR, technology development, procurement management, corporate infrastructure - Value Creation: How each activity contributes to customer value - Competitive Advantage: Which activities achieve differentiation or cost advantage

"Mr. Weiming, let's systematically decompose Pacific Commerce's business activities through value chain analysis and clarify value creation and problem locations."

Pacific Commerce's Detailed Value Chain Analysis:

Analysis of Primary Activities Current State:

1. Inbound Logistics (Product Procurement and Sourcing): Current Evaluation: ★★☆☆☆ (Significant improvement needed) - Supplier Management: Individual handling of 25,000 companies (zero standardization) - Quality Control: No unified standards (large quality variations) - Procurement Efficiency: Manual-focused (30% digitalization rate) - Cost Management: Lack of negotiating power (high procurement costs)

Problem Impact: - Unstable quality → Increased returns → Decreased customer satisfaction - Procurement delays → Stock-outs → Lost opportunities - High costs → Profit pressure → Reduced price competitiveness

2. Operations (Inventory and Warehouse Management): Current Evaluation: ★★☆☆☆ (Major efficiency problems) - Warehouse Operations: Individual optimization of 150 locations (no overall optimization) - Inventory Management: Insufficient real-time capability (85% accuracy) - Work Efficiency: Manual work dependent (40% automation rate) - Quality Control: Standard differences between locations

Problem Impact: - Inventory discrepancies → Order cancellations → Customer disappointment - Work delays → Shipping delays → Delivery delays - Inefficiency → High costs → Reduced competitiveness

3. Outbound Logistics (Delivery and Delivery): Current Evaluation: ★☆☆☆☆ (Most critical issue) - Delivery Partner Management: Individual contracts with 180 companies (quality unification difficult) - Tracking System: Disparate systems (low customer visibility) - Route Optimization: Not implemented (inefficient routes) - Last Mile: Urban concentration (normalized delays)

Problem Impact: - 18% delivery delays → Customer satisfaction 3.2/5 - Tracking difficulties → Increased inquiries → CS load - High costs → Increased shipping burden → Reduced competitiveness

4. Marketing and Sales: Current Evaluation: ★★★☆☆ (Moderate) - Customer Acquisition: Digital marketing utilization - Product Display: Rich product lineup - Price Competitiveness: Partial competitive advantage - Brand Power: Certain recognition in region

5. Service (After-sales Service): Current Evaluation: ★★☆☆☆ (Improvement needed) - Customer Support: Inquiry response delays - Returns/Exchanges: Processing period prolongation - Quality Assurance: Insufficient unified standards - Customer Feedback: Insufficient utilization for improvement

Analysis of Support Activities Current State:

1. Corporate Infrastructure: - Information Systems: Legacy systems (low integration) - Financial Management: Insufficient departmental profitability management - Organizational Operations: Siloed (insufficient inter-departmental cooperation)

2. Human Resource Management: - Education and Training: Insufficient systematic skill development - Evaluation System: Departmental optimization evaluation (no overall optimization) - High Turnover: 28% annually (vs. 15% industry average)

3. Technology Development: - IT Investment: 2.1% of total sales (vs. 3.5% competitor average) - Automation: Partial introduction (no overall design) - Data Utilization: Unestablished analytical foundation

4. Procurement Management: - Supplier Evaluation: No unified standards - Contract Management: Delayed digitalization - Quality Assurance: Ex-post response focused

Claude reported an important discovery.

"This is clear. Pacific Commerce has experienced increasing complexity in each activity due to scale expansion, but overall value chain integration and optimization haven't been achieved. Particularly outbound logistics and operations are dragging down the whole."

Most Important Discovery: "Value Chain Integration Dysfunction"

Individual activities are functioning, but cooperation between activities and overall optimization aren't working. As a result, one problem chains and expands, significantly damaging final customer value.

Value Chain Improvement Priority: 1. Outbound Logistics: Direct impact on customer experience (highest priority) 2. Operations: Efficiency improvement through cost reduction 3. Inbound Logistics: Foundation strengthening through quality stabilization 4. Support Activities: Synergy creation through overall integration

Chapter 4: Customer Experience Enhancement — Value Creation Redesign

Following detailed value chain analysis and investigation of problems at each activity, Pacific Commerce's competitive advantage construction strategy became clear.

