ROI Case File No.319 | 'FineTech's Invisible Value'

📅 2025-11-15 23:00

🕒 Reading time: 10 min

🏷️ VALUECHAIN

- Chapter 1: The Trap of Efficiency—Cut Costs, Lose Customers

- Chapter 2: The Blind Spot of Inward Focus—Looking Only at Costs, Not Customers

- Chapter 3: Dissecting Processes—Where Value Is Created, Where to Cut

- Chapter 4: The Choice of Value—Adding Is Faster Than Cutting

- Chapter 5: The Result of Return—Revival After 12 Months

- Chapter 5: The Detective's Diagnosis—Value Is Born in the Flow

- Related Files

Chapter 1: The Trap of Efficiency—Cut Costs, Lose Customers

The week after Asia Marine's OODA case was resolved, a consultation arrived from Kanagawa regarding production reform at a semiconductor manufacturing equipment maker. Case File 319 of Volume 26, "The Pursuit of Reproducibility," tells the story of a company that rushed into cost-cutting, lost sight of customer value, and then reclaimed it.

"Detective, for 3 years we've been thoroughly cutting costs. Material costs reduced 15%, outsourcing costs reduced 20%, personnel costs reduced 12%... However, sales are declining. We've lost 2 major customers. They say 'FineTech's equipment quality has dropped compared to before.'"

Seiichi Hosokawa, Manufacturing Manager of FineTech Instruments Co., born in Kawasaki, visited 221B Baker Street unable to hide his confusion. In his hands were cost reduction achievement reports and, in stark contrast, sales reports marked "customer churn."

"We manufacture semiconductor manufacturing equipment in Kanagawa. Wafer inspection equipment, cleaning equipment... We deliver to semiconductor manufacturers. We have 180 employees. However, business performance deteriorated 3 years ago, and we've prioritized cost reduction."

FineTech's Cost of Cost Reduction: - Established: 1998 (semiconductor manufacturing equipment) - Annual Revenue: 5.2 billion yen (24% decline from 6.8 billion 3 years ago) - Employees: 180 (22% decline from 230 three years ago) - Major Customers: 8 semiconductor manufacturers (was 10 three years ago) - Cost Reduction Achievement (3 years): Cumulative 820 million yen - Problem: As result of cost reduction, customers left

Hosokawa's voice carried deep regret.

"Three years ago, management ordered 'cut costs at all costs.' All departments rushed to cut costs. However, as a result, customers started saying 'quality dropped,' 'delivery delays,' 'support deteriorated.' Major customer Company A switched to a competitor. We lost 1.2 billion yen in annual transactions."

Cost Reduction Implementation (3 years):

1. Material Cost Reduction (15% cut): - Changed parts procurement to low-price manufacturers - Result: Parts defect rate rose from 3% → 8%

2. Outsourcing Cost Reduction (20% cut): - Changed precision machining vendors to low-price contractors - Result: Machining precision declined, equipment performance variation

3. Personnel Cost Reduction (12% cut): - Solicited early retirement, veteran engineers left - Reduced inspection process personnel - Result: Inspection became insufficient, defective products discovered at customer sites

4. R&D Cost Reduction (30% cut): - Froze new product development - Result: Fell behind competitors technologically

5. After-Service Reduction (25% cut): - Reduced on-site support, switched to phone support - Result: Customer satisfaction dropped from 4.2 → 2.8

Major Customer Company A (Semiconductor Manufacturer) Departure:

3 years ago: "FineTech's equipment is high quality with excellent support. A long-term business partner."

2 years ago: "Recently, equipment malfunctions have increased. Parts replacement frequency is up."

1 year ago: "Delivery delays have increased. Not delivered on promised dates, affecting our production schedules."

This year: "We're reconsidering our relationship with FineTech. Competitor Company B's equipment is the same price but with superior quality and support."

Result: Transaction with Company A ended (1.2 billion yen annually)

Hosokawa sighed deeply.

