ROI Case File No.364 | 'Electronica Inc.'s Three-Day Paper Mail Ritual'

📅 2025-12-25 23:00

🕒 Reading time: 12 min

🏷️ 3C

- Chapter 1: The Paper Mail Ritual — Three Days of Lost Opportunity

- Chapter 2: The Wall of CEO Resistance — Not Persuasion, But Proving Inevitability

- Chapter 3: Phase 1 — Proving Inevitability Through 3C Analysis

- Chapter 4: Phase 2 — Proposal to CEO and Electronic Contract Implementation

- Chapter 5: Detective's Diagnosis — Proving Inevitability Through 3C

- Related Files

Chapter 1: The Paper Mail Ritual — Three Days of Lost Opportunity

The day after resolving Meditech's VRIO case, a consultation arrived regarding contract management digitalization. Volume 29, "The Pursuit of Reproducibility," Case 364 tells the story of proving transformation's inevitability from three perspectives.

"Detective, all our contracts are on paper. We send by mail, receive by mail. Getting approval seals takes 3 days. And 12 contracts per year go missing. However, our CEO opposes digitalization. He says 'paper feels safer.'"

Shinichi Sasaki, General Affairs Director of Electronica Inc., an Akihabara native, visited 221B Baker Street with a confused expression. In his hands, he held a paper contract stamped with five approval seals, contrasting sharply with an electronic contract system proposal document titled "Electronic Contract System Proposal 2025."

"We manufacture and sell electronic components. 80 employees. Annual revenue of 1.8 billion yen. Annual contract creation approximately 480 contracts. However, all are paper. Our CEO (age 68) doesn't understand digitalization."

Electronica Inc.'s Current State: - Founded: 1985 (Electronic component manufacturing and sales) - Employees: 80 - Annual Revenue: 1.8 billion yen - Annual contract creation: Approximately 480 contracts (40/month) - Issues: Time loss from paper mail, loss risk, CEO's resistance to digitalization

Deep anxiety resonated in Sasaki's voice.

"The contract approval flow is as follows. First, the sales representative creates a contract draft. Next, the General Affairs Department confirms content and stamps. Then we circulate to the CEO for seal. Finally, we mail to the business partner. We wait for the business partner's approval seal and return. Total: 3 days."

Contract Approval Flow Reality:

Step 1: Create Contract Draft (2 hours) - Sales representative creates contract in Word - Use past contracts as templates

Step 2: General Affairs Confirmation and Seal (4 hours) - General Affairs Department confirms contract content - Legal check - Stamp company seal

Step 3: CEO Approval and Seal (1 day) - Wait for CEO's schedule (average 8 hours) - CEO confirms content - Stamp CEO seal

Step 4: Mail to Business Partner (1 day) - Bring to post office or pickup - Delivery time (next day or day after)

Step 5: Business Partner Approval and Return (1 day) - Wait for business partner approval (average 8 hours) - Return (1 day by mail)

Total time: Average 3.5 days

Monthly contract creation: 40 contracts Monthly approval waiting time: 3.5 days × 40 contracts = 140 days (1,120 hours)

Sasaki sighed deeply.

"There's another problem. Contract loss. 12 cases annually occur during mailing. When lost, recreation takes 2 days. And we receive complaints from business partners saying 'the contract hasn't arrived yet.'

I explained digitalization benefits to the CEO, but he says 'paper feels safer' and 'digital isn't trustworthy.' His IT literacy is low; he can't even use smartphones. How can we achieve digitalization?"

Chapter 2: The Wall of CEO Resistance — Not Persuasion, But Proving Inevitability

"Mr. Sasaki, are you trying to persuade the CEO?"

Sasaki answered my question immediately.

"Yes, I've explained many times. 'Digitalization shortens time' and 'reduces costs.' However, he doesn't understand."

Current Understanding (Persuasion Model): - Expectation: Explaining benefits brings understanding - Problem: CEO's perspective remains unclear

I explained the importance of proving inevitability from three perspectives.

