ROI Case File No.306 | 'PeriTech's Invisible Enemy'

📅 2025-11-09 11:00

🕒 Reading time: 10 min

🏷️ 5F

- Chapter 1: The Illusion of Efficiency—Losing Sight of DX's Essence

- Chapter 2: The Inward-Looking Trap—Decisions Ignoring Competitive Environment

- Chapter 3: The Five Forces—Visualizing Invisible Enemies

- Chapter 4: Strategy Redefinition—DX as Survival Weapon

- Chapter 5: Competition Reality—The Battlefield 12 Months Later

- Chapter 5: Detective's Diagnosis—Competitive Environment Determines Strategy

- Related Files

Chapter 1: The Illusion of Efficiency—Losing Sight of DX's Essence

The week after resolving WineTrade's RFM incident, a consultation arrived from Ibaraki regarding an IT peripheral manufacturer's DX promotion. Episode 306 of Volume 25 "The Pursuit of Certainty" tells the story of discovering that what appeared to be internal efficiency DX was actually industry survival competition itself.

"Detective, we're promoting DX. We want to automate manufacturing line visual inspection to improve efficiency. However, management is skeptical—'Are the investment effects worth it?' ROI unclear, can't get budget approval."

Hiroshi Tanaka, production technology manager at PeriTech Inc., originally from Tsukuba, visited 221B Baker Street unable to hide his confusion. In his hands were a DX promotion plan and, in stark contrast, management meeting minutes stamped "Investment Effect Unclear."

"We manufacture IT peripherals in Ibaraki. USB hubs, cables, adapters... BtoB products. Currently, manufacturing line visual inspection depends on human eyes. We want to automate this."

PeriTech's DX Promotion Stagnation: - Establishment: 1998 (IT peripheral manufacturing) - Annual Revenue: ¥4.8 billion - Employees: 280 - Manufacturing Base: 1 Ibaraki factory - Inspection Process: Visual inspection (18 inspectors) - Defect Outflow Rate: 0.8% (industry average 0.5%) - DX Investment Plan: Visual inspection automation (investment ¥85M) - Status: Awaiting management approval (stalled 3 months)

Deep frustration filled Tanaka's voice.

"The problem is that DX's purpose can only be explained as 'efficiency.' With automation, we can reduce 18 inspectors to 12. Annual labor cost reduction is about ¥24M. Investment recovery period is 3.5 years. But management says 'Is that all?'"

Management Meeting Record (3rd Meeting):

President: "Mr. Tanaka, ¥85M is a large investment. If labor cost reduction is the only purpose, wouldn't maintaining status quo without investment be better?"

Tanaka: "However, efficiency is important. Competitors are also advancing DX"

Finance Manager: "Can't approve with only 'because competitors are advancing' as reason. Show us why DX is truly necessary for us"

Tanaka: "That's..."

Result: Approval pending, instructed to reconsider

"Honestly, I couldn't answer. I couldn't explain 'why DX is necessary' in words other than efficiency."

Chapter 2: The Inward-Looking Trap—Decisions Ignoring Competitive Environment

"Mr. Tanaka, from what perspective was the current DX promotion plan created?"

To my question, Tanaka answered.

"Basically 'internal perspective.' In our factory, which process can be made efficient. How much costs can be reduced. That's all we thought about. Didn't really consider competitors or customers."

Current Approach (Internal Perspective Type): - Perspective: Only internal efficiency - Purpose: Labor cost reduction - Problem: Not considering competitive environment

I explained the importance of industry structure analysis.

