ROI Case File No.250 | 'Competitive Strategy of a Central European Startup'

📅 2025-10-12 11:00

🕒 Reading time: 20 min

🏷️ 3C

- Chapter 1: Intensifying Competition—A Startup Losing Its Positioning

- Chapter 2: The 3C Perspective—Three Axes to Organize Chaos

- Chapter 3: Deep Customer Understanding—True Needs and Value Criteria

- Chapter 4: Differentiation from Competitors—Establishing Unique Position

- Chapter 5: Detective's 3C Diagnosis—Establishing Advantage

- Chapter 6: Strategic Advantage Establishment—Completion of Volume XIX

- Detective's Perspective—Summary of Volume XIX "New Frontiers of Analysis"

- Related articles

Chapter 1: Intensifying Competition—A Startup Losing Its Positioning

The week after resolving WanderTech Asia's AIDMA implementation case, another consultation arrived from Central Europe regarding competitive strategy. This final case of Volume XIX, "New Frontiers of Analysis," the milestone 250th episode, dealt with the challenge of establishing competitive advantage in an intensifying market.

"Detective, we are a Central European FinTech solutions startup, but the rapid growth of competitors has left us unable to see our position in the market. We need to organize the relationships among customers, competitors, and ourselves to develop a survival strategy."

TechFlow Solutions co-founder Jan Novák, from the Czech Republic, visited 221B Baker Street with undisguised urgency. In his hands were reports showing rapidly changing market conditions and confused competitive analysis materials.

"We provide financial management and payment solutions for SMEs in Central and Eastern Europe. We were confident in our technology and initial market share, but the entry of major players and emergence of new companies have made strategic restructuring urgent."

TechFlow Solutions' Current Status and Market Confusion: - Founded: 2020 (Central European FinTech startup) - Business Domain: Financial management, payments, and accounting automation for SMEs - Market Coverage: Czech Republic, Slovakia, Poland, Hungary - Customer Base: 8,500 companies (regional mid-tier level) - Annual Revenue: 4.5 billion yen (maintaining stable growth)

The numbers certainly showed a degree of success. However, Jan's expression bore deep anxiety.

"The problem is that the market environment has changed dramatically this past year, and everything has become ambiguous—what our competitive advantage is, which customer segments we should target, who we should compete against."

Strategic Confusion Due to Market Environment Changes: - Major Player Entry: International giants like Microsoft and SAP entered the Central European market in earnest - Startup Emergence: 5-10 new FinTech companies entering the market monthly - Customer Needs Evolution: COVID-19 rapidly expanded and diversified digitalization needs - Price Competition Intensification: Proliferation of free/low-cost services increased price pressure - Regulatory Changes: EU financial regulation changes increased compliance costs

"We've lost sight of 'for whom, with what, and how we win.' We're losing our sense of purpose amid market chaos."

Chapter 2: The 3C Perspective—Three Axes to Organize Chaos

"Mr. Novák, how do you currently understand the situations of customers, competitors, and your company regarding market conditions?"

Holmes asked quietly.

Jan began explaining the current situation with a perplexed expression.

"We've collected information on each, but analyzing them separately means we can't see the overall picture or interrelationships. Even when trying to formulate strategy, the fundamental grasp of current conditions is confused."

Current Analysis Status (Fragmented, Non-integrated):

Customer Recognition Confusion: - Target Definition: Ambiguous definition of "SMEs" - Needs Understanding: No grasp of consistent trends through individual request responses - Segment Analysis: No systematic analysis by industry, size, or region - Satisfaction Measurement: No regular customer satisfaction surveys

Competitor Recognition Confusion: - Competitor Definition: Unclear distinction between direct and indirect competitors - Strengths/Weaknesses Analysis: Only superficial feature comparisons - Strategy Analysis: Insufficient understanding of competitors' strategies and intentions - Market Trends: No analysis of new entry/exit impacts

Company Recognition Confusion: - Strengths/Weaknesses: Primarily subjective self-assessment - Management Resources: No objective evaluation of people, assets, capital, technology - Competitive Advantage: Ambiguous recognition of differentiation factors - Future Potential: Insufficient analysis of growth possibilities and limiting factors

I focused on the lack of relationship analysis among the three elements.