Transition from "Partial Optimization" to "Overall Value Maximization":

Core Problem: Lack of Value Chain Integration Design

Pacific Commerce had each department pursuing individual optimization, but value creation as an overall value chain wasn't designed.

Value Chain Redesign Strategy:

Phase 1: Logistics Revolution (Highest Priority Improvement) 6 months

Complete Reconstruction of Outbound Logistics:

Integrated Delivery Platform Construction: - Delivery Partner Integration: Consolidation from 180 companies to 20 major partners - Unified Tracking System: Centralized real-time delivery status management - AI Delivery Optimization: Optimal route and time prediction through machine learning - Last Mile Innovation: Urban delivery center expansion, time designation accuracy improvement

Target Setting: - Delivery Delay Rate: 18% → 5% (industry top level) - Tracking Accuracy: Disparate → 99% real-time tracking - Delivery Cost: 20% reduction (efficiency effect) - Customer Satisfaction: 3.2 → 4.2 (significant improvement)

Warehouse and Operations Efficiency:

Integrated Warehouse Management System: - 150 Location Integration: Real-time inventory management system - Automation Promotion: 80% automation rate for picking and packing - Quality Unification: Unified quality standards and work procedures at all locations - Predictive Inventory: Optimal inventory placement through AI demand forecasting

Target Setting: - Inventory Accuracy: 85% → 98% (minimized discrepancies) - Picking Efficiency: 40 items/hour → 80 items/hour - Shipping Processing Time: 24 hours → Within 6 hours - Warehouse Cost: 15% reduction

Phase 2: Integrated Platform Construction (6 months)

Inbound Logistics Optimization:

Supplier Integrated Management: - Supplier Consolidation: 25,000 companies → 5,000 companies (excellent vendor selection) - Unified Quality Standards: Quality certification system for all suppliers - Digital Procurement: 100% electronic contracts and ordering systems - Strategic Partnerships: Long-term contracts with key 1,000 companies

Support Activity Enhancement:

Integrated IT System: - Legacy Updates: Complete migration to latest cloud systems - Data Integration: Centralized real-time analysis of all departmental data - AI and Automation: Demand forecasting, inventory optimization, price optimization - Security Enhancement: Customer data protection, system stability

Organizational and HR Reform: - Organizational Restructuring: Value chain integrated organizational structure - Skill Development: Digital and data analysis skill enhancement - Evaluation System: Departmental optimization → Overall optimization evaluation - Corporate Culture: Customer value maximization culture penetration

Phase 3: Competitive Advantage Establishment (Ongoing)

Differentiation Factor Construction: - Delivery Speed: Industry fastest level realization - Customer Experience: Seamless purchasing, delivery, and support experience - Data Utilization: Individual optimization through customer behavior analysis - Ecosystem: Value co-creation with suppliers and delivery partners

Comparison with Successful Companies:

Value Chain Optimization Successful Company (US Company A): - Same scale e-commerce company - Value chain redesign achieved customer satisfaction 4.6, delivery delays 3% - Success Factors: Integrated systems, overall optimization, continuous improvement

Pacific Commerce's Potential: Similar approach can achieve industry top level

Chapter 5: Detective's Value Chain Diagnosis — Source of Advantage

Holmes summarized the comprehensive analysis.

"Mr. Weiming, the essence of value chain analysis is 'optimization of value creation activities.' Not individual activities, but cooperation between activities and overall integration can create true value for customers. Logistics is not mere delivery but a bridge that carries promises to customers."