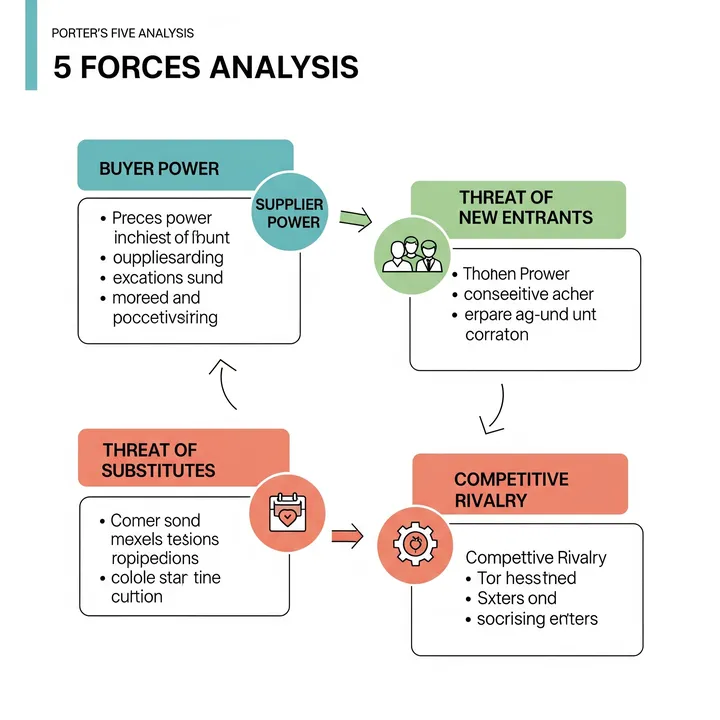

"DX isn't internal efficiency. It's survival competition. 5 Forces Analysis—5 factors. New entry, competition, substitutes, buyers, suppliers. These 5 forces determine industry profitability. And you need to determine how DX affects those forces."

⬜️ ChatGPT | Catalyst of Vision

"Don't look inward. Survey the industry with 5F. DX isn't efficiency, it's survival strategy"

🟧 Claude | Alchemist of Stories

"Those who can't see competitors are already defeated when they notice"

🟦 Gemini | Compass of Reason

"5F analysis is competition map. Read industry structure with 5 forces: new entry, competition, substitutes, buyers, suppliers"

The three members began analysis. Gemini developed the "5 Forces Analysis Framework" on the whiteboard.

Five Forces (5 Competitive Factors): 1. Threat of New Entry: Possibility of new competitors entering 2. Threat of Existing Competition: Competition with existing competitors 3. Threat of Substitutes: Possibility of replacement by other products/services 4. Bargaining Power of Buyers: Customers' power to demand price and quality 5. Bargaining Power of Suppliers: Suppliers' power to determine prices for materials/parts

"Mr. Tanaka, let's re-evaluate PeriTech's DX promotion with 5F analysis."

Chapter 3: The Five Forces—Visualizing Invisible Enemies

Phase 1: Threat of New Entry (2 weeks)

First, surveyed status of new entry into IT peripheral market.

Market Research Findings:

Rise of Chinese Manufacturers: - Past 5 years: 15 companies entered Japanese market from China - Price: 60-70% of PeriTech's products - Quality: Improving (defect rate 0.4%, better than PeriTech) - Auto-inspection adoption rate: 100% (all companies already introduced AI inspection)

Vietnamese/Thai Manufacturers: - Past 3 years: 8 companies entered - Competitive with low prices + automation

Tanaka was stunned:

"Chinese manufacturers had already introduced auto-inspection... Moreover, defect rate lower than ours (0.4% vs 0.8%)"

Threat of New Entry: High (low entry barriers, numerous new entrants)

Phase 2: Threat of Existing Competition (2 weeks)

Next, analyzed existing domestic competitors.

Competitor A (major, annual revenue ¥12B): - Fully introduced AI visual inspection 3 years ago - Defect rate: 0.3% (less than half PeriTech's) - Inspectors: Zero (fully automated) - Result: Customer trust improved, expanding share

Competitor B (mid-sized, annual revenue ¥5.2B): - Partially introduced auto-inspection 2 years ago - Defect rate: 0.5% (lower than PeriTech) - Same scale as PeriTech but widening gap

Competitor C (small, annual revenue ¥1.8B): - Continuing visual inspection - Defect rate: 1.2% (industry worst) - Lost 2 major customers last year, management crisis

Discovery: - Companies introducing auto-inspection: Expanding share - Companies continuing visual inspection: Declining

Threat of Existing Competition: High (automated competitors gaining advantage)

Phase 3: Threat of Substitutes (1 week)

Surveyed products substituting IT peripherals.