"Each element is understood, but their interrelationships and strategic implications remain invisible."

Jan answered with a serious expression.

"Exactly. We have individual information, but we can't integrate it to derive strategy."

Specific Problems from Lack of Integrated Analysis:

Strategic Direction Confusion: - Customer Segments: Unfocused approach of "serving all SMEs" - Value Proposition: Unclear differentiation through feature enumeration - Competitive Strategy: No basic policy on who to compete with and how - Investment Allocation: Unclear priorities for R&D, sales, and marketing

Reactive Competitor Response: - Microsoft Entry: Unable to predict major player strategy/impact, responding reactively - Startup Emergence: Underestimating disruptive innovation from small companies - Price Competition: Caught in price wars, declining profit margins - Feature Competition: Development resources scattered in feature addition battles

Ambiguous Customer Value Delivery: - Unclear Value: Unable to explain to customers "why choose TechFlow" - Needs Mismatch: Gap between what customers truly seek and delivered value - Declining Satisfaction: Reduced relative attractiveness through competitor comparisons - Increasing Attrition: Existing customer defection to competitors continues at 2-3% monthly

⬜️ ChatGPT | Catalyst of Conception

"Customer, competitor, company. Survey the battlefield from these three axes, and the winning opportunity emerges."

🟧 Claude | Alchemist of Narrative

"Competition is three-dimensional chess. Only by grasping the overall structure can the next move be determined."

🟦 Gemini | Compass of Reason

"3C analysis is the foundation of strategy. Only with this base can sustainable advantage be built."

The three members began analysis. Gemini developed a "FinTech Industry-Specific 3C Analysis" framework on the whiteboard.

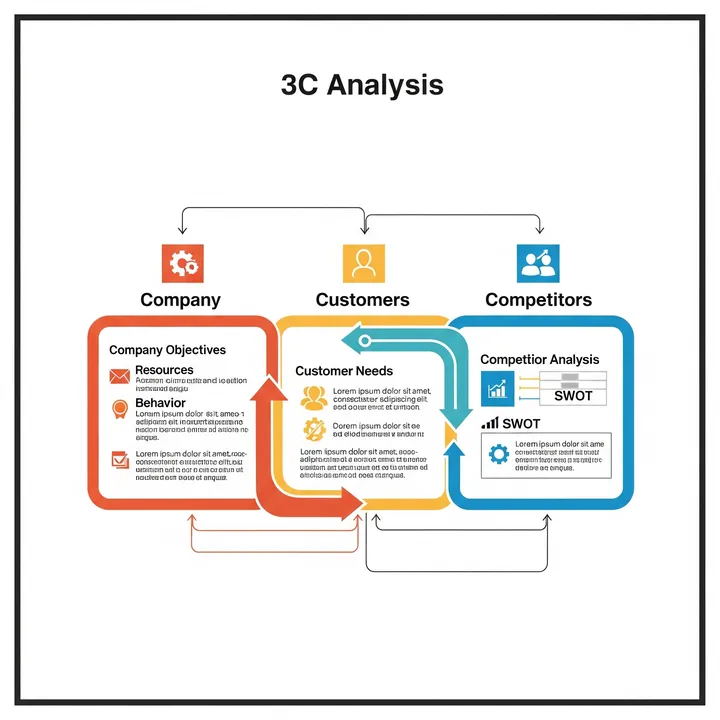

3C Analysis Integrated Framework: - Customer: Needs, segments, purchasing behavior, value evaluation - Competitor: Strategy, strengths/weaknesses, market position, future trends - Company: Management resources, capabilities, competitive advantage, constraints - 3C Integration: Interrelationships, strategic opportunities, direction for competitive advantage building

"Mr. Novák, let's systematically organize TechFlow Solutions' market situation through integrated 3C analysis and clarify the strategy for establishing competitive advantage."