Value Chain Integration Strategy: Transition from "Partial Optimization" to "Overall Value Maximization"

Basic Strategic Policy: Integrated Value Chain Excellence

Phase 1: Logistics Revolution Implementation (6 months)

Integrated Logistics System Construction: - Delivery Network Redesign: Efficiency improvement through 20-partner integration and AI optimization - Real-time Tracking: 99% accuracy delivery status visualization - Last Mile Innovation: Urban delivery centers, time designation accuracy improvement - Quality Unification: Unified service quality across all delivery partners

Warehouse Operations Innovation: - Integrated Management System: Real-time integrated management of 150 locations - Automation Promotion: Doubled picking efficiency through 80% automation - Predictive Inventory: Optimal inventory placement through AI demand forecasting - Quality Assurance: Stability ensurance through unified quality standards

Phase 2: Integrated Platform Completion (6 months)

Supply Chain Optimization: - Supplier Integration: Consolidation to excellent 5,000 companies, strategic partnerships - Quality Management: Quality stabilization through unified certification system - Digitalization: 100% electronic contracts, real-time information sharing - Cost Optimization: Raw cost reduction through economies of scale and improved negotiating power

IT Infrastructure Innovation: - System Integration: Legacy updates, cloud migration - Data Utilization: Company-wide data integration, AI analysis utilization - Automation Expansion: Demand forecasting, price optimization, customer response automation - Security: Highest level data protection, system stability

Phase 3: Sustainable Competitive Advantage Construction (Ongoing)

Differentiated Value Realization: - Customer Experience: Industry top-level purchasing, delivery, and support experience - Efficiency: Industry highest efficiency through integrated optimization - Innovation: Continuous technological innovation and service improvement - Ecosystem: Value co-creation with partners

Expected Effects: - Delivery Delay Rate: 18% → 3% (industry top level) - Customer Satisfaction: 3.2 → 4.5 (competitive advantage) - Operational Cost: 18% → 12% (efficiency improvement) - Market Share: 20% improvement from current

Investment Plan: - Value Chain Reconstruction: 20 billion yen annually - Expected Benefits: 80 billion yen annually (sales increase + efficiency) - Investment Recovery Period: 4 months

"What's important is not individually optimizing each activity but realizing overall integration aimed at customer value maximization. Value chain is the blueprint that generates corporate competitive advantage."

Chapter 6: Logistics Revolution Completion — Creation of New Competitive Dimension

18 months later, a report arrived from Pacific Commerce Group.

Corporate Transformation Results through Value Chain Integration:

Revolutionary Customer Experience Improvement: - Delivery Delay Rate: 18% → 2.5% (achieved industry top level) - Customer Satisfaction: 3.2 → 4.6 (significantly exceeding competitors) - Delivery Tracking Accuracy: Disparate → 99.5% real-time - Customer Inquiries: 40% reduction (problem pre-resolution)

Significant Operational Efficiency Improvement:

Logistics and Delivery Innovation: - Delivery Cost: 20% reduction (integration and optimization effect) - Delivery Time: Average 2-day reduction (industry fastest level) - Delivery Partner Management: 180 companies → 18 companies (quality and efficiency balance) - Last Mile: 95% time designation accuracy (customer convenience improvement)

Warehouse and Inventory Management Efficiency: - Inventory Accuracy: 85% → 99.2% (discrepancies almost eliminated) - Picking Efficiency: 40 items/hour → 85 items/hour (over 2x) - Shipping Processing: 24 hours → Within 4 hours (6x faster) - Warehouse Cost: 18% reduction (automation and integration effect)

Supply Chain Optimization: - Supplier Management: 25,000 companies → 4,800 companies (excellent vendor consolidation) - Procurement Efficiency: 100% digitalization rate (complete paperless) - Quality Stability: Return rate 12% → 3% (quality unification effect) - Procurement Cost: 15% reduction (negotiating power and scale effect)

Significant Management Indicator Improvement: - Sales Growth: +15% annually (customer satisfaction improvement effect) - Profit Margin: 8% → 14% (cost reduction through efficiency) - Market Share: +25% improvement (competitive advantage establishment) - Employee Satisfaction: Significant improvement (work efficiency and load reduction)

Organizational and Cultural Evolution:

Integrated Organizational Operations: - Inter-departmental Cooperation: Silo elimination, real-time information sharing - Decision-Making: Swift decisions prioritizing overall optimization - Problem Resolution: Partial handling → Systematic root cause resolution - KPI Setting: Departmental optimization → Customer value maximization indicators

