ROI 【🔏CLASSIFIED CASE FILE】 No. X011 | What is 5F (Five Forces)

📅 2025-05-28

🕒 Reading time: 7 min

🏷️ 5F 🏷️ Learning 🏷️ 【🔏CLASSIFIED CASE FILE】

- What is 5F (Five Forces) - Case Overview

- Basic Structure of 5F - Evidence Analysis

- 5F Analysis Implementation Procedure - Investigation Methods

- The Power of 5F - Hidden Truths

- 5F Limitations and Precautions - Potential Dangers

- 5F Evolution and Related Theories - Related Case Files

- Conclusion - Investigation Summary

Detective's Note: The "5F (Five Forces)" analytical method revered by strategy consultants and corporate planning departments. Professor Michael Porter's industry structure analysis theory, proposed at Harvard Business School in 1980, continues to reign as the foundation of competitive strategy over 40 years later. However, reports continue that many companies "conduct analysis but cannot apply it to actual strategic planning" and question "whether this is outdated theory for the digital age." Determine the identity of the structural mechanism behind the laws of industry dominance woven by five competitive factors and why this theory continues to wield power across eras.

What is 5F (Five Forces) - Case Overview

5F (Five Forces), formally known as "Five Forces Analysis," is the industry structure analysis theory proposed by Harvard Business School Professor Michael Porter in his 1980 book "Competitive Strategy." This method, which systematized five competitive factors determining industry profitability, is recognized among our clients as "the bible of competitive strategy." However, in actual workplaces, voices saying "too theoretical, lacking practicality" and "difficult to apply to the digital economy" are frequent, with debates about its contemporary significance.

Investigation Memo: The mechanism determining industry profitability through five forces. A theoretical framework explaining seemingly complex market competition through structural factors. We need to explore why these five specifically, and the limitations and possibilities of effectiveness in modern times.

Basic Structure of 5F - Evidence Analysis

Primary Evidence: The Five Factors of Five Forces

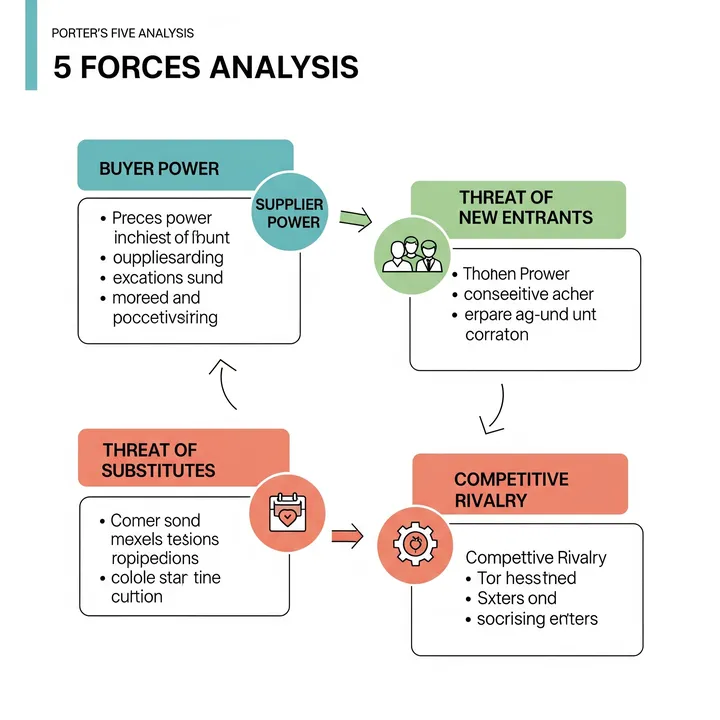

1. Industry Rivalry (Competitive Intensity Among Existing Firms)

"Competition intensity among existing competitors"

・Number of competing companies and relative power

・Industry growth rate and market maturity

・Degree of product/service differentiation

・Customer switching costs

・Exit barrier height

2. Threat of New Entrants

"Possibility and impact of new company entry"

・Entry barrier height (economies of scale, capital requirements, etc.)

・Existing company retaliation possibility

・Distribution channel access

・Government regulations/policies

・Brand loyalty strength

3. Threat of Substitutes

"Threat level of substitute products/services"

・Substitute product performance/price competitiveness

・Customer inclination to switch to substitutes

・Substitute improvement pace

・Substitute providing industry profitability

・Price/performance trade-offs

4. Bargaining Power of Buyers

"Customer/purchaser price negotiation power"

・Buyer concentration and purchase volume

・Whether products are standardized

・Buyer information level

・Backward integration possibility

・Importance to buyers

5. Bargaining Power of Suppliers

"Supplier price/condition negotiation power"

・Supplier concentration and substitutability

・Input factor differentiation degree

・Forward integration threat

・Industry importance to suppliers

・Switching cost height

Evidence Analysis: 5F's excellence lies in comprehensively organizing structural factors determining industry profitability. It possesses clear logical structure where stronger forces reduce industry profitability while weaker forces enable higher profits.

5F Analysis Implementation Procedure - Investigation Methods

Investigation Finding 1: Concrete 5F Analysis Example (Smartphone Industry)

Case Evidence:

1. Industry Rivalry (High):

・Fierce competition among Apple, Samsung, Chinese manufacturers

・Technology innovation-driven differentiation competition

・Price competition intensification (especially mid to low-end)

・Intense global market share battles

2. Threat of New Entrants (Medium):

・High R&D investment creates entry barriers

・Patent/intellectual property walls

・Brand building difficulty

・However, emergence of Chinese newcomers

3. Threat of Substitutes (Medium-High):

・Evolution of tablets, wearable devices

・Functional overlap with PCs/laptops

・Replacement possibility by new technologies (AR/VR, etc.)

