ROI Case File No.269 | 'Pacifica BioLabs' Competitive Pressure'

📅 2025-10-21 23:00

🕒 Reading time: 8 min

🏷️ 5F

- Chapter One: The Wall of Raw Material Inflation - A Structure Where Profits Disappear

- Chapter Two: New Entrants, Substitutes, Buyers, Suppliers, Rivals - Five Forces

- Chapter Three: Swapping Bargaining Power Through the Value Chain - Designing Structural Transformation

- Chapter Four: Contract Design and Price Communication - New Power Balance

- Chapter Five: The Detective's 5 Forces Diagnosis - Change Structure, Change Rules

- The Detective's Perspective - Structure Determines Destiny

- Related files

Chapter One: The Wall of Raw Material Inflation - A Structure Where Profits Disappear

The week following the resolution of NordicWave Logistics' JTBD case, a consultation arrived from North America regarding an environmental materials company's profitability deterioration. Episode 269 of Volume 21 "Deepening Analysis" tells the story of analyzing the industry structure itself and reconstructing the source of competitive advantage.

"Detective, we manufacture environmentally friendly bio-materials. Demand is growing, yet profits continue shrinking. Suppliers raise raw material prices, customers demand discounts. We're caught in the middle."

Pacifica BioLabs' Chief Financial Officer, Elena Morales from San Diego, visited 221B Baker Street with a grave expression. In her hands were graphs showing rising revenue and sharply falling profit margins in stark contrast.

"We manufacture plant-based bioplastics in California. With rising environmental consciousness, demand is robust. Yet we can't make a profit."

Pacifica BioLabs' Profit Squeeze: - Founded: 2018 (Environmental materials startup) - Annual revenue: $71M (YoY +25% growth) - Operating profit margin: 2% (15% three years ago) - Main raw material: Corn (procured from 3 major suppliers) - Main customers: 3 major beverage manufacturers (65% of revenue)

Elena's expression showed deep anxiety.

"The problem is we have no bargaining power. Material suppliers unilaterally announce 'prices are rising due to tight supply-demand,' and customers demand 'we won't buy if it's more expensive than petroleum plastic.'"

Profit Squeeze Structure: - Raw material cost: 48% increase over 3 years - Sales price: Only 12% increase over 3 years - Difference: Profit margin compressed 15% → 2% - Negotiation room: Nearly zero

"We're growing but not profitable. At this rate, we'll go bankrupt."

Chapter Two: New Entrants, Substitutes, Buyers, Suppliers, Rivals - Five Forces

"Ms. Morales, what analysis have you done of the current competitive environment?"

To my question, Elena answered.

"Mainly we watch competitor moves. We compete on price, quality, and delivery. But no matter how hard we try, the situation doesn't improve."

Current Competitive Analysis (Competitors Only): - Perspective: Comparison with 3 direct competitors - Analysis items: Price, quality, delivery, technology - Problem: Pressures beyond competitors invisible

I explained the importance of seeing the entire industry structure.