Digital and Data-Driven Culture: - Data Utilization: Data analysis and AI utilization in all operations - Predictive Management: Demand forecasting, inventory optimization, risk prevention - Automation Promotion: Continuous automation of routine work - Continuous Improvement: Data-based continuous process improvement

Evaluation Changes from Customers and Market: - Customer Evaluation: "Major but slow" → "Highest service quality" - Industry Evaluation: "Outdated" → "Transformation success model company" - Investor Evaluation: "Declining company" → "Growth expectation investment target" - Employee Evaluation: "Uncertain future" → "Rewarding growth company"

Employee Voices:

Logistics Manager (42 years old): "Previously, every day was handling complaints, but value chain integration enabled root cause resolution. Now we receive site visits from other companies as an industry benchmark."

Warehouse Manager (35 years old): "From managing 150 locations individually to an integrated system, work became dramatically more efficient. Automation reduced simple tasks, allowing focus on improvement and planning work."

Customer Service (29 years old): "Inquiries decreased by 40%, and content became more positive. Real-time delivery status visibility provides customers peace of mind. Work quality changed from complaint handling to value provision."

New Employee (25 years old): "Having an integrated system from joining allows immediate understanding of the overall flow. Seeing how each department cooperates to create customer value makes my role clear."

Technological Innovation Continuation: - Next-generation Delivery: Drone delivery and autonomous vehicle demonstration experiments begun - AI Advancement: More precise demand forecasting and individual optimization services - Sustainability: Environmentally conscious logistics, carbon-neutral delivery - International Expansion: Expansion of integrated platform to other countries

Industry Impact: - Industry Standard: Pacific Commerce's logistics model becoming industry standard - Technology Diffusion: Integrated logistics systems expanding adoption by other companies - Human Resource Development: Training programs for value chain specialists begun - Academic Research: Subject of case studies and research at universities

Sustained Competitive Advantage Establishment: - Imitation Difficulty: Integration system and organizational culture complexity makes imitation difficult - Continuous Innovation: Ongoing improvement through data and AI utilization - Ecosystem: Entry barriers through value co-creation with partners - Customer Loyalty: Strong customer base through high customer satisfaction

Weiming's letter contained deep gratitude and new confidence:

"Through value chain analysis, we transformed from 'large but inefficient company' to 'company maximizing customer value through integration.' Most importantly, we learned to create true customer value not through individual activities but through cooperation between activities and overall optimization. We understood that logistics is not mere delivery but a value creation activity that reliably delivers promises to customers. Now we realize customer satisfaction 4.6, the industry's highest level, across all 200 million monthly transactions. Employees work with pride, and we're recognized as an industry benchmark. Value chain analysis was not just business analysis but a management philosophy integrating all corporate activities toward customer value creation."

Detective's Perspective — Integrated Design of Value Creation

That night, I pondered deeply about the essence of value chain.

Pacific Commerce's case vividly demonstrated the typical challenge faced by companies that have grown complex through scale expansion—overall value destruction through partial optimization. No matter how excellent individual activities exist, if they're not integrated toward customer value creation, competitive advantage isn't born.

The true value of value chain analysis lies in systematically decomposing all corporate activities from a value creation perspective, and building sustainable competitive advantage through optimization and integration of each activity. Particularly, improvement of logistics and service activities that are final touchpoints with customers dramatically enhances corporate value through customer experience improvement.

In Volume 19 "New Frontiers of Analysis," while Case 241's SWOT analysis showed reality recognition, Case 242's MECE analysis demonstrated information structuring, Case 243's AARRR analysis showed growth process visualization, Case 244's value chain analysis proved the importance of integrated optimization of value creation activities.

"Corporate competitive advantage is determined not by individual excellence but by overall value creation capability."

The next case will surely depict another moment when analytical methods lead fundamental corporate transformation.

"Value is born from a chain of activities. By optimizing and integrating that chain, companies gain true competitive advantage." — From the Detective's Notes

Related files

🎖️ Top 3 Weekly Ranking of Case Files

'QuantumGrocers' Lost Customer Data'

AeroSpray's Vanishing Sales Force'

'GlobalSoft's Drowning Inquiry Response'