"If we cut costs, profit should increase. But in reality, sales decreased and profit also decreased. What went wrong...?"

Chapter 2: The Blind Spot of Inward Focus—Looking Only at Costs, Not Customers

"Hosokawa-san, when proceeding with cost reduction, did you examine the impact on customers?"

To my question, Hosokawa answered.

"Honestly, we didn't. 'Reduce costs' was the only goal. Each department only thought about 'how to cut our department's costs.' As a result, what impact it would have on customers... no one thought about it."

Current Approach (Cost Reduction Type): - Goal: Cost reduction - Perspective: Internal efficiency only - Problem: Ignored customer value, resulting in customer churn

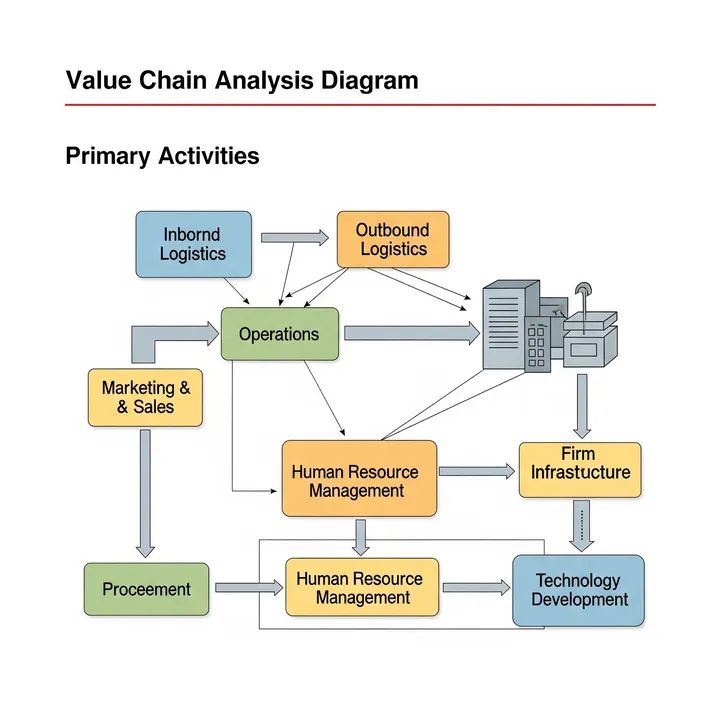

I explained the importance of Value Chain.

"Cost reduction is a means, not an end. Value Chain analysis—primary and support activities. Identify which processes create customer value and concentrate investment there. This is the essence of competitive advantage."

⬜️ ChatGPT | Catalyst of Conception

"Don't cut costs, identify value-creating processes. Survey the whole with Value Chain."

🟧 Claude | Alchemist of Narrative

"Value is born in the flow. What should be cut is only processes that don't create value."

🟦 Gemini | Compass of Reason

"Value Chain is value analysis technology. Decompose primary and support activities to identify profit-generating processes."

The three members began their analysis. Gemini unfolded the "Value Chain Framework" on the whiteboard.

Value Chain Structure:

【Primary Activities】(Directly involved in product/service creation)

- Inbound Logistics: Raw material/parts procurement

- Operations: Equipment assembly and inspection

- Outbound Logistics: Customer delivery

- Sales & Marketing: Order activities

- After-Sales Service: Maintenance and support

【Support Activities】(Supporting primary activities)

- Firm Infrastructure: Business management

- Human Resource Management: Recruitment and training

- Technology Development: R&D

- Procurement: Material purchasing

"Hosokawa-san, let's analyze all of FineTech's processes with Value Chain."

Chapter 3: Dissecting Processes—Where Value Is Created, Where to Cut

Phase 1: Value Chain Visualization (4 weeks)

We broke down all of FineTech's processes into primary and support activities.