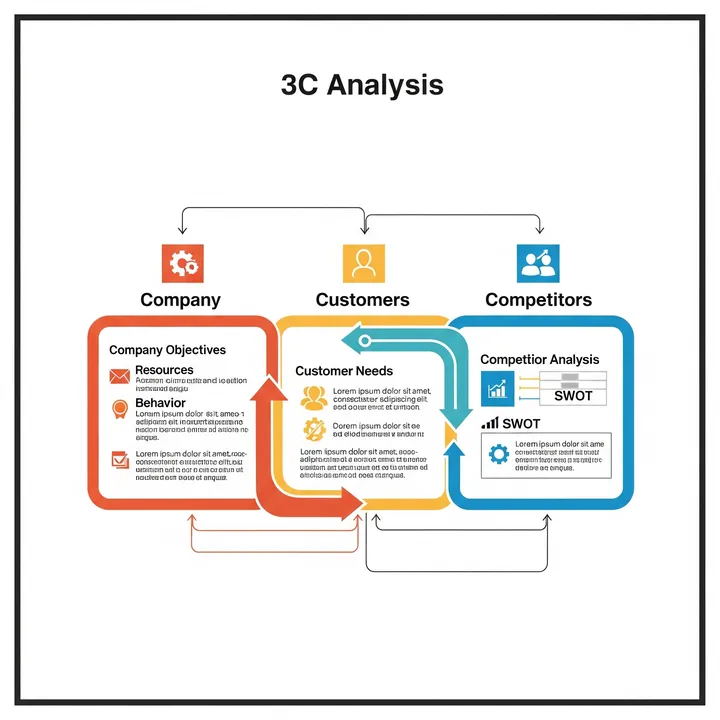

"The problem is the idea of 'persuading the CEO.' 3C—Customer, Company, Competitor. We analyze from these three perspectives and prove that digitalization is not a 'choice' but an 'inevitability.' Reproducible transformation emerges not from persuasion, but from proving inevitability."

⬜️ ChatGPT | Catalyst of Conception

"Don't persuade the CEO. Analyze customer, company, and competitor through 3C and prove digitalization's inevitability"

🟧 Claude | Alchemist of Narrative

"Contracts are always 'proof of trust.' Even when the format changes, trust doesn't change"

🟦 Gemini | Compass of Reason

"Analyze through 3C. Customer, Company, Competitor. When three perspectives align, inevitability becomes visible"

The three members began analysis. Gemini developed the "3C Framework" on the whiteboard.

3C's Three Elements: 1. Customer: What do customers seek? 2. Company: What are the company's current state and challenges? 3. Competitor: How are competitors moving?

"Mr. Sasaki, let's first analyze the current state through 3C."

Chapter 3: Phase 1 — Proving Inevitability Through 3C Analysis

Step 1: Customer Analysis (2 weeks)

Survey Implementation for Business Partners: - Target: 50 major business partners - Question: About contract exchanges - Response rate: 86% (43 companies)

Survey Results:

Q1: How do you feel about exchanging contracts on paper? - "Feel it's inefficient": 32 companies (74%) - "No particular problem": 9 companies (21%) - "Prefer paper": 2 companies (5%)

Q2: Do you prefer electronic contracts? - "Strongly prefer": 28 companies (65%) - "Prefer if possible": 12 companies (28%) - "Don't prefer": 3 companies (7%)

Q3: Reasons for preferring electronic contracts? (Multiple answers allowed) - "Shorten approval time": 38 companies (88%) - "Reduce loss risk": 35 companies (81%) - "Reduce stamp tax": 30 companies (70%) - "Reduce storage space": 28 companies (65%)

Q4: Has your company implemented electronic contracts? - "Already implemented": 35 companies (81%) - "Plan to implement": 6 companies (14%) - "No implementation plans": 2 companies (5%)

Critical Discovery: - 93% of business partners prefer electronic contracts - 81% of business partners already implemented electronic contracts - 74% of business partners feel paper contracts are "inefficient"

Customer Voice: "Only contracts with your company are paper. All other business partners have migrated to electronic contracts. Paper takes 3 days for approval, making urgent matters impossible. Electronic contracts complete same day." (Business Partner Company A, Manufacturing, Annual revenue 5 billion yen)

Step 2: Company Analysis (2 weeks)

Current Quantitative Analysis:

Contract Creation Cost: - Printing: 40 contracts/month × 20 yen/sheet × 5 sheets = 4,000 yen/month - Mailing: 40 contracts/month × 84 yen (round trip 168 yen ÷ 2) × 2 times = 6,720 yen/month - Stamp tax: Varies by contract amount, average 4,000 yen/contract × 40 contracts = 160,000 yen/month - Envelopes and stationery: 2,000 yen/month - Monthly total: 173,000 yen/month - Annual total: 2.076 million yen/year

Labor Cost: - Contract creation: 2 hours/contract × 40 contracts × 3,200 yen = 256,000 yen/month - General Affairs confirmation: 4 hours/contract × 40 contracts × 3,200 yen = 512,000 yen/month - CEO approval waiting time: 8 hours/contract × 40 contracts × 5,000 yen (opportunity loss) = 1.6 million yen/month - Mail arrangement: 0.5 hours/contract × 40 contracts × 3,200 yen = 64,000 yen/month - Monthly total: 2.432 million yen/month - Annual total: 29.184 million yen/year