Evolution of Wireless Technology: - Wireless power/communication technology eliminating USB cables - Substitutes PeriTech's main products (USB hubs, cables)

Cloud Migration: - Decreasing local storage → Reduced USB memory demand

Integrated Devices: - Multi-functionality reducing dedicated adapter demand

Threat of Substitutes: Medium (long-term threat, but short-term demand exists)

Phase 4: Bargaining Power of Buyers (2 weeks)

Conducted interviews with customer companies.

Survey of 10 Major Customers:

Customer A (Major Electronics Manufacturer): "Quality is top priority. If defects mix in, it affects our products. Recently evaluated samples from Chinese Manufacturer B—quality good, price low. Want to continue with PeriTech, but if quality doesn't improve, will consider switching"

Customer B (Mid-sized IT Company): "Honestly, PeriTech's 0.8% defect rate is high. Competitor A is 0.3%. We're quality-focused, so increasing orders to Competitor A"

Customer C (Startup): "Price competition is intense in our market. PeriTech products have good quality but high price. Can procure 30% cheaper from Chinese manufacturers"

Discovery: - Customers demand both quality and price - High defect rate → Possibility of transaction reduction - Customer choices increasing (Chinese, Southeast Asian manufacturers)

Bargaining Power of Buyers: High (many customer choices, strict quality demands)

Phase 5: Bargaining Power of Suppliers (1 week)

Analyzed suppliers of raw materials and parts.

Major Suppliers: - Plastic resin: Procured from 3 companies (substitutable) - Electronic parts: Procured from 5 companies (substitutable) - Molds: Procured from 2 companies (somewhat limited)

Bargaining Power of Suppliers: Low (can procure from multiple suppliers)

Phase 6: 5F Analysis Integration (3 days)

Comprehensively evaluated the 5 forces.

【5F Analysis Results】

1. Threat of New Entry: 【High】

→ Chinese/Southeast Asian manufacturers entering with low price + high quality

2. Threat of Existing Competition: 【High】

→ Automated competitors expanding share

3. Threat of Substitutes: 【Medium】

→ Wireless technology etc. long-term threat

4. Bargaining Power of Buyers: 【High】

→ Many customer choices, strict quality demands

5. Bargaining Power of Suppliers: 【Low】

→ Can procure from multiple suppliers

【Conclusion】

Industry Profitability: Deteriorating trend (3 of 5 high threats)

PeriTech's Position: Defensive (will decline if status quo)

Tanaka turned pale.

"We were considering DX for efficiency. But it was actually a fight for survival..."

Chapter 4: Strategy Redefinition—DX as Survival Weapon

Phase 7: DX Strategy Restructuring Based on 5F (2 weeks)

Based on 5F analysis results, redefined DX investment meaning.

New DX Strategy Positioning:

Vs. Threat of New Entry - Introduce auto-inspection → Quality improvement (defect rate 0.8% → 0.3%) - Achieve quality equal to Chinese manufacturers - Effect: Defense wall against new entry

Vs. Threat of Existing Competition - Equal quality to Competitors A (0.3%), B (0.5%) - Clear differentiation from Competitor C (1.2%) - Effect: Maintain competitive advantage

Vs. Bargaining Power of Buyers - Meet customer demands (high quality) - Zero defect outflow → Gain customer trust - Effect: Transaction continuation and expansion

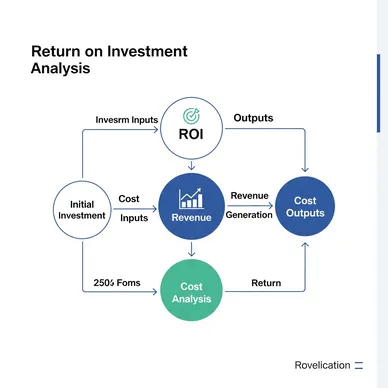

Investment Effect Recalculation:

Direct Effects (Traditional ROI): - Labor cost reduction: ¥24M annually - Investment recovery period: 3.5 years

Indirect Effects (5F Perspective Additional Effects): - Customer retention maintaining revenue: ¥4.8B annually - Prevent revenue loss from new entry: Estimated ¥500M annually - Prevent losses from defect outflow: ¥8M annually - Total Indirect Effects: About ¥500M/year risk avoidance

New ROI Explanation: - Investment: ¥85M - Direct Effect: ¥24M annually - Indirect Effect: ¥500M annual risk avoidance - True Investment Recovery Period: 0.2 years (2.4 months)

Phase 8: Re-proposal to Management Meeting (1 week later)

Presented 5F analysis to management.