Chapter 3: Deep Customer Understanding—True Needs and Value Criteria

TechFlow Solutions' Integrated 3C Analysis:

Detailed Customer Analysis:

Customer Segment Redefinition:

Previous Ambiguous Segments: - "SMEs" (all industries with 10-500 employees) - "Companies with financial management challenges" - "Companies wanting to advance digitalization"

Precise Segments Through 3C Analysis:

Segment A: Growth-Stage Startups (10-50 employees) - Needs: Flexible financial systems that can handle rapid growth - Purchase Criteria: Implementation speed, scalability, cost-performance - Decision Makers: CEO/CFO (quick decisions) - Price Sensitivity: High (10,000-50,000 yen monthly limit) - Growth Potential: High (+200% annual growth segment)

Segment B: Stable-Stage SMEs (50-200 employees) - Needs: Efficiency and automation of existing systems - Purchase Criteria: Stability, support structure, existing system integration - Decision Makers: Accounting Manager/System Administrator (careful consideration) - Price Sensitivity: Medium (50,000-200,000 yen monthly appropriate) - Growth Potential: Medium (+15% annual growth)

Segment C: Traditional Industry Enterprises (200-500 employees) - Needs: Regulatory compliance and compliance enhancement - Purchase Criteria: Security, audit compliance, legal compliance - Decision Makers: Management/IT departments (long consideration process) - Price Sensitivity: Low (200,000-500,000 yen monthly acceptable) - Growth Potential: Low (+5% annual growth)

Discovery of Customer Value Evaluation Criteria:

Functional Value Criteria: - Ease of Implementation: Immediate use without complex setup - Operability: Intuitive UI/UX with low learning costs - Integration: Coordination with existing systems, banks, accounting software - Automation: Manual work reduction, error prevention, efficiency improvement

Emotional Value Criteria: - Sense of Security: Trust in data security and system stability - Growth Feeling: Expectation as tool contributing to business growth - Expertise: High-quality service based on financial/accounting expertise - Partnership: Business support beyond mere tool provision

Detailed Competitor Analysis:

Competitor Classification and Strategy Analysis:

Tier 1: International Major Players - Microsoft (Power Platform + Dynamics): - Strategy: Market dominance through existing Office user base utilization - Strengths: Brand power, capital, existing customer base, integration - Weaknesses: SME-specific needs response, price, implementation complexity - Threat Level: High (risk of losing large enterprise customers)

- SAP (Business One):

- Strategy: SME capture through downsizing of large enterprise ERP

- Strengths: Rich ERP functionality, global standards, industry-specific features

- Weaknesses: High price, complexity, long implementation period

- Threat Level: Medium (threat to high-function requirement customers)

Tier 2: Regional Specialized Players - 3 Regional Established Software Companies: - Strategy: Long-term regional focus, existing customer retention, phased digitalization - Strengths: Regional knowledge, existing customer relationships, customization - Weaknesses: Technology innovation lag, UI/UX, cloud response - Threat Level: Medium (competition in existing customer retention)

Tier 3: Emerging FinTech Companies - 5-10 New Monthly Entrants: - Strategy: Specific feature specialization, free/low-price, rapid feature additions - Strengths: Latest technology, agility, innovation, price competitiveness - Weaknesses: Reliability, capital, comprehensiveness, support structure - Threat Level: High (disruptive impact through price competition and feature innovation)

Detailed Company Analysis:

Objective Evaluation of Management Resources and Capabilities:

Technical Resources and Capabilities: - Development Team: 25 members (including 8 senior engineers) - Tech Stack: Modern cloud-native architecture - Patents/IP: 2 patents related to payment processing optimization - Technical Advantage: Deep understanding and response to Central European regulations and tax systems

Sales and Marketing Resources: - Sales Team: 12 members (region-focused direct sales structure) - Marketing: 3 members (digital marketing focus) - Brand Recognition: Medium regional recognition (approximately 15%) - Customer Relations: Direct relationships with 8,500 companies, high customer satisfaction

Financial and Organizational Resources: - Capital: 18 months of operating funds secured - Organization: 45 members (balanced composition of technology, sales, support) - Corporate Culture: Startup agility and customer focus - Growth Potential: Stable revenue base, continuous customer acquisition

Competitive Advantage and Differentiation Factors: - Regional Specialization: Complete response to regulations and business customs of 4 Central European countries - Customer Understanding: Understanding of SME practical-level needs - Support Quality: Thorough support and consulting in regional languages - Implementation Track Record: Proven solutions across 8,500 companies

Claude reported an important discovery.