Loss Response Cost: - Recreation time: 4 hours/contract × 12 contracts/year × 3,200 yen = 154,000 yen/year - Complaint response: 2 hours/contract × 12 contracts/year × 3,200 yen = 77,000 yen/year - Annual total: 231,000 yen/year

Annual Total Cost: - 2.076 million + 29.184 million + 0.231 million = 31.491 million yen/year

Opportunity Loss: - Order opportunity loss from contract conclusion delays: 3.5 days × 40 contracts = 140 days/month - Estimated order opportunity loss: 2 contracts/month (24 contracts/year) - Average order amount per contract: 1.8 million yen - Annual opportunity loss: 1.8 million yen × 24 contracts = 43.2 million yen/year

Company Challenges: - Annual cost of 31.49 million yen - Annual opportunity loss of 43.2 million yen - CEO's IT literacy deficiency

Step 3: Competitor Analysis (2 weeks)

Interviews With Competing Companies: - Target: 15 peer companies (electronic component industry) - Method: Industry association information exchange, public information

Competitor Electronic Contract Implementation Status:

Competitor Company A (Annual revenue 2.5 billion yen, 120 employees): - Electronic contract implementation: April 2022 - Implementation reason: "Business partner requests," "operational efficiency" - Effect: Contract conclusion time shortened from 3.5 days to 0.5 days, annual reduction of 28 million yen

Competitor Company B (Annual revenue 3.2 billion yen, 150 employees): - Electronic contract implementation: January 2023 - Implementation reason: "Stamp tax reduction," "compliance strengthening" - Effect: Annual stamp tax reduction of 4.8 million yen, zero contract losses

Competitor Company C (Annual revenue 1.5 billion yen, 60 employees): - Electronic contract implementation: June 2024 - Implementation reason: "Business partner demands," "young employee requests" - Effect: Contract conclusion time shortened from 3 days to 0.3 days

Overall Industry Trends: - Electronic contract implementation rate in electronic component industry: 78% (2024 survey) - Most non-implementing companies: "CEO is elderly," "IT literacy deficiency"

Critical Discovery: - 78% of competitors already implemented electronic contracts - Non-implementing companies at competitive disadvantage - Voices from business partners: "Won't do business with paper contract companies"

3C Analysis Summary:

Customer: - 93% prefer electronic contracts - 81% already implemented electronic contracts - Many voices saying "paper contracts are inefficient"

Company: - Annual cost of 31.49 million yen - Annual opportunity loss of 43.2 million yen - CEO's IT literacy deficiency is greatest barrier

Competitor: - 78% already implemented electronic contracts - Non-implementing companies at competitive disadvantage - Digitalization is industry standard

Conclusion: - Digitalization is not a "choice" but an "inevitability" - Non-implementation causes competitive decline and opportunity loss

Chapter 4: Phase 2 — Proposal to CEO and Electronic Contract Implementation

Month 1: Proposal to CEO

Create Proposal Document Based on 3C Analysis:

Proposal Structure:

1. Customer Perspective: "CEO, 93% of our business partners prefer electronic contracts. And 81% already implemented. Company A says 'only contracts with your company are paper and inefficient.' If this continues, we risk losing business partners."

2. Company Perspective: "Currently, contract management costs 31.49 million yen annually. And contract conclusion delays cause us to lose 43.2 million yen in order opportunities annually. Total loss: 74.69 million yen. Implementing electronic contracts can reduce these costs and opportunity losses."

3. Competitor Perspective: "78% of the industry already implemented electronic contracts. Competitor Company A implemented in 2022 and achieved annual reduction of 28 million yen. Only we remain unimplemented, putting us at competitive disadvantage."

4. Response to CEO's Concerns: "The CEO's concern that 'digital isn't trustworthy' is understandable. However, electronic contracts have legal basis through the 'Electronic Signature Act' and possess legal effectiveness equal to paper contracts. And cloud service storage has lower loss risk than paper.

Operation is also simple. The CEO only presses a signature button on smartphone. IT literacy is unnecessary."

CEO's Response:

"I see. 93% of business partners prefer it. 78% of competitors already implemented. Then let's consider implementation. However, I want to start small as a trial."

