ROI Case File No.360 | 'BlueWave Hotels' Cutting-Edge Technology Implementation'

📅 2025-12-21 23:00

🕒 Reading time: 12 min

🏷️ 5F

- Chapter One: The Wave of Digital Transformation—But Competitors Not Visible

- Chapter Two: The Robot Implementation Decision—But Industry Structure Not Visible

- Chapter Three: Discovery Through Analysis—Industry Structure Becomes Visible

- Chapter Four: Execution as Transformation—Results After 8 Months

- Chapter Five: The Detective's Diagnosis—Industry Structure Determines Strategy

- Related Files

Chapter One: The Wave of Digital Transformation—But Competitors Not Visible

The day after resolving the blueprint checking efficiency case at UrbanDesign, another consultation arrived regarding technology implementation in the hotel industry. Volume 29, "The Pursuit of Reproducibility," Episode 360, tells the story of surveying industry structure.

"Detective, we want to streamline serving operations in our hotel's restaurant and banquet hall. Aiming for personnel cost reduction and publicity creation. Considering serving robot and cleaning robot implementation. However, should we really implement? Also concerned about competitor trends. What changes are occurring industry-wide?"

Miho Nakamura, business planning manager from BlueWave Hotels, born in Yokohama, visited 221B Baker Street with an expression mixing expectation and anxiety. In her hands were a serving robot catalog and, in stark contrast, a proposal noting "Competitive analysis: Not conducted."

"We operate a business hotel chain. Twenty locations nationwide, 450 employees. Annual revenue of 8.5 billion yen. Primarily targeting business customers. We've already implemented business card management, invoice compliance, and ordering digitalization in-house. Actively advancing DX."

BlueWave Hotels' Current State: - Established: 2008 (Business hotel chain) - Locations: 20 nationwide - Employees: 450 - Annual revenue: 8.5 billion yen - Target customers: Business customers centered - DX: Business card management, invoice compliance, ordering digitalization completed - Problems: High serving operation personnel costs, competitor trends unknown

Deep interest permeated Nakamura's voice.

"Serving operations in hotel restaurants and banquet halls are a major burden. Restaurants require 3 staff constantly per floor. Depending on reservation status, increase to maximum 5 people. Banquet halls have fluctuating staff numbers depending on reservation status, relying on staffing agencies during busy periods.

We've heard that implementing serving robots can reduce staff. Same for cleaning robots. And we can create publicity as 'hotel implementing cutting-edge technology.' However, should we really implement? What are competitors doing? Cannot see industry-wide trends."

Typical Operation Reality:

Restaurant Operations (All 20 Locations): - Business hours: Breakfast 6:30-10:00, Dinner 18:00-22:00 - Staff: Constant 3 people (2 floor staff, 1 kitchen) - Busy periods: 5 people (4 floor staff, 1 kitchen) - Personnel costs: 1,500 yen/hour × 3 people × 7.5 hours × 365 days × 20 locations = Annual approximately 250 million yen

Banquet Hall Operations (All 20 Locations): - Operations: Monthly average 15 times/location - Staff: 5-15 people (varies by scale) - Staffing agencies: Depend on agencies during busy periods (2,000 yen/hour) - Personnel costs: Annual approximately 80 million yen

Cleaning Operations (All 20 Locations): - Room cleaning: External outsourcing (Annual 120 million yen) - Common space cleaning: Staff response (Annual 30 million yen)

Nakamura sighed deeply.

"We received a proposal from serving robot manufacturer. 3 million yen per unit. Two units per location implementation, 6 million yen. All 20 locations total 120 million yen. And cleaning robots are 1.5 million yen per unit. One unit per location, all 20 locations total 30 million yen. Total 150 million yen investment.

However, should we really invest? What are competitors doing? What changes are occurring industry-wide? We don't know."

Chapter Two: The Robot Implementation Decision—But Industry Structure Not Visible

"Ms. Nakamura, do you think implementing serving robots will reduce personnel costs?"

My question received Nakamura's immediate answer.

"Yes, we expect to reduce staff. But is that really so? Worried competitors implement first and we fall behind."

Current Understanding (Technology-First Type): - Expectation: Robot implementation reduces personnel costs - Problem: Industry structure, competitive environment not analyzed

I explained the importance of analyzing industry competitive environment with five factors.