Tanaka's Presentation:

"President, last time I only said 'efficiency.' But that was wrong. DX's essence is countermeasure to 5 threats"

Slide 1: Threat of New Entry "15 Chinese companies have entered. All introduced auto-inspection, achieving 0.4% defect rate. Our 0.8% is inferior in quality"

Slide 2: Threat of Existing Competition "Competitor A automated 3 years ago, 0.3% defect rate. Expanding share. Competitor C didn't automate, lost major customers last year"

Slide 3: Bargaining Power of Buyers "Customer A explicitly stated 'will switch if quality doesn't improve.' Annual ¥1.2B transaction"

Slide 4: Scenario Without Investment "If we skip DX, within 3 years we'll lose 3 major customers, revenue declining to ¥3.5B (27% down from current ¥4.8B). Automated competitors will steal market"

Slide 5: Scenario With Investment "Introducing auto-inspection achieves 0.3% defect rate, maintaining and expanding customers. Becomes defense wall against new entry"

President: "...I understand. This isn't efficiency, it's survival strategy. Approved"

Result: Approved same day, DX investment decided

Chapter 5: Competition Reality—The Battlefield 12 Months Later

Phase 9: Auto-Inspection System Introduction (6 months)

Introduction Content: - AI camera visual inspection - Inspection speed: 0.8 sec/piece (1/10 of visual) - Defect detection accuracy: 99.7%

Post-Introduction Results: - Defect rate: 0.8% → 0.28% (65% reduction) - Inspectors: 18 → 12 - Inspection process bottleneck resolved

Business Results After 12 Months:

Customer Retention/Expansion: - Major Customer A: Order volume +20% (quality improvement appreciated) - Major Customer B: Order volume maintained (stopped switching to Competitor A) - New Customer Acquisition: 3 companies ("high quality" appreciated)

Revenue Growth: - Annual Revenue: ¥4.8B → ¥5.4B (+12.5%)

Market Share: - Share in domestic IT peripheral market: 8.5% → 9.2% - Competitor C (no automation): Share 3.2% → 1.8% (major decline)

Defense Against New Entry: - Quality gap with Chinese manufacturers: Nearly equal - Differentiation with "Japanese reliability" + "high quality through automation"

Organizational Change: - Recognition established: DX is "competitive strategy," not "cost reduction" - Next DX investment (production process automation) approved

Tanaka's Reflection:

"Until 5F analysis, I thought DX was 'efficiency.' But it was really investment for 'survival.'

If we alone continued visual inspection while competitors automated, we would have lost major customers within 3 years. DX wasn't optional, it was essential."

Chapter 5: Detective's Diagnosis—Competitive Environment Determines Strategy

That night, I contemplated the essence of 5F analysis.

Initially, PeriTech only saw DX as "internal efficiency." Tried to justify investment with labor cost reduction and ROI.

However, when surveying industry structure with 5F analysis, truth became visible. Wave of new entry, automating competitors, customers demanding quality. DX wasn't efficiency but countermeasure to these threats.

"Strategy doesn't arise internally. Competitive environment determines strategy. 5F visualizes invisible enemies."

The next case will also depict the moment 5F analysis reads industry structure.

"Don't look inward. Survey the 5 forces. New entry, competition, substitutes, buyers, suppliers. Competitive environment determines strategy"—From the Detective's Notes

Related Files

🎖️ Top 3 Weekly Ranking of Classified Case Files

What is STP Analysis

What is ROI

What is the RICE Framework