ROI Case File No.284 | 'ElectraParts Trading Company's Value Chain Discovery'

📅 2025-10-29 11:00

🕒 Reading time: 10 min

🏷️ VALUECHAIN

- Chapter 1: Scattered Proposals — Exhaustion from Too-Wide Battlefronts

- Chapter 2: The Chain of Activities — Where Value Is Born and Where It Leaks

- Chapter 3: Anatomy of Value — Where to Invest

- Chapter 4: The Power of Focused Proposals — Value Presentation with Narrowed Focus

- Chapter 5: The Detective's Value Chain Diagnosis — Technology for Discerning Value Sources

- The Detective's Perspective — Value Resides in Chains

- Related files

Chapter 1: Scattered Proposals — Exhaustion from Too-Wide Battlefronts

The week following the resolution of DineWave's Blue Ocean case, a consultation arrived from Tokyo regarding an electronic components trading company's DX proposal strategy. Episode 284 of Volume 23 "The Pursuit of Reproducibility - Sequel" tells the story of discovering true value creation points among countless proposal possibilities.

"Detective, we're strengthening IoT and DX proposals to manufacturing customers. But the proposal scope is too broad and results aren't appearing. Production, logistics, quality control, sales support... We're proposing in all areas, but everything is half-hearted."

ElectraParts Trading Company's business planning manager, Makoto Kimura from Tokyo, visited 221B Baker Street with an exhausted expression. In his hands were 28 DX proposals and, in stark contrast, a report showing zero contract results.

"We're an electronic components and semiconductor trading company in Tokyo. An era where component sales alone don't generate profit has arrived, so we started DX consulting as a value-added service. But nothing sells."

ElectraParts Trading Company's Proposal Confusion: - Founded: 1998 (electronic components and semiconductor trading) - Annual revenue: $233 million (component sales) - Clients: 850 companies (manufacturing focus) - DX proposal start: 2 years ago - DX proposals submitted: 28 (past year) - Contract results: 0 - Proposal preparation hours: Cumulative 1,200 hours - Opportunity loss: Estimated $2 million annually

Deep anxiety showed on Kimura's face.

"The problem is our policy of 'propose everything DX-capable.' Let's install sensors on factory equipment, visualize inventory with IoT, introduce tablets for sales. Customers ask 'So what improves?' but we can't answer clearly."

Scattered Proposal Themes: - Procurement: Supply chain visibility, automated ordering - Production: Equipment operation monitoring, predictive maintenance, quality data collection - Logistics: IoT inventory management, delivery optimization - Quality control: Inspection data analysis, traceability - Sales: Mobile sales support, customer data analysis - Management: Dashboards, business analysis

Proposal Failure Patterns:

Proposal A: Auto Parts Manufacturer (300 employees) "Let's install IoT sensors on all factory equipment and collect operation data." Customer response: "So what changes? What's the ROI?" Result: Consideration pending

Proposal B: Precision Machinery Manufacturer (180 employees) "Let's implement IoT inventory management for real-time visibility." Customer response: "We already grasp inventory. What's the problem?" Result: Not adopted

Proposal C: Electric Manufacturer (500 employees) "Let's distribute tablets to sales and share customer information." Customer response: "Sales say paper is easier to use." Result: Rejected

"We say 'DX is necessary,' but customers can't see 'why it's necessary.' And we ourselves don't understand."

Chapter 2: The Chain of Activities — Where Value Is Born and Where It Leaks

"Mr. Kimura, what criteria guide your current DX proposal area selection?"

To my question, Kimura answered.

"Basically, 'what we can propose.' We handle IoT sensors, so we propose equipment monitoring. We partnered with an inventory management system vendor, so we propose inventory IoT. In other words, we reverse-engineer from what we 'can sell.'"

Current Proposal Process (Product-Out): - Starting point: Products and services we can handle - Conception: "We want to sell this product to someone" - Proposal: Propose without listening to customer issues - Result: Doesn't resonate with customers

I explained the importance of understanding customers' value chains.

"Manufacturing activities are a single chain. From raw material procurement through production, logistics, sales, to service. Where in this chain is value created, and where does it leak? Discerning that is the starting point of true proposals."

⬜️ ChatGPT | Catalyst of Concepts

"See the customer's value chain. Where is strong, where is weak? The weak link is the proposal's vital point."

🟧 Claude | Alchemist of Narratives

"Value flows like a river. Where does it stagnate in that flow, where does it overflow? Those who find this can present true solutions."

🟦 Gemini | Compass of Reason

"Value Chain analysis is a map of value. At the intersection of primary and support activities lies the optimal investment answer."

The three members began analysis. Gemini deployed a "Manufacturing Industry-Specific Value Chain Analysis" framework on the whiteboard.