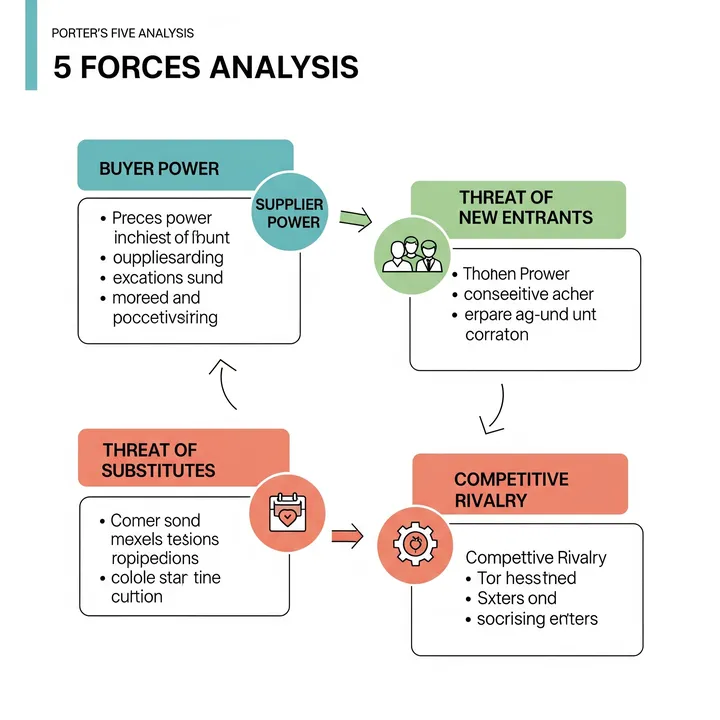

"The problem is 'industry structure not visible.' Porter's 5 Forces Analysis—Five Forces. Five competitive factors. Industry new entrants, substitutes, supplier bargaining power, buyer bargaining power, industry rivalry. By analyzing these five, you can see whether to truly invest and whether competitive advantage can be built."

⬜️ ChatGPT | Catalyst of Conception

"Don't look at technology alone. Look at industry. Survey competitive environment with 5F."

🟧 Claude | Story Alchemist

"Investment should always consider 'position within industry.' Look at five forces."

🟦 Gemini | Compass of Reason

"5F is competitive analysis technique. Analyze industry new entrants, substitutes, bargaining power, rivalry."

The three members began their analysis. Gemini displayed the "Porter's 5 Forces Framework" on the whiteboard.

Porter's 5 Forces (5 Competitive Factors): 1. Threat of New Entrants: Is it easy for new players to enter? 2. Threat of Substitutes: Can it be replaced by other services? 3. Supplier Bargaining Power: Are suppliers strong? 4. Buyer Bargaining Power: Are customers strong? 5. Industry Rivalry: Is competition with existing rivals intense?

"Ms. Nakamura, let's analyze the business hotel industry with 5F."

Chapter Three: Discovery Through Analysis—Industry Structure Becomes Visible

Phase 1: Threat of New Entrants (2 weeks)

Analysis: Is new entry into business hotel industry easy?

Entry Barriers: 1. Initial investment: Hundreds of millions to billions yen for land/buildings 2. Location: Prime locations like near stations occupied by existing hotels 3. Brand: Major chains (Toyoko Inn, APA Hotel, etc.) established 4. Operating know-how: Accommodation industry operation experience required

Recent Trends: - Private lodging (Airbnb, etc.): Rapid increase after 2018 Private Lodging Act - Capsule hotels: Expanding in low-price range - Foreign hotels: Entry in high-price range (Hilton, Marriott, etc.)

Evaluation: - Threat of new entrants: Moderate - Reason: Initial investment high, but entry increasing in low-price range like private lodging/capsule hotels

Impact on BlueWave Hotels: - Mid-price business hotels under pressure from above and below - Differentiation necessary

Phase 2: Threat of Substitutes (2 weeks)

Analysis: What services substitute business hotels?

Substitutes: 1. Private lodging (Airbnb): Low price, community-focused 2. Capsule hotels: Ultra-low price 3. Remote work: Business trips themselves decreasing 4. Online meetings: Zoom, etc. eliminate face-to-face need

Post-COVID Trends: - 2020-2021: Business trip demand plummeted, hotel occupancy 30-40% - 2022-2024: Recovery trend, but remote work established - Business trip demand: Recovered to about 80% of pre-COVID

Evaluation: - Threat of substitutes: High - Reason: Private lodging, remote work, online meetings widespread

Impact on BlueWave Hotels: - Business trip demand won't fully recover - New value provision necessary

Phase 3: Supplier Bargaining Power (2 weeks)

Analysis: What is supplier bargaining power in hotel industry?

Major Suppliers: 1. Staffing agencies: Securing staff during busy periods 2. Food suppliers: Restaurant/banquet hall ingredients 3. Cleaning companies: Room cleaning external outsourcing 4. Equipment manufacturers: Serving robots, cleaning robots, etc.