"This is clear. TechFlow Solutions can analyze customer, competitor, and company individually, but the interrelationships and strategic implications remain invisible. Through integrated 3C analysis, the specific direction for establishing competitive advantage becomes clear."

Most Important Discovery: "Positioning White Space"

3C analysis revealed white space between major players and startups, between global standards and regional specialization, where TechFlow Solutions can demonstrate superiority.

Chapter 4: Differentiation from Competitors—Establishing Unique Position

After conducting detailed integrated 3C analysis and market structure analysis, TechFlow Solutions' competitive advantage establishment strategy became clear.

Transformation from "Confused Competition" to "Strategic Positioning":

Essence of the Problem: Unclear Competitive Advantage and Market Position

TechFlow Solutions competed individually with each market player but couldn't establish a strategic position that leveraged its unique strengths.

Integrated 3C Competitive Strategy:

Strategic Position: "Regional Growth Partner"

Positioning white space discovered through 3C analysis: - Customer: "Business growth support partner" needs of growth-stage SMEs - Competitor: Between major players (global standards) and startups (feature specialization) - Company: Unique combination of regional knowledge × technical capability × customer understanding

Customer Strategy: Deep Cultivation Through Segment Focus

Primary Segment: Growth-Stage SMEs (50-200 employees) - Reason: Highest growth potential segment where company strengths shine - Needs: Managing financial complexity accompanying business growth - Value Proposition: "Financial infrastructure supporting business growth" - Differentiation: Flexible system expansion and customization aligned with growth stages

Sub-segment: Defense in Stable-Stage SMEs - Reason: Protecting existing customer base and securing stable revenue - Needs: Business optimization through efficiency and automation - Value Proposition: "Reliability supporting stable business operations" - Differentiation: Region-focused support and complete existing system integration

Competitor Strategy: Competition Avoidance Through Differentiation

vs. International Major Players (Microsoft, SAP): - Competition Avoidance: Actively cede large enterprise and complex function requirement segments - Differentiation: SME specialization, ease of implementation, region-focused support - Coexistence Strategy: Position as safety net for customers where major implementations are difficult - Collaboration Potential: Building integration and complementary relationships with major products

vs. Emerging FinTech Companies: - Differentiation: Reliability, track record, comprehensiveness, support quality - Price Response: Shift from cost-performance focus to value proposition focus - Feature Response: Prioritize stability and integration over latest feature additions - Customer Education: Emphasize importance of "comprehensive value" over "cheapness"

vs. Regional Companies: - Technical Advantage: Modern architecture, UI/UX, cloud compatibility - Innovation: Continuous development and provision of new features and services - Efficiency: Business efficiency improvement through automation and AI utilization - Future Readiness: Long-term technology evolution and business growth response capability

Company Strategy: Maximizing Unique Strengths

Core Competence Enhancement: - Regional Specialized Technology: Complete response to regulations, tax systems, and business customs of 4 Central European countries - Customer Understanding: Deep understanding of SME practical-level needs - Implementation and Support Capability: Comprehensive support from implementation to operation - Relationship Building: Building and maintaining long-term partnership relationships

Optimal Management Resource Allocation: - R&D Investment: Concentration on region-specific and SME-specific features - Sales Enhancement: Strengthening sales structure for growth-stage SME segment - Support Expansion: Strengthening customer success support and consulting functions - Marketing: Strengthening "growth partner" branding

Phase 1: Strategic Focus (6 months)

Segment Focus Strategy: - 70% sales resource concentration on growth-stage SMEs - Deep cultivation in industry specialization (manufacturing, distribution, services) - Accumulation and horizontal expansion of customer success stories - Development and provision of segment-specific features

Differentiation Enhancement Strategy: - Expansion of region-specific features (tax, regulatory, language support) - Strengthening implementation and migration support services - Provision of customer growth support consulting - Development of industry-specific templates and best practices