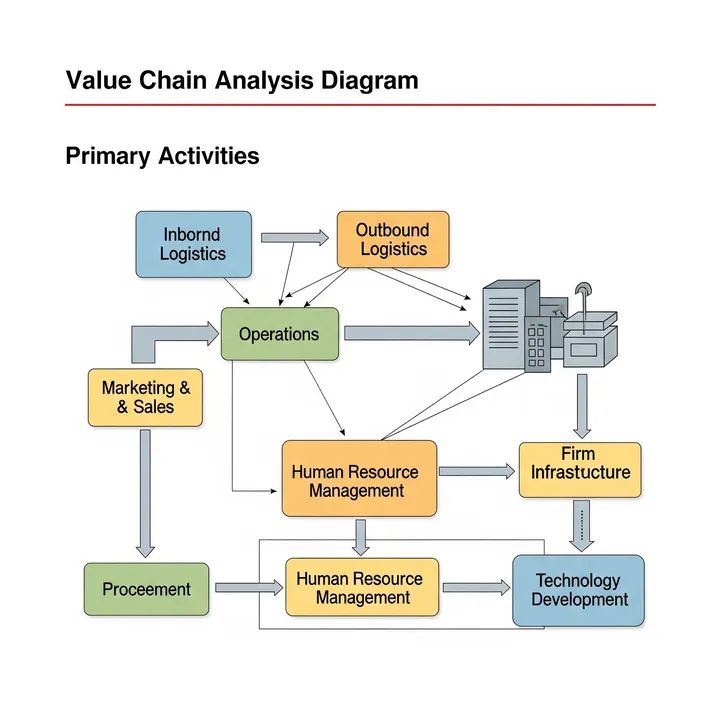

Value Chain Structure:

Primary Activities: 1. Inbound Logistics 2. Operations 3. Outbound Logistics 4. Marketing & Sales 5. Service

Support Activities: 1. Firm Infrastructure 2. Human Resource Management (HRM) 3. Technology Development 4. Procurement

"Mr. Kimura, let's dissect ElectraParts' customers' value chains."

Chapter 3: Anatomy of Value — Where to Invest

Phase 1: Representative Customer Value Chain Analysis (3 weeks)

We analyzed in detail Company A (300 employees), an auto parts manufacturer who had previously rejected proposals.

Company A Primary Activity Analysis:

1. Inbound Logistics (raw material and parts receiving): - Activities: Steel, plastic material procurement, incoming inspection, warehouse storage - Cost: $10 million annually - Issues: None in particular (stable supply secured) - IoT effectiveness: Low

2. Operations (production activities): - Activities: Press processing, assembly, painting, inspection - Cost: $23.3 million annually - Issues: Equipment utilization 78% (industry average 85%), defect rate 2.1% - IoT effectiveness: High (room for utilization improvement)

3. Outbound Logistics (shipping): - Activities: Finished product storage, shipment, delivery - Cost: $6.7 million annually - Issues: Low inventory turnover (6 times/year, industry average 10 times) - IoT effectiveness: Medium (inventory optimization potential)

4. Marketing & Sales: - Activities: Sales to auto manufacturers, quotation creation - Cost: $4.2 million annually - Issues: None in particular (long-term contracts with existing customers) - IoT effectiveness: Low

5. Service (after-sales service): - Activities: Post-delivery complaint response, quality improvement proposals - Cost: $2.5 million annually - Issues: None in particular - IoT effectiveness: Low

Phase 2: Discovering Value and Cost Gaps

We identified the area with "greatest improvement potential" in Company A's value chain.

Detailed Operations (Production) Analysis:

Causes of Low Equipment Utilization: - Long changeover times (average 45 minutes per changeover) - Unexpected stoppages from equipment failures (average 8 times/month) - Manual speed adjustments watching equipment condition (craftsman-dependent)

Causes of High Defect Rate: - Processing condition fine-tuning is person-dependent - Cannot detect defect precursors - Sampling inspection, not full inspection

Calculation: If utilization improves to 85% and defect rate to 1.0%: - Production capacity: 20% improvement - Defect cost reduction: $467,000 annually - Total effect: $1.5 million annual cost reduction

Phase 3: Focusing on Production and Logistics Intersection

Further analysis revealed an unexpected discovery.

True Reason for Low Inventory Turnover: - Production plan and shipment plan not linked - "Overproduction" from month-end concentrated production causing excess inventory - "Stockouts" from inability to respond to sudden orders causing opportunity loss

Lack of Production-Logistics Coordination: - Production: "Make according to plan" - Logistics: "Ship according to customer orders" - Problem: Both operate independently, inventory not optimized

Phase 4: Identifying Value Creation Points

Value Chain analysis results yielded a clear conclusion.

Areas ElectraParts Should Propose: 1. Production IoT implementation (improve utilization and defect rates) 2. Production-logistics coordination strengthening (inventory optimization)

Areas Not to Propose: - Procurement, sales, service (small improvement potential)

Chapter 4: The Power of Focused Proposals — Value Presentation with Narrowed Focus

Phase 5: New Proposal Design (1 month)

Based on Value Chain analysis, we designed a re-proposal to Company A.