Staffing Agency Bargaining Power: - Due to labor shortage, dispatch fees rising - Hourly rate: 2020: 1,800 yen → 2024: 2,000 yen (+11%)

Equipment Manufacturer Bargaining Power: - Serving robots: Several manufacturers (Keenon Robotics, Pudu Robotics, etc.) - Cleaning robots: Many manufacturers (iRobot, Ecovacs, etc.) - Gradually declining due to price competition

Evaluation: - Supplier bargaining power: Medium-High - Reason: Staffing agencies have high bargaining power, equipment moderate

Impact on BlueWave Hotels: - Should reduce dependence on staffing agencies - Robot implementation reduces bargaining power

Phase 4: Buyer Bargaining Power (2 weeks)

Analysis: What is customer (business traveler) bargaining power?

Customer Characteristics: - Business customers: Moderate price sensitivity, prioritize convenience - Reservations: 70% via OTA (Rakuten Travel, Jalan, etc.) - Selection criteria: Location, price, cleanliness

OTA Commissions: - Rakuten Travel: 10-15% - Jalan: 10-15% - Booking.com: 15-18%

Customer Voices: - "If location good, will book even if somewhat expensive" - "Satisfied if clean" - "Will repeat if breakfast delicious"

Evaluation: - Buyer bargaining power: Moderate - Reason: Many OTA bookings, easy price comparison

Impact on BlueWave Hotels: - OTA commissions heavy (Annual revenue 8.5B yen × 70% × 12% = 714M yen) - Measures to increase direct bookings necessary

Phase 5: Industry Rivalry (2 weeks)

Analysis: Is competition with existing rivals intense?

Competitive Analysis:

Major Chains: - Toyoko Inn: 350 locations, low price, stable quality - APA Hotel: 700 locations, station-front locations, unique strategy - Route Inn: 250 locations, large bath feature

BlueWave Hotels' Position: - Locations: 20 locations (less than 1/10 of major chains) - Price range: Mid-price (7,000-9,000 yen per night) - Features: No clear differentiation factors

Competitor Latest Trends: - Toyoko Inn: Started serving robot implementation from 2023 (testing at 10 locations) - APA Hotel: AI check-in implementation (50 locations) - Route Inn: Room cleaning robot implementation (testing at 5 locations)

Evaluation: - Industry rivalry: Very intense - Reason: Major chains advancing DX ahead

Impact on BlueWave Hotels: - If falling behind major chains, competitiveness declines - Urgent technology implementation necessary

Phase 6: 5F Analysis Comprehensive Evaluation (1 week)

5F Analysis Results:

| Factor | Threat Level | Evaluation |

|---|---|---|

| New Entrants | Medium | Private lodging/capsule hotels increasing |

| Substitutes | High | Remote work, online meetings widespread |

| Supplier Power | Medium-High | Staffing agency bargaining power high |

| Buyer Power | Medium | Many OTA bookings, easy price comparison |

| Industry Rivalry | Very High | Major chains advancing DX |

Conclusion: "Business hotel industry is very competitive. Threat of substitutes also high. BlueWave Hotels lacks differentiation factors, falling behind major chains. Serving robot/cleaning robot implementation is essential. However, that alone insufficient. Further differentiation strategy necessary."

Chapter Four: Execution as Transformation—Results After 8 Months

Phase 7: Technology Implementation Plan (Months 1-2)

Strategy Based on 5F Analysis:

Strategy 1: Serving Robot/Cleaning Robot Implementation (Response to Industry Rivalry) - Advance DX without falling behind major chains - Personnel cost reduction and publicity creation

Strategy 2: AI Concierge Implementation (Differentiation) - Lead in area major chains haven't addressed - Customer experience improvement

Strategy 3: Direct Booking Enhancement (Response to Buyer Bargaining Power) - OTA commission reduction - Official site bookings from 20% → 40%

Investment Plan: - Serving robots: 6M yen × 20 locations = 120M yen - Cleaning robots: 1.5M yen × 20 locations = 30M yen - AI concierge: 2M yen (common system for all locations) - Official site renewal: 5M yen - Total: 165M yen

Phase 8: Phased Implementation (Months 3-8)

Months 3-4: Pilot Implementation (5 Locations) - Serving robots: 2 units/location - Cleaning robots: 1 unit/location - AI concierge: Test at 5 locations

Pilot Results: - Serving operations: Staff 3 people → 2 people (33% reduction) - Cleaning operations: Common space cleaning time 50% reduction - AI concierge: Customer satisfaction +12 points

Months 5-8: All Location Deployment - Sequential implementation at remaining 15 locations

Results After 8 Months:

Personnel Cost Reduction:

Restaurants: - Before: 3 people × 7.5 hours × 365 days × 20 locations = 164,250 hours - After: 2 people × 7.5 hours × 365 days × 20 locations = 109,500 hours - Reduction: 54,750 hours × 1,500 yen = Annual 82.125 million yen

Cleaning (Common Spaces): - Before: Annual 30 million yen - After: Annual 15 million yen (50% reduction) - Reduction: Annual 15 million yen

Banquet Hall (Staffing Agency Reduction): - Before: Annual 80 million yen - After: Annual 64 million yen (20% reduction) - Reduction: Annual 16 million yen

Total Personnel Cost Reduction: Annual 113 million yen

Direct Booking Increase: - Before: OTA 70%, Direct booking 30% - After: OTA 55%, Direct booking 45% - OTA commission reduction: Annual revenue 8.5B yen × 15% × 12% = 15.3M yen reduction

Publicity Creation: - Media coverage: 10 outlets (TV 2, newspaper 3, web 5) - SNS spread: Twitter 50K retweets, Instagram 30K likes - Booking increase: Year-on-year +8% - Revenue increase: 8.5B yen × 8% = 680M yen - Gross margin increase: 680M yen × 25% = 170M yen

Annual Total Effect: - Personnel cost reduction: 113M yen - OTA commission reduction: 15.3M yen - Gross margin increase: 170M yen - Total: 298.5 million yen

Investment: - Initial investment: 165M yen - Operation costs: Robot maintenance 6M yen/year, AI system operation 3M yen/year, total 9M yen

ROI (First Year): - Return: 298.5M yen - Investment: 165M + 9M = 174M yen - ROI: (298.5M - 174M) / 174M × 100 = 71.6% - Net effect: 124.5M yen - Investment recovery: 7.0 months

5F Response Effects:

Response to New Entrants: - Successfully differentiated from private lodging/capsule hotels through cutting-edge technology implementation

Response to Substitutes: - Customer experience improvement with AI concierge, counter to remote work

Response to Supplier Bargaining Power: - Reduced dependence on staffing agencies through robot implementation, strengthened bargaining power

Response to Buyer Bargaining Power: - Achieved 45% direct bookings, reduced OTA dependence

Response to Industry Rivalry: - Achieved DX equivalent to major chains, caught up

Organizational Transformation:

Restaurant Staff A's Voice: "Initially, I was concerned 'robots will take jobs.' But actually, robots carry food and we can concentrate on customer service. Conversations with customers increased, fulfillment increased. Staff numbers decreased, but individual satisfaction increased."

Customer (Business Traveler) B's Voice: "I was surprised when serving robot brought food. Felt like hotel implementing cutting-edge technology. And AI concierge for tourism information is convenient. BlueWave Hotels differs from other business hotels. Will repeat."

Business Planning Manager (Nakamura's) Reflection:

"Until conducting 5F analysis, we simply thought 'implement serving robots and it's good.' However, by analyzing industry structure, we understood that alone is insufficient.

New entrants (private lodging), substitutes (remote work), supplier bargaining power (staffing agencies), buyer bargaining power (OTA), industry rivalry (major chain DX). We analyzed five competitive factors and formulated strategies responding to each.

Result: Personnel cost reduction 113M yen, OTA commission reduction 15.3M yen, gross margin increase 170M yen, total effect 298.5M yen realized. ROI 71.6%, investment recovery 7.0 months.

And achieved 45% direct bookings, reduced OTA dependence. Media coverage 10 outlets, booking increase 8%. BlueWave Hotels recognized as 'hotel implementing cutting-edge technology.'

5F analysis clarified position within industry, guided strategy to build competitive advantage."

Chapter Five: The Detective's Diagnosis—Industry Structure Determines Strategy

That evening, I contemplated the essence of Porter's 5 Forces analysis.

BlueWave Hotels simply thought "implement serving robots and it's good." However, they couldn't see industry structure—new entrants, substitutes, supplier bargaining power, buyer bargaining power, industry rivalry.

By surveying industry structure with 5F analysis, true strategy became visible. Serving robots/cleaning robots (response to industry rivalry), AI concierge (differentiation), direct booking enhancement (response to buyer bargaining power). These three strategies created annual effect of 298.5 million yen.

"Don't look at technology alone. Look at industry. Analyze five forces of new entrants, substitutes, suppliers, buyers, rivalry. Industry structure determines strategy."

The next case will surely depict another moment of surveying industry structure and building competitive advantage.

"New entrants, substitutes, supplier bargaining power, buyer bargaining power, industry rivalry. Analyze five competitive factors. Understanding industry structure reveals true strategy."—From the Detective's Notes

Related Files

🎖️ Top 3 Weekly Ranking of Classified Case Files

What is the RICE Framework

What is RFP

What is STP Analysis