ROI Case File No.277|'QuantumVista Cloud's Battlefield Choice'

📅 2025-10-25 23:00

🕒 Reading time: 9 min

🏷️ SWOT

- Chapter 1: The Battlefield is Too Wide—Defeat of Dispersed Forces

- Chapter 2: The Intersection of Internal and External—The Four-Quadrant Map

- Chapter 3: Fact Mapping—Gap Between Self-Perception and Reality

- Chapter 4: Concentration and Withdrawal Judgment Axis—From 32 Markets to 3 Markets

- Chapter 5: The Detective's SWOT Diagnosis—Choose Your Battlefield

- The Detective's Perspective—Choice is Strategy, Dispersion is Defeat

- Related files

Chapter 1: The Battlefield is Too Wide—Defeat of Dispersed Forces

The week after resolving the Aurora HealthTech Lean Startup case, a consultation arrived from Europe regarding a cloud infrastructure company's strategic wandering. Case File 277 of Volume 22 "The Pursuit of Reproducibility" is a story about choosing the battlefield to fight from countless possibilities, making victory reproducible.

"Detective, we're fighting in all markets. Large enterprises, SMEs, startups. SaaS, IaaS, PaaS. North America, Europe, Asia. We address everything. Yet we're mediocre in every market."

Eva van der Berg, Chief Strategy Officer of QuantumVista Cloud from Amsterdam, visited 221B Baker Street with an exhausted expression. In her hands were expansion plans for 30+ market segments contrasted sharply with the reality of under 5% share in every market.

"We provide cloud infrastructure services in the Netherlands. To compete with AWS, Azure, Google Cloud, we've tried to address every customer and every use case. But we're losing in every battlefield."

QuantumVista Cloud's Dispersed Strategy Failure: - Founded: 2019 (cloud infrastructure startup) - Target markets: 32 segments - Annual revenue: 8.5 billion yen - Market share: 3-5% in all segments - Operating margin: -8% (continued losses) - Employees: 280

Eva's expression held deep anxiety.

"The problem is we're trying to 'address everything.' Advanced security features large enterprises want, low prices SMEs seek, flexibility startups need. We try to provide everything and end up resonating with nobody."

Dispersed Forces: - Sales team: Evenly distributed across 32 markets - Development resources: Address all customer type requests - Marketing budget: Thinly spread across all markets - Result: Low awareness in every market, defeated by competitors

Status in Each Market: - Large enterprises: Can't beat AWS on price or features - SMEs: Can't match Google Cloud's usability - Startups: Can't counter Azure's free tier - Geographic expansion: Mediocre in Europe, North America, Asia

"We're fighting in every battlefield and losing in every battlefield."

Chapter 2: The Intersection of Internal and External—The Four-Quadrant Map

"Eva, by what criteria are your current strategies decided?"

To my question, Eva answered.

"Basically 'enter because there's a market.' The cloud market is growing, so we think there's potential in all segments."

Current Strategy Decision (Opportunity-Following): - Criteria: "Large market size" "High growth rate" - Evaluation: External environment (opportunities) only - Blind spot: Not considering own strengths/weaknesses - Result: Enter even unwinnable markets

I explained the importance of viewing both internal and external aspects.

"Having a market and being able to win are different. SWOT analysis—multiply own strengths/weaknesses with external opportunities/threats. At that intersection lies the battlefield to fight."

⬜️ ChatGPT|Catalyst of Concepts

"Seize opportunities with strengths, avoid weaknesses, withstand threats. Four quadrants decide strategy"

🟧 Claude|Alchemist of Narratives

"Battlefields are infinite. But the winnable battlefield is only one"

🟦 Gemini|Compass of Reason

"SWOT analysis is the art of choice. Choose the best from four strategy cards: SO, WO, ST, WT"

The three members began analysis. Gemini deployed the "Cloud Infrastructure-Specialized SWOT Analysis" framework on the whiteboard.

