ROI 【🔏CLASSIFIED CASE FILE】 No. X000 | What is ROI

📅 2025-05-06

🕒 Reading time: 3 min

🏷️ ROI 🏷️ Learning 🏷️ 【🔏CLASSIFIED CASE FILE】

Detective's Note: Cases involving the keyword "ROI" are flooding in. Uncover the true identity of this term that many speak of but few truly comprehend. Investigate the tangled definitions and mysterious calculation formulas to reveal the truth. Create a foundational case file accessible to both novices and experts. Urgent.

What is ROI - Case Overview

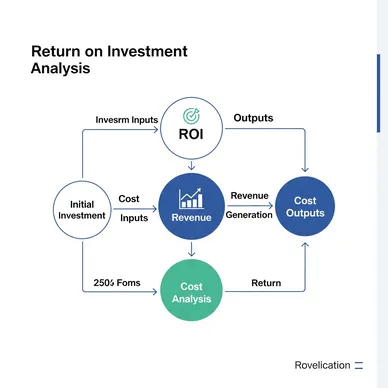

ROI (Return on Investment) - literally "investment return rate." Frequently mentioned among our clients, yet its definition often remains vague and breeds misunderstanding. This investigation aims to unveil the true nature of this ROI concept and organize the elements causing confusion.

Investigation Memo: ROI is an indicator showing how much return was generated from an investment. Simply put, it measures how much profit was gained relative to the amount invested.

ROI Calculation Method - Evidence Analysis

Primary Evidence: Basic ROI calculation formula

ROI = (Profit - Investment Amount) ÷ Investment Amount × 100%

Evidence Analysis: This formula represents the percentage of profit relative to the investment amount. By expressing it as a percentage, investments of different scales and types become comparable.

Case Evidence: When investing 10 million yen and gaining 3 million yen profit:

ROI = (3 million yen - 10 million yen) ÷ 10 million yen × 100% = -70%

When investing 10 million yen and gaining 13 million yen profit:

ROI = (13 million yen - 10 million yen) ÷ 10 million yen × 100% = 30%

Evidence Analysis Results: ROI can be both negative and positive. The former indicates failure to recover the investment amount, while the latter shows returns exceeding the initial investment.

Importance of ROI - Deep Investigation

Investigation Finding 1: Value as a Decision-Making Tool ROI serves as crucial material for management decisions on which investment projects deserve funding. It functions as a "compass" for effective resource allocation with limited resources.

Investigation Finding 2: Past Investment Evaluation Measuring the effectiveness of already implemented investments. Beyond simple success/failure determination, it becomes valuable "precedent" influencing future decision-making.

Investigation Finding 3: Comparative Analysis Indicator Effectiveness comparison between different departments, projects, and initiatives. It answers the question: "Which would be more effective with the same investment amount?"

ROI Limitations and Precautions - Hidden Truths

Warning File 1: Time Horizon Issues Short-term ROI and long-term ROI can differ significantly. Investments like brand building or R&D, which take time to show effects, risk reaching incorrect conclusions if judged solely on short-term ROI.

Warning File 2: Overlooking Qualitative Effects Effects difficult to quantify (employee motivation improvement, brand image enhancement, etc.) are rarely included in ROI calculations. Ignoring these "hidden values" can lead to missing the complete picture.

Warning File 3: Inconsistent Calculation Methods When calculation methods aren't standardized within an organization, comparisons become meaningless. Results vary significantly based on the definition of "profit" (gross or net) and scope of "investment amount" (direct costs only or including indirect costs).

Other ROI Variants - Related Case Files

Related Evidence 1: SROI (Social Return on Investment) Social Return on Investment. A method calculating not only monetary value but also social and environmental value.

SROI = (Monetary Value of Social Benefits + Economic Benefits - Investment Amount) ÷ Investment Amount × 100%

Related Evidence 2: ROE (Return on Equity) Return on Equity. Measures returns on shareholders' investments.

ROE = Net Profit ÷ Shareholders' Equity × 100%

Related Evidence 3: ROA (Return on Assets) Return on Assets. Shows how efficiently a company's total assets generate profit.

ROA = Net Profit ÷ Total Assets × 100%

Conclusion - Investigation Summary

Detective's Final Report:

ROI is a crucial indicator showing "the percentage of return on investment" and plays a central role in business decision-making. However, it's essential to understand the underlying assumptions and limitations of calculations rather than merely chasing surface-level numbers.

The key finding from this investigation is that ROI is not a "universal indicator" but rather "one tool to assist decision-making." Making investment decisions from a multifaceted perspective that includes qualitative value and long-term effects leads to truly wise management.

Furthermore, understanding related indicators that could be considered ROI variants (SROI, ROE, ROA, etc.) enables more comprehensive investment evaluation.

We hope this file helps clarify the mysterious concept of ROI and serves as an aid for more effective investment decision-making.

Case Closed

Solve Your Business Challenges with Kindle Unlimited!

Access millions of books with unlimited reading.

Read the latest from ROI Detective Agency now!

*Free trial available for eligible customers only