Phase 2: Competitive Advantage Establishment (12 months)

Ecosystem Building: - Collaboration with regional partners (accounting firms, consulting companies) - Strengthening relationships with industry associations and chambers of commerce - Partnership with regional financial institutions - Participation in government and local authority digitalization support programs

Brand Establishment: - Establishing "Central European SME Growth Partner" brand - Quantitative dissemination of customer success stories and implementation effects - Enhanced presence at industry events and seminars - Increased exposure in regional media and industry publications

Phase 3: Building Sustainable Advantage (Ongoing)

Sustaining Competitive Advantage: - Building entry barriers through accumulation of customer data and industry insights - Establishing central position in regional ecosystem - Continuous innovation and feature development - Improving customer loyalty and switching costs

Comparison with Successful Companies:

Successful 3C Utilization Company (Danish Company A): - Similar scale and industry Nordic FinTech company - Before 3C Analysis: Struggling in price competition with major players and startups - After 3C Analysis: Established unique advantage through regional specialization positioning - Success Factors: Clear segment focus and differentiation strategy

TechFlow Solutions' Success Potential: Sustainable competitive advantage establishment expected through similar approach

Chapter 5: Detective's 3C Diagnosis—Establishing Advantage

Holmes summarized the comprehensive analysis.

"Mr. Novák, the essence of 3C analysis is 'strategic foundation.' By surveying the market from three axes—customer, competitor, and company—the position where you can build unique competitive advantage becomes visible. Competition is three-dimensional chess, and only by grasping the overall structure can the next move be determined."

Integrated 3C Strategy: Transformation from "Competitive Confusion" to "Strategic Positioning"

Strategic Basic Policy: Strategic Competitive Positioning

Phase 1: 3C Foundation Establishment (6 months)

Customer Deep Cultivation System: - Segment Specialization: Focus and deep cultivation on growth-stage SMEs - Needs Understanding: Systematic grasp of customer needs by business growth stage - Value Proposition: Comprehensive value provision as "growth partner" - Relationship Deepening: From mere tool provision to business support partner

Competitor Differentiation System: - Position Establishment: Establishing unique position between major players and startups - Competition Avoidance: Competitive advantage through differentiation, not direct competition - Leveraging Strengths: Differentiation through regional specialization, customer understanding, implementation capability - Collaboration Strategy: Partial collaboration with competitors, ecosystem building

Company Enhancement System: - Core Competence: Integrated strengthening of regional specialization × customer understanding × technical capability - Resource Allocation: Concentrated investment in strategic priority areas - Organizational Capability: Building organizational capability for segment-specific sales and customer success support - Cultural Transformation: Shift from competition orientation to customer value creation orientation

Phase 2: Competitive Advantage Realization (12 months)

Integrated Strategy Execution: - Market Focus: Establishing market-dominant position in selected segments - Differentiation Realization: Providing unique value clearly distinguished from competitors - Customer Success: Concrete contribution to customer business growth and outcome creation - Ecosystem: Strengthening competitive advantage through collaboration with regional partners

Ensuring Sustainability: - Entry Barriers: Building entry barriers through customer relationships, regional knowledge, and track record - Switching Costs: Increasing customer migration costs and risks - Continuous Improvement: Continuous value enhancement through customer feedback - Innovation: Continuous innovation in regional and segment specialization

Phase 3: Market Leadership Establishment (Ongoing)

Industry Position Establishment: - Market Leader: Establishing overwhelming position in selected segments - Industry Standard: De facto standard for regional SME FinTech - Ecosystem Center: Central presence in regional FinTech ecosystem - Sustainable Growth: Realizing sustainable growth based on competitive advantage

Expected Effects: - Market Share: Over 50% in selected segments - Profitability: 25% profit margin improvement (price premium through differentiation) - Customer Satisfaction: 4.8/5 (partnership relationship building) - Sustainable Competitive Advantage: Sustained advantage for over 5 years

Investment Plan: - 3C Strategy Implementation: 800 million yen annually - Expected Effect: 2.5 billion yen annually (differentiation premium + market expansion) - Investment Recovery Period: 5 months

"What's important is not competing, but establishing competitive advantage. 3C analysis is the strategic compass for discovering and establishing that advantage."