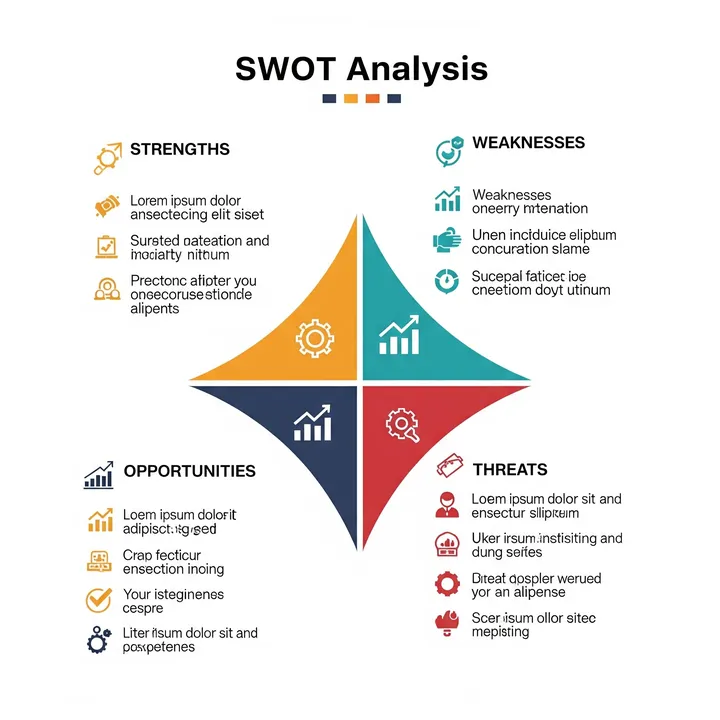

SWOT Analysis 4 Elements:

Internal Environment: - Strengths - Advantages over competitors - Weaknesses - Disadvantages against competitors

External Environment: - Opportunities - External environment favorable conditions - Threats - External environment threats

4 Strategy Directions: - SO Strategy - Seize opportunities with strengths (aggressive offense) - WO Strategy - Overcome weaknesses to seize opportunities (gradual strengthening) - ST Strategy - Avoid threats with strengths (differentiated defense) - WT Strategy - Avoid weaknesses and threats (withdrawal/downsizing)

"Eva, let's find QuantumVista's true strengths and winnable markets."

Chapter 3: Fact Mapping—Gap Between Self-Perception and Reality

Phase 1: Strengths Identification (2 weeks)

First, we listed what we thought were "strengths."

Self-Perceived Strengths: - High-performance infrastructure - Flexible customization support - European data centers - Lower pricing than competitors - Thorough support

Next, we verified whether these truly held "competitive advantage."

Objective Evaluation:

High-Performance Infrastructure: - QuantumVista: 150ms response - AWS: 120ms response - Conclusion: Not a strength (competitors perform better)

Flexible Customization: - QuantumVista: Custom development per customer request - Competitors: Standardized general services - Customer voices: "Don't need customization. Standard is sufficient" - Conclusion: Not a strength (no demand)

European Data Centers: - QuantumVista: Own DCs in Netherlands, Germany, France - Competitors: Expanding in Europe but US-based - Regulations: GDPR (European Data Protection Regulation) favors European storage - Conclusion: True strength (regulatory compliance advantage)

Pricing: - QuantumVista: 15% cheaper than AWS - Customer voices: "Won't switch for 15% price difference" - Conclusion: Not a strength (insufficient differentiation)

Thorough Support: - QuantumVista: 24/7/365, European language support - Customer satisfaction: 4.7/5 (industry top) - Competitors: English only, slow response - Conclusion: True strength (clear differentiation)

True Strengths (only 2): 1. European data centers and full GDPR compliance 2. Thorough support in European languages

Phase 2: Weaknesses Identification

Clear Weaknesses: - Brand awareness: 1/20th of AWS/Azure/GCP - Development resources: 1/50th of competitors (can't win large-scale investments) - Global expansion: Europe only (weak in other regions) - Feature breadth: About 60% of competitors

Phase 3: Opportunities Identification

External Environment Opportunities: - GDPR regulation strengthening (European companies should store data in Europe) - Distrust of US clouds (privacy concerns) - European enterprise digitalization acceleration (market growth) - SME cloud migration (20% annual growth)

Phase 4: Threats Identification

External Environment Threats: - AWS/Azure/GCP European data center expansion - Intensifying price competition - Rise of open-source clouds - IT budget cuts from recession

Phase 5: SWOT Matrix Creation

We placed the 4 elements in a 2×2 matrix and derived strategies.

SO Strategy (Strengths × Opportunities): - Strengths: European DC + European language support - Opportunities: GDPR regulation strengthening - Strategy: Specialize as "GDPR-fully compliant European-exclusive cloud"

WO Strategy (Weaknesses × Opportunities): - Weaknesses: Insufficient development resources - Opportunities: SME cloud migration - Strategy: Give up general features, specialize in specific industries (concentrate development)

ST Strategy (Strengths × Threats): - Strengths: Thorough support - Threats: Major players' European entry - Strategy: Differentiate by "support quality" (majors can't imitate)

WT Strategy (Weaknesses × Threats): - Weaknesses: No global expansion capability - Threats: Intensifying price competition - Strategy: Withdraw from global markets

Chapter 4: Concentration and Withdrawal Judgment Axis—From 32 Markets to 3 Markets

Phase 6: Battlefield Selection (1 month)

Based on SWOT analysis results, we re-evaluated 32 market segments.