・Longer replacement cycles due to feature saturation

4. Bargaining Power of Buyers (Medium):

・Individual consumers weak individually but information-armed

・Telecom carriers maintain strong negotiation power

・Enterprise bulk purchases have price negotiation power

・Price transparency through online comparison

5. Bargaining Power of Suppliers (High):

・Semiconductor manufacturer oligopoly (Qualcomm, TSMC, etc.)

・Limited supply of critical components (batteries, displays)

・Rare metal/rare earth supply constraints

・Influence of companies controlling technology standards

Investigation Finding 2: Inter-Force Interaction Analysis

Mutual Influence Examples:

New Entrants × Industry Rivalry:

Increased new entrants → Competition intensification → Profitability decline

Substitutes × Buyer Power:

Abundant substitutes → Increased buyer options → Strengthened negotiation power

Supplier Power × Industry Rivalry:

Raw material cost increases → Difficulty passing costs → Profit pressure

Investigation Finding 3: Strategic Planning Utilization - Identifying and leveraging weakest forces (profit opportunities) - Countermeasures against strongest forces (profit inhibiting factors) - Examining strategic options to change 5F structure - Industry positioning optimization

The Power of 5F - Hidden Truths

Critical File 1: Structural Understanding of Industry Profitability Can explain why some industries are highly profitable while others are low-profit through structural factors rather than intuition or experience. Becomes objective evaluation criteria for investment decisions and business entry.

Critical File 2: Strategic Option Systematization By considering strategy from five perspectives, can discover easily overlooked competitive factors and strategic opportunities. Enables transition from single-perspective to multi-faceted strategy.

Critical File 3: Long-term Competitive Advantage Design Enables strategic planning that changes industry structure itself rather than temporary tactics. Can structurally design sources of sustainable competitive advantage.

Critical File 4: Investment Decision Objectification Provides criteria for quantitatively evaluating industry structural attractiveness in business investment and M&A decisions. Promotes transition from emotional to logical judgment.

5F Limitations and Precautions - Potential Dangers

Warning File 1: Static Analysis Limitations Remains at industry structure analysis at one point in time, with insufficient response to dynamic changes. Risk of failing to capture rapid structural changes in the digital age.

Warning File 2: Digital Economy Application Difficulties Limited response to elements not anticipated in the 1980s: platform economy, network effects, freemium business models, etc.

Warning File 3: Industry Boundary Ambiguity Cases where "industry" definition itself becomes difficult as digitalization makes industry boundaries unclear. Difficult to predict structural changes from cross-industry entry.

Warning File 4: Qualitative Analysis Subjectivity Risk that force strength/weakness judgments are influenced by analyst subjectivity. Reliability decreases without objective data backing.

Warning File 5: Gap with Strategy Execution Cases where theoretical analysis dominates with insufficient linkage to actual strategy execution and organizational capabilities. Risk of falling into analysis for analysis' sake.

5F Evolution and Related Theories - Related Case Files

Related Evidence 1: Extension to 6F (Six Forces)

5F + Government/regulatory authority influence

Regulatory environment changes, government policy impacts

Considering relationships with public institutions as competitive factors

Related Evidence 2: 5F Evolution Theory for Digital Age

・Platform effect consideration

・Differentiation through data/AI utilization

・Ecosystem competition expansion

・Increased importance of speed/agility

Related Evidence 3: Integration with VRIO Analysis

5F (industry analysis) + VRIO (internal company analysis)

Integrated analysis of external environment and internal resources

More comprehensive competitive strategy planning

Related Evidence 4: Contrast with Blue Ocean Strategy

5F = Red Ocean (existing market) analysis

Blue Ocean = New market creation strategy

Strategic choice between existing competition vs new market creation

Related Evidence 5: Dynamic Capability Theory

Complementing static 5F analysis limitations

Focus on organizational adaptation/change response capabilities

Emphasizing dynamic aspects of sustainable competitive advantage

Conclusion - Investigation Summary

Detective's Final Report:

5F (Five Forces) is "the pinnacle of competitive strategy theory." Over 40 years have passed since Professor Michael Porter proposed it in 1980, yet its theoretical foundation continues to be utilized as the basis for much strategic planning. This is not coincidental but due to the universality of theory that comprehensively and logically organized structural factors determining industry profitability.

The most impressive finding in this investigation was the power of 5F's "structural thinking." By understanding seemingly complex market competition as interactions of five forces, objective strategic planning becomes possible without relying on intuition or experience. Additionally, the structural design that clarifies strategic focus areas by identifying which forces are strong and which are weak is nothing short of brilliant.

However, "application limitations" in the digital age also became clear. Response to elements not anticipated in the 1980s - platform economy, network effects, industry boundary ambiguity - is insufficient. As countermeasures for this problem, realistic solutions involve maintaining 5F's basic thinking framework while utilizing evolved forms incorporating contemporary elements.

It also became evident that 5F's true value lies not in "conducting Analysis" but in "applying it to strategy." True value is demonstrated by connecting to concrete actions: strategies changing the structure of five forces, strategies leveraging the weakest forces, strategies countering the strongest forces, rather than ending with theoretical analysis.

Competitive Strategy Maxim: "Excellent strategy means understanding industry structural factors and