Primary Activities:

1. Inbound Logistics (Parts Procurement): - Annual Cost: 1.2 billion yen - Major Parts: Precision sensors, control boards, machined parts - Cost Reduction Implemented: 15% material cost reduction (switched to low-price manufacturers)

2. Operations (Assembly and Inspection): - Annual Cost: 1.8 billion yen (personnel, equipment costs) - Process: Parts assembly → Operation inspection → Performance inspection → Shipping inspection - Cost Reduction Implemented: 30% reduction in inspection process personnel

3. Outbound Logistics (Delivery): - Annual Cost: 240 million yen - Content: Installation at customer factories, trial runs

4. Sales & Marketing: - Annual Cost: 480 million yen (sales personnel costs, exhibition fees) - Activities: Customer visits, technical proposals

5. After-Sales Service: - Annual Cost: 600 million yen - Content: Regular inspections, breakdown response, technical support - Cost Reduction Implemented: 25% reduction in on-site support

Support Activities:

1. Technology Development (R&D): - Annual Cost: 840 million yen - Content: New product development, existing product improvement - Cost Reduction Implemented: 30% reduction (froze new product development)

2. Human Resource Management: - Annual Cost: 360 million yen

3. Procurement: - Annual Cost: 120 million yen

Phase 2: Customer Value Analysis (3 weeks)

Next, we conducted interviews with Company A (departed major customer).

Question: "What do you value most in FineTech's equipment?"

Company A's Response:

1st: Equipment Performance and Precision (Importance: 10/10) "In semiconductor manufacturing, even slight precision deviations create defects. Equipment performance is paramount."

2nd: After-Service Quality (Importance: 9/10) "When equipment breaks down, immediate response is crucial. If production lines stop, losses are millions of yen per hour."

3rd: Technology Development Capability (Importance: 8/10) "Semiconductor miniaturization is advancing. Whether you can provide equipment supporting latest technology is important."

4th: On-Time Delivery (Importance: 7/10) "Delivery on promised date is a prerequisite."

5th: Price (Importance: 5/10) "Price matters too, but if performance and support are poor, cheap means nothing."

Phase 3: ROI Analysis of Each Process (2 weeks)

We analyzed how much each process contributes to "customer value" and "profit."

Analysis Results:

| Process | Annual Cost | Customer Value Contribution | Profit Contribution | Impact After Reduction |

|---|---|---|---|---|

| Inbound Logistics | 1.2B yen | High (directly impacts performance) | Medium | Material cost cut→defect rate up→customer churn |

| Operations (Inspection) | Part of 1.8B | High (quality assurance) | High | Inspection cut→defects shipped→customer churn |

| After-Sales Service | 600M yen | Very High | High | Support cut→satisfaction down→customer churn |

| Technology Development | 840M yen | Very High | Very High | Development cut→fell behind competitors→customer churn |

| Procurement (indirect) | 120M yen | Low | Low | Can be reduced |

Findings:

Processes That Shouldn't Have Been Cut: - Inbound Logistics (material cost reduction): Customer value "High" but cut→defect rate increased - Operations (inspection): Customer value "High" but cut→quality declined - After-Sales Service: Customer value "Very High" but cut→satisfaction dropped - Technology Development: Customer value "Very High" but cut→competitiveness declined

Processes That Should Have Been Cut: - Procurement (indirect materials): Customer value "Low"→small impact if cut

Hosokawa was stunned.

"We cut processes with high customer value and left processes with low customer value untouched..."

Chapter 4: The Choice of Value—Adding Is Faster Than Cutting

Phase 4: Investment Reallocation (6 months)

Based on Value Chain analysis results, we reallocated investment.