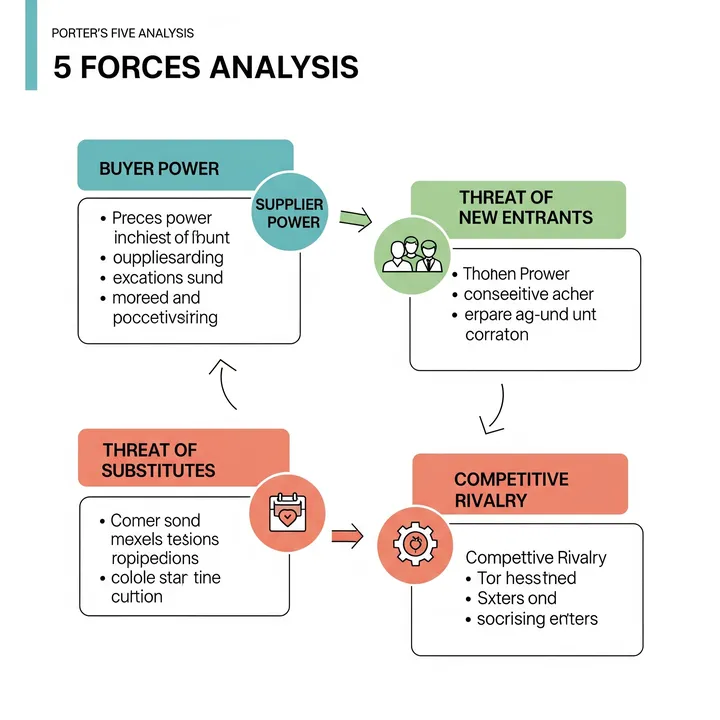

"Looking only at competitors is insufficient. Porter's Five Forces analysis - you need to understand the five competitive pressures determining industry profitability."

⬜️ ChatGPT | Catalyst of Concepts

"Rivals, suppliers, buyers, substitutes, new entrants. Five pressures determine profit."

🟧 Claude | Alchemist of Narratives

"Industries are ecosystems. When power balance collapses, profits flow out."

🟦 Gemini | Compass of Reason

"Five Forces analysis is the art of structural understanding. Identify pressures, change position."

The three members began their analysis. Gemini deployed the "Bio-Materials Industry-Specific Five Forces Analysis" framework on the whiteboard.

Porter's Five Forces (5 Competitive Pressures): 1. Rivalry Among Existing Competitors - Intensity of competition with peers 2. Bargaining Power of Suppliers - Suppliers' pricing power 3. Bargaining Power of Buyers - Customers' pricing power 4. Threat of Substitutes - Ease of switching to other solutions 5. Threat of New Entrants - Barriers to new player entry

"Ms. Morales, let's analyze the five pressures surrounding Pacifica BioLabs."

Chapter Three: Swapping Bargaining Power Through the Value Chain - Designing Structural Transformation

Phase 1: Five Forces Analysis (2 weeks)

We analyzed each competitive pressure in detail.

1. Rivalry Among Existing Competitors: Moderate - Number of competitors: 4 (equivalent technology) - Differentiation: Difficult (product specs commoditized) - Market growth: High (20% annual growth) - Conclusion: Limited competitive pressure in growth market

2. Bargaining Power of Suppliers: Very Strong - Raw material suppliers: 3 major companies oligopoly - Switching cost: High (2 years for certification) - Threat of forward integration: Exists (suppliers can productize) - Conclusion: Largest pressure source

3. Bargaining Power of Buyers: Very Strong - Customer concentration: 3 major companies = 65% of revenue - Substitute existence: Petroleum plastic (cheaper) - Price sensitivity: High (cost reduction pressure) - Conclusion: Second pressure source

4. Threat of Substitutes: High - Petroleum plastic: 30% cheaper - Performance: Nearly equivalent - Switching ease: High - Conclusion: Price competitiveness essential

5. Threat of New Entrants: Moderate - Entry barriers: 3 years technology development, 2 years certification - Capital requirements: Medium-scale ($16M) - Market growth: Attractive (20% annual) - Conclusion: Potential entry increase ahead

Phase 2: Formulating Structural Transformation Strategy (1 month)

Analysis revealed "bargaining power of suppliers" and "bargaining power of buyers" were squeezing profits.

Strategic Direction: Change the bargaining power structure

Strategy 1: Weaken Supplier Bargaining Power

Diversifying Raw Material Sources: - Conventional: Purchase from 3 major companies - New strategy: Direct contracts with small farmers - Initiatives: - Partner with regional agricultural cooperatives (5 locations in California) - Farmer development program (organic cultivation technical support) - Long-term contracts (5 years) for price stability - Result: Procurement sources dispersed from 3 companies → 150 farms

Considering Vertical Integration: - Trial operation of own farm (200 hectares) - Secure option for future raw material in-sourcing

Strategy 2: Weaken Buyer Bargaining Power

Dispersing Customer Base: - Conventional: 3 major companies = 65% of revenue - New strategy: Expand channels to mid-tier companies - Initiatives: - Cultivate 50 environmentally conscious mid-tier companies - Add production lines capable of small-lot response - Provide customization services - Result: Major dependence 65% → 35%