Chapter 6: Strategic Advantage Establishment—Completion of Volume XIX

Twenty-four months later, the final report arrived from TechFlow Solutions.

Results of Competitive Advantage Establishment Through Integrated 3C Strategy:

Market Position Establishment: - Selected Segment Market Share: 15% → 58% (overwhelming position established) - Annual Revenue: 4.5 billion yen → 12.5 billion yen (3x growth) - Profit Margin: 12% → 32% (differentiation premium effect) - Customer Base: 8,500 companies → 28,000 companies (3x expansion)

Competitive Advantage Realization:

Customer Advantage Establishment: - Customer Satisfaction: 3.8/5 → 4.9/5 (partnership relationship building) - Customer Retention: 85% → 96% (switching cost increase) - Net Promoter Score (NPS): +25 → +78 (overwhelming recommendation intent) - Segment Recognition: 15% → 85% (established position in growth-stage SMEs)

Competitor Advantage Establishment: - Price Premium: High closing rate even with +35% pricing vs. competitors - Feature Differentiation: Competitive advantage difficult to follow in region-specific features - Support Quality: Evaluation far exceeding competitors in customer satisfaction - Brand Position: Established positioning as "Central European SME Growth Partner"

Company Advantage Establishment: - Core Competence: Unique advantage through integration of regional specialization × customer understanding × technical capability - Management Efficiency: 3x revenue and 2.7x profit margin efficiency improvement through selective focus - Organizational Capability: Advanced specialization in segment-specific sales and customer success support - Cultural Transformation: Complete shift from competition orientation to customer value creation orientation

Specific Success Stories:

Overwhelming Advantage in Manufacturing Segment: - Market Share: 5% → 75% (monopolistic position through manufacturing-specific features and know-how) - Customer Case: 40% business efficiency improvement and 25% cost reduction at auto parts manufacturer A - Differentiation Factor: Depth of manufacturing-specific cost and inventory management features - Competitive Situation: Both major players and startups unable to follow in manufacturing specialization

Market Leader in Growth-Stage Startup Segment: - Market Share: 10% → 65% (position established as growth support partner) - Success Story: Supported IT startup B's financial structure preparation for IPO - Differentiation Factor: Flexible system expansion and customization aligned with growth stages - Customer Value: 80% of successful IPO companies use TechFlow

Central Position in Regional Ecosystem: - Partner Collaboration: Partnerships with 150 accounting firms and 50 consulting companies - Government Collaboration: Official partner in Czech and Polish government DX support programs - Financial Institution Collaboration: Built loan screening integration system with 10 regional banks - Industry Association: Official recommended solution certification by Central European SME Federation

Organizational and Cultural Evolution:

Strategic Thinking Establishment: - All employees understand and utilize 3C analysis framework - 3C analysis implemented as essential process for new product/service development - Continuous monitoring and analysis of customer, competitor, and company changes - Significantly improved quality and speed of strategic decision-making

Customer Centricity Establishment: - Complete establishment of "customer success is our success" corporate culture - All departments deeply understand needs and characteristics of customer segments - Judgment criteria prioritizing customer value creation over competitive comparison - Daily sharing and learning of customer success stories internally

Continuous Competitive Advantage Establishment:

Entry Barrier Construction: - Difficulty of imitation through accumulation of customer data and industry insights - Blocking new entrants through regional partner networks - Switching cost increase through deep customer relationships - Trust establishment through expertise and track record

Innovation Cycle: - Continuous feature improvement through customer feedback - Deep value provision through segment specialization - Continuous advancement of region-specific technology - Rapid conversion of new technology to customer value

Industry and Investor Evaluation Changes:

Industry Evaluation Improvement: - Central European FinTech Industry: "One of the startups" → "Industry Leader" - Customer Companies: "Tool Provider" → "Business Growth Partner" - Competitor Companies: "Price Competition Target" → "Differentiated, Different Dimension Company" - Government/Local Authorities: "Private Company" → "Strategic Partner for Regional DX Promotion"

Investor Evaluation Transformation: - Investment Decision: "Competition Intensification Risk" → "Stable Growth Through Sustainable Competitive Advantage" - Corporate Value: 5x valuation increase from 3 years ago due to competitive advantage establishment - Growth Potential: Predictable growth due to overwhelming position in selected segments - ESG Evaluation: Social value creation through regional society and SME growth support

Employee Voices:

Sales Manager (4 years with company): "We used to struggle with price competition, but 3C analysis helped us clarify our unique value. Now customers say 'it must be TechFlow,' and I couldn't enjoy sales more."