Policy Shift: - Before: "Cost reduction in all processes" - After: "Concentrate investment on high customer value processes, reduce low-value processes"

1. Inbound Logistics (Material Costs): Retract Reduction, Return to High-Quality Parts - Return parts procurement to original high-quality manufacturers - Cost: +15% (180 million yen annual increase) - Effect: Parts defect rate improved from 8% → 3%

2. Operations (Inspection Process): Increase Personnel - Increase inspection process personnel by 30% (return to pre-reduction level) - Cost: +12% (220 million yen annual increase) - Effect: Improved pre-shipment inspection accuracy, zero defects found at customer sites

3. After-Sales Service: Strengthen On-Site Support - Increase on-site support visits (1.5x pre-reduction level) - Establish 24-hour hotline - Cost: +40% (240 million yen annual increase) - Effect: Customer satisfaction improved from 2.8 → 4.5

4. Technology Development: Resume New Product Development - Launch next-generation inspection equipment development project - Cost: +50% (420 million yen annual increase) - Effect: Recover technological advantage over competitors

5. Procurement (Indirect Materials): Thorough Reduction - Reduce office supplies, meeting costs, entertainment expenses by 50% - Cost: 60 million yen annual reduction - Effect: No impact on customer value

Investment Reallocation Total: - Increase: +1.06 billion yen (procurement, operations, service, development) - Reduction: -60 million yen (indirect materials) - Net Increase: +1.0 billion yen

Hosokawa expressed concern.

"But costs will increase by 1 billion yen annually. Won't profit decrease...?"

I answered.

"Short-term, costs increase. However, by increasing customer value, sales will recover. And long-term, profit will also increase."

Chapter 5: The Result of Return—Revival After 12 Months

Results After 12 Months:

Customer Reactions:

Company A (Departed Major Customer): "We heard FineTech's quality has recovered. We'd like to receive proposals for new equipment."

Renewed Contract: 800 million yen annually (not full recovery, but partial transactions resumed)

Company B (Existing Customer): "Recently, FineTech's response has been excellent. Breakdown response is faster. We want to increase orders."

Order Increase: +300 million yen annually

Company C (New Customer): "We're interested in FineTech's next-generation inspection equipment. Reputation is that performance exceeds competitors."

New Orders: 500 million yen annually

Financial Results:

Sales: - Before (3 years ago): 6.8 billion yen - Worst Period (1 year ago): 5.2 billion yen - After (12 months later): 6.4 billion yen (+23%)

Profit: - Before (3 years ago): Operating profit 680 million yen (10% margin) - Worst Period (1 year ago): Operating profit 310 million yen (6% margin) - After (12 months later): Operating profit 770 million yen (12% margin)

Investment Recovery: - Additional Investment: 1.0 billion yen/year - Sales Increase: +1.2 billion yen/year - Profit Increase: +460 million yen/year - Investment Recovery Period: 2.2 years

Customer Satisfaction: - Worst Period: 2.8/5 - 12 Months Later: 4.5/5

Organizational Change:

Management Policy Shift: - Before: "Cost reduction is top priority" - After: "Concentrate investment on customer value-creating processes"

Regular Value Chain Meetings: - Quarterly evaluation of each process's ROI - Measure customer value contribution - Review investment allocation

Hosokawa's Reflection:

"For 3 years, we ran in the wrong direction. We believed 'if we cut costs, profit increases.' But we cut processes we shouldn't have cut and destroyed customer value.

Value Chain analysis revealed 'which processes create customer value.' And we concentrated investment on those processes. Short-term, costs increased, but customers came back.

Now I understand: 'Adding value is faster than cutting costs.'"

Chapter 5: The Detective's Diagnosis—Value Is Born in the Flow

That night, I contemplated the essence of Value Chain.

FineTech rushed into cost reduction and uniformly cut all processes. But that was an act of destroying customer value.

By breaking down processes with Value Chain analysis and identifying "where value is created," the processes requiring investment became clear. Inbound logistics, operations, after-sales service, technology development. These were the processes creating customer value.

"Adding value is faster than cutting costs. Value Chain illuminates which processes deserve investment."

The next case will also depict the moment when Value Chain visualizes value.

"Don't cut costs, identify value-creating processes. Procurement, operations, service, development. Value Chain reveals which creates customer value"—From the Detective's Notes

Related Files

🎖️ Top 3 Weekly Ranking of Classified Case Files

What is ROI

What is STP Analysis

What is the RICE Framework