Evaluation Axes: 1. Do our strengths apply? 2. Is market opportunity sufficient? 3. Can we avoid threats?

Evaluation Results:

Markets to Withdraw (29 segments): - Large enterprise global market (strengths don't apply) - North America/Asia markets (geographic weakness) - General IaaS market (head-on collision with competitors) - Price competition markets (can't differentiate)

Markets to Concentrate (3 segments):

Market 1: European Regulated Industries (Finance, Healthcare) - Strength utilization: Full GDPR compliance, European DC - Market size: 45 billion yen (Europe only) - Competitive situation: US players lag in regulatory compliance - Growth rate: 15% annually

Market 2: European Mid-sized Manufacturing - Strength utilization: Thorough support (German, French, Dutch) - Market size: 28 billion yen - Customer needs: "Need support because not good at English" - Competitive situation: Majors English-only, inadequate support

Market 3: European SaaS Companies (Backend) - Strength utilization: GDPR compliance + flexible customization - Market size: 18 billion yen - Customer needs: Obligation to store customer data in Europe - Competitive situation: Niche, few competitors

Phase 7: Resource Reallocation (3 months)

We executed withdrawal and concentration.

Withdrawal Measures: - Stop global market sales - Stop new development of general features - Cease marketing for 29 markets - Employees: 280 → 180 (selection and concentration)

Concentrated Investment: - Strengthen finance/healthcare compliance features - Triple German/French language support structure - Develop manufacturing-specialized templates - Concentrate sales resources on 3 markets

New Positioning: "European cloud, for European companies, by Europeans"

Marketing Messages: - "Your customer data never leaves Europe" - "Consult anytime in your native language" - "GDPR? We handle everything"

Results after 6 months:

Dramatic Market Share Increase: - Finance/healthcare market: 3% → 22% (Europe 2nd) - Mid-sized manufacturing: 4% → 18% - SaaS companies: 5% → 31% (Europe top)

Business Metrics: - Annual revenue: 8.5 billion yen → 14.2 billion yen (+67%) - Operating margin: -8% → +16% (profitable) - Customer unit price: 1.8 million yen annually → 4.2 million yen (higher value) - Customer satisfaction: 4.2 → 4.8

Successful Differentiation from Competitors: - GDPR complexity creates high entry barriers for US players - European language support majors can't imitate - Track record in regulated industries becomes entry barrier

Customer Voices:

German Healthcare CTO: "Storing patient data in US clouds is legally impossible. QuantumVista has European data centers, fully GDPR-compliant. Plus German-language support. Can't go back to AWS."

French Manufacturing IT Director: "Not fluent in English, so French support is helpful. Technical questions convey accurately in native language."

Chapter 5: The Detective's SWOT Diagnosis—Choose Your Battlefield

Holmes compiled the comprehensive analysis.

"Eva, the essence of SWOT is 'choice.' You can't fight in all markets. Choose markets where your strengths apply and opportunities can be seized. Then concentrate all resources there. The courage to choose battlefields makes victory reproducible."

Final Report after 12 months:

QuantumVista Cloud transformed into a niche leader in the European cloud market.

Final Achievements: - Annual revenue: 8.5 billion yen → 22 billion yen (2.6x) - Operating margin: -8% → +24% - European regulated industry share: 3% → 35% (top share) - Company value: 8x from founding

Eva's letter contained deep learning:

"Through SWOT analysis, we transformed from 'a company addressing everything' to 'a company winning in chosen battlefields.' Most important was the courage to withdraw. Abandoning 29 markets, concentrating on 3. That decision changed everything. Now when considering new markets, we always evaluate with SWOT. We never enter markets where strengths don't apply. We understood choosing battlefields is strategy's essence."

The Detective's Perspective—Choice is Strategy, Dispersion is Defeat

That night, I contemplated strategy's essence.

The true value of SWOT analysis lies in self-awareness. Many companies overestimate strengths and underestimate weaknesses. Then they chase all opportunities, disperse, and lose.

But true strengths are few. And markets where those strengths apply are also few. Then bet everything on that intersection.

"Battlefields are chosen. Those who fight in all battlefields lose in all battlefields."

The next case will also depict a moment when selection and concentration open a company's future.

"Strength is a weapon. But weapons unleash power only on the right battlefield"—From the detective's notes

Related files

🎖️ Top 3 Weekly Ranking of Classified Case Files

What is MVP

What is Agile Development

What is STP Analysis