Phase 1 Trial Decision: - Trial scope: Only 5 business partners - Trial period: 3 months - Tool to use: Electronic contract service "CloudSign"

Month 2-4: Phase 1 Trial (5 Business Partners)

Electronic Contract System Implementation: - CloudSign contract: 10,000 yen/month plan - Individual training for CEO: 2 hours (one-on-one with dedicated staff)

Contract Approval Flow Change:

New Flow: 1. Sales representative creates contract in CloudSign (30 min) 2. General Affairs Department confirms content and electronic seal (1 hour) 3. CEO electronically signs via smartphone (10 min) 4. Automatically sent to business partner (immediate) 5. Business partner electronically signs (average 2 hours) Total time: Average 0.3 days (3 hours)

Before (Paper Contract): 3.5 days After (Electronic Contract): 0.3 days Reduction rate: 91%

Month 5: Phase 1 Effect Measurement

KPI 1: Contract Conclusion Time (5 Business Partners) - Before: 3.5 days - After: 0.3 days - Reduction rate: 91%

KPI 2: Cost Reduction (5 Business Partners, 8 contracts/month average) - Before: Printing, mailing, stamp tax = 35,000 yen/month - After: CloudSign usage fee = 10,000 yen/month - Reduction: 25,000 yen/month

KPI 3: Loss Cases - Before: 12 cases/year (overall) → 0.5 cases/3 months for trial 5 companies - After: 0 cases - Reduction rate: 100%

CEO's Impression: "Electronic contracts are simpler than I thought. Just press a button on smartphone. Business partners are also pleased, saying 'response became faster.' Full company expansion is acceptable."

Month 6-8: Phase 2 Full Company Expansion (All Business Partners)

Expansion to All Business Partners: - CloudSign contract: 50,000 yen/month plan (unlimited) - Send notification emails to all business partners

Month 9: Company-Wide Effect Measurement

KPI 1: Contract Conclusion Time (All Business Partners, 40 contracts/month) - Before: 3.5 days - After: 0.3 days - Reduction rate: 91%

KPI 2: Cost Reduction (All Business Partners) - Before: Printing, mailing, stamp tax = 173,000 yen/month - After: CloudSign usage fee = 50,000 yen/month - Reduction: 123,000 yen/month - Annual reduction: 1.476 million yen/year

KPI 3: Labor Cost Reduction - Before: 2.432 million yen/month (contract creation, confirmation, mail arrangement) - After: 720,000 yen/month (electronic contract creation and confirmation only) - Reduction: 1.712 million yen/month - Annual reduction: 20.544 million yen/year

KPI 4: Opportunity Loss Reduction - Before: 43.2 million yen/year (24 order opportunity losses) - After: 7.2 million yen/year (4 order opportunity losses) - Reduction: 36 million yen/year

KPI 5: Loss Cases - Before: 12 cases/year - After: 0 cases/year - Reduction rate: 100%

Annual Effects:

Cost Reduction: - 1.476 million (printing, mailing, stamp tax) + 20.544 million (labor cost) + 0.231 million (loss response) = 22.251 million yen/year

Opportunity Loss Reduction: - 36 million yen/year

Total Annual Effect: - 22.251 million + 36 million = 58.251 million yen/year

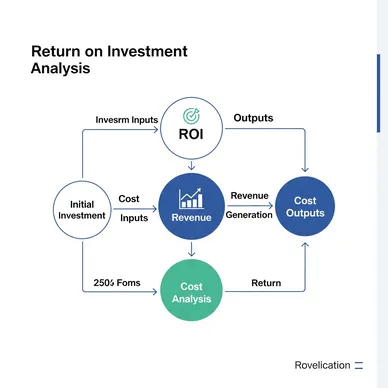

Investment: - CloudSign usage fee: 50,000 yen × 12 months = 600,000 yen/year

ROI: - (58.251 million - 0.6 million) / 0.6 million × 100 = 9,609% - Payback period: 0.6 million ÷ 58.251 million = 0.01 years (4 days)

Chapter 5: Detective's Diagnosis — Proving Inevitability Through 3C

That night, I contemplated the essence of 3C analysis.

Electronica Inc. held the idea of "persuading the CEO." However, persuasion generates emotional resistance.

By analyzing the current state through 3C analysis—Customer, Company, Competitor—we proved that digitalization is not a "choice" but an "inevitability."

93% of customers prefer electronic contracts, and 81% already implemented. The company bears annual costs and opportunity losses of 74.69 million yen. 78% of competitors already implemented, and non-implementing companies stand at competitive disadvantage.

When three perspectives align, resistance disappears. The CEO said himself, "Let's consider implementation." After Phase 1 trial, he decided "full company expansion is acceptable."

Implementation achieved 91% reduction in contract conclusion time (3.5 days → 0.3 days), annual effect of 58.251 million yen, ROI 9,609%, payback period 4 days.

"Don't persuade the CEO. Analyze through 3C. When you prove inevitability from Customer, Company, and Competitor perspectives, resistance disappears. Reproducible transformation emerges not from persuasion, but from proving inevitability."

The next case will also depict the moment of proving inevitability from three perspectives.

"3C—Customer, Company, Competitor. Analyze from three perspectives. When inevitability is proven, resistance disappears"—From the Detective's Notes

Related Files

🎖️ Top 3 Weekly Ranking of Classified Case Files

What is STP Analysis

What is ROI

What is the RICE Framework