Product Manager (3 years with company): "3C analysis clarified differentiation points from competitors, making feature development prioritization easier. When I see customers' 'this is what we wanted' reactions, I'm confident we're heading in the right direction."

Customer Success (2 years with company): "With clear customer segments, I can understand customer needs more deeply. I feel recognized not just as support, but as a business growth partner."

Founder and CEO Jan Novák: "Through 3C analysis, we completely transformed our approach from 'omnidirectional competition' to 'strategic advantage establishment.' Understanding the relationships among customers, competitors, and ourselves transformed us into a company creating unique value rather than competing. We've become indispensable to Central European SMEs and established a sustainable growth foundation."

On Completing Volume XIX:

Reaching "New Frontiers of Analysis": Volume XIX, "New Frontiers of Analysis," presented solutions to various challenges enterprises face through ten powerful analytical methods: SWOT, MECE, AARRR, Value Chain, Double Diamond, OKR, JTBD, PDCA, AIDMA, and 3C.

These analytical methods function not independently but as an integrated toolkit that complements each other, supporting comprehensive corporate growth and transformation.

True Value of Analytical Methods: - Accurate grasp of reality (SWOT, 3C) - Information structuring (MECE, Value Chain) - Growth process visualization (AARRR, AIDMA) - Structuring creativity (Double Diamond) - Organizational integration (OKR) - Customer value discovery (JTBD) - Continuous improvement (PDCA)

The Next Horizon: Volume XX will integrate these analytical methods to address more complex and advanced corporate transformations. The journey continues from new frontiers of analysis to even greater heights.

Jan's final letter contained deep gratitude and conviction:

"Through 3C analysis, we transformed from 'a company caught in competition' to 'a company establishing competitive advantage.' By surveying the market from three axes—customer, competitor, and company—we discovered our unique position and built overwhelming advantage there. We learned that competition isn't something to avoid, but something to engage in on favorable ground. We've now established a solid position as a growth partner for Central European SMEs, creating win-win relationships across customers, competitors, and ourselves. 3C analysis was not mere competitive analysis, but a strategic guidebook for realizing sustained success."

Detective's Perspective—Summary of Volume XIX "New Frontiers of Analysis"

With the 250th episode's 3C analysis case, Volume XIX, "New Frontiers of Analysis," concludes.

Through ten cases in this volume, we've depicted diverse challenges facing modern enterprises and the power of analytical methods to resolve them. From a South American coffee company's reality recognition to a Central European startup's competitive advantage establishment, each case holds unique value while collectively demonstrating comprehensive utilization of analytical methods.

Particularly important is that these analytical methods function not independently but as an integrated system complementing each other. Recognize reality through SWOT analysis, structure information through MECE analysis, visualize growth through AARRR analysis, and ultimately establish competitive advantage through 3C analysis. This flow is the true "new frontier of analysis."

Lessons from Volume XIX: "Analysis is a means. The purpose is the happiness and growth of all people involved with the enterprise. As long as that purpose is not lost, analytical methods will continue creating lasting value."

Volume XX will build upon these foundational analytical methods, unfolding stories of more advanced and complex corporate transformations.

"True competitive advantage arises from avoiding competition. 3C analysis is the strategist's eye that discerns which competition to avoid and which to engage."—From the Detective's Notes

— Volume XIX "New Frontiers of Analysis" Complete —

Related articles

🎖️ Top 3 Weekly Ranking of Case Files

'QuantumGrocers' Lost Customer Data'

AeroSpray's Vanishing Sales Force'

'GlobalSoft's Drowning Inquiry Response'