Strengthening Differentiation: - From mere material supply → Environmental value visualization service - Provide CO2 reduction certification reports - Provide data for customers' ESG reports - Contribute to brand value enhancement

Strategy 3: Reducing Threat of Substitutes

Performance Differentiation: - Decomposition speed control technology (optimization by application) - Heat resistance improvement (equivalent to petroleum plastic) - Improved coloring/processability

Total Cost Advantage: - Price higher but cheaper including disposal costs - Appeal ESG rating improvement increases corporate value

Chapter Four: Contract Design and Price Communication - New Power Balance

Phase 3: Implementing New Structure (6 months)

We executed strategy and changed the company's position in industry structure.

Raw Material Procurement Changes: - Direct contracts completed with 150 contract farms - Raw material cost: 22% reduction vs conventional - Price volatility risk: Significant decrease (long-term contract effect) - Supply stability: Improved (dispersion effect)

Customer Composition Changes: - New customers: 48 mid-tier companies acquired - Major dependence: 65% → 38% - Average transaction value: +18% increase (customization effect) - Price negotiation power: Improved

Differentiation Effects: - Environmental value visualization service adoption rate: 78% - Contribution to customers' ESG rating improvement: Clear - Brand loyalty: Improved

Results After 12 Months:

Financial Metrics Recovery: - Annual revenue: $71M → $82M (+15%) - Operating profit margin: 2% → 12% (6x) - Raw material cost ratio: 62% → 45% (structural improvement) - Gross margin: 38% → 55% (17 point improvement)

Competitive Structure Changes: - Supplier bargaining power: Strong → Medium (procurement dispersion effect) - Buyer bargaining power: Strong → Medium (customer dispersion effect) - Threat of substitutes: High → Medium (differentiation effect) - Result: Profit outflow stopped, shifted to accumulation

Customer Voices:

Mid-Tier Beverage Manufacturer (New Customer): "Major suppliers had large minimum lots we couldn't adopt. Pacifica handles small lots and even supports environmental value visualization. Price is slightly higher, but ESG report creation becomes easier, so total benefits exist."

Contract Farmer Representative: "With major companies, prices were unilaterally decided. With Pacifica, long-term contracts stabilize prices. Organic cultivation technical support exists too - it's a win-win relationship."

Chapter Five: The Detective's 5 Forces Diagnosis - Change Structure, Change Rules

Holmes compiled the comprehensive analysis.

"Ms. Morales, the essence of Five Forces analysis is 'structural understanding.' Lack of profit isn't insufficient effort - it's an industry structure problem. Understand the five competitive pressures and change unfavorable structure. That's true strategy."

Final Report After 24 Months:

Pacifica BioLabs transformed into a high-profit bio-materials company.

Final Results: - Annual revenue: $71M → $121M (+70%) - Operating profit margin: 2% → 16% (8x) - Contract farms: 150 → 280 locations - Customer count: 15 → 85 companies (stability through dispersion)

Elena's letter contained profound learning:

"Through Five Forces analysis, we transformed from 'victims' to 'structure designers.' What mattered most was seeing not just competitors but the entire industry structure. By changing supplier and buyer bargaining power, profit structure dramatically improved. Now we constantly analyze industry structure and maintain advantageous position."

The Detective's Perspective - Structure Determines Destiny

That evening, I contemplated the essence of industry structure.

The true value of Five Forces analysis lies in liberation from fatalism. Rather than resigning "no profit because of the industry," think "profit emerges by changing industry structure."

Structure can be changed. Only those who understand that can change destiny.

"Don't fight the river's flow. But you can change the river's course."

The next case will also depict the moment when structural understanding opens a company's future.

"Industry structure isn't given destiny. It's changeable environment. Only those with will to change become true victors." - From the Detective's Notes

Related files

🎖️ Top 3 Weekly Ranking of Classified Case Files

What is MVP

What is Agile Development

What is STP Analysis