New Proposal: "Production × Logistics Coordination IoT System"

Proposal Content:

Phase 1: Production IoT Implementation (Investment $233,000) - Equipment operation monitoring sensor installation (20 primary equipment units) - Real-time vibration, temperature, current data collection - Predictive maintenance algorithm (failure precursor detection) - Automatic processing condition optimization

Expected Effects: - Equipment utilization: 78% → 85% (+7 points) - Unexpected stoppages: 8 times/month → 2 times/month (75% reduction) - Defect rate: 2.1% → 1.0% (halved) - Annual effect: +$1.5 million

Phase 2: Production-Logistics Coordination (Investment $100,000) - Finished product inventory IoT (automatic location and quantity tracking) - Integrated production plan and shipment plan system - Optimal production volume calculation by demand forecasting AI

Expected Effects: - Inventory turnover: 6 times/year → 10 times/year - Excess inventory reduction: 40% - Zero stockouts - Annual effect: +$792,000

Total Investment: $333,000

Total Effect: $2.29 million annually

Investment Recovery Period: 5.2 months

Phase 6: Re-Proposal Implementation (2 weeks)

We proposed to Company A, who had previously rejected us, based on Value Chain analysis.

Proposal Presentation:

Kimura: "Last time, we proposed 'let's install IoT sensors.' This time is different. We analyzed your value chain and identified 'where investment produces maximum effect.'"

Company A President: "Go ahead, let's hear it."

Kimura: "Your greatest issue is 'production.' Utilization 78%, defect rate 2.1%. Improving here enables $1.5 million annual cost reduction. Furthermore, coordinating production and logistics can reduce inventory 40%, yielding $792,000 annual effect."

Company A Production Manager: "Certainly, utilization is an issue. But can IoT improve it that much?"

Kimura: "Similar company B improved utilization 8 points with a similar system. You can recover investment in 5.2 months."

Company A President: "...Let's do it. However, start with Phase 1, and proceed to Phase 2 if effective. Agreed?"

Kimura: "Of course."

Result: Contract Secured (ElectraParts' first DX project)

Phase 7: Implementation and Effect Verification (6 months)

We progressively implemented at Company A.

After 3 Months (Phase 1 Complete): - Equipment utilization: 78% → 83% (+5 points) - Unexpected stoppages: 8 times/month → 3 times/month - Defect rate: 2.1% → 1.3% - Actual effect: $1.17 million annualized - Company A evaluation: "Better than expected"

After 6 Months (Phase 2 Complete): - Inventory turnover: 6 times/year → 9 times/year - Excess inventory reduction: 35% - Stockouts: 2 times/month → 0.2 times/month - Actual effect: $1.92 million annualized

Phase 8: Horizontal Expansion and Business Growth (12 months)

Based on Company A's success case, we expanded proposals to other customers.

Value Chain Analysis-Based Proposals: - Proposal count: 28 (all focused on production or production × logistics) - Contract rate: 18/28 (64%) - Average contract value: $267,000 - Total revenue: $4.8 million

Comprehensive Results After 12 Months:

DX Business Establishment: - Annual revenue: $0 → $4.8 million - Operating profit margin: 35% (7x component sales) - Contract customers: 18 companies - Retention rate: 100% (all satisfied and continuing)

Ripple Effect on Component Sales: - Component purchases from DX-implementing customers: Average +22% - Switches from other companies: 3 companies - Component sales revenue: $233M → $246M

Organizational Change: - DX proposal team: 5 → 12 members (increased) - Proposal standardization: Value Chain analysis template created - Sales capability enhancement: Value Chain training for all sales

Customer Testimonial:

Company A President: "Last proposal was 'IoT-first.' This time was 'our issues-first.' We hadn't even realized production was the real issue. ElectraParts changed from a company selling components to a company creating value."

Chapter 5: The Detective's Value Chain Diagnosis — Technology for Discerning Value Sources

Holmes compiled the comprehensive analysis.

"Mr. Kimura, Value Chain analysis's essence is 'customer understanding.' Not what you want to sell, but understanding activities where customers create value. Where in that chain are issues, where does investment produce maximum effect? The power to discern that is true proposal capability."

Final Report 24 Months Later:

ElectraParts Trading Company established a new position as "manufacturing industry DX partner" in the electronic components industry.

Final Results: - Annual revenue: $233M → $260M (+11%) - DX business revenue: $4.8M → $11.7M - Operating profit margin: 6% → 11% - Customer evaluation: "Trading company most understanding manufacturing field"

Kimura's letter expressed deep gratitude:

"Through Value Chain analysis, we transformed from 'a company selling products' to 'a company creating value.' Most important was viewing customer activities as a single chain. Now before new proposals, we always draw the customer's Value Chain. Where value is created, where it leaks—at that intersection lies true proposals. This we now understand."

The Detective's Perspective — Value Resides in Chains

That night, I reflected on the essence of value creation.

Value Chain analysis's true value lies in a holistic perspective. Many companies start from their own products. But true proposals start from customer activities.

Customers create value through a series of activities. Where in that chain is strong, where is weak? Strengthening the weak link becomes maximum value provision.

"Customers don't buy products. They choose products to strengthen their value chain."

The next case will also depict a moment when Value Chain analysis carves out a company's future.

"The value chain flows like a river. Only those who discern where it stagnates in that flow can present true solutions."—From the detective's notes

Related files

🎖️ Top 3 Weekly Ranking of Classified Case Files

What is MVP

What is Agile Development

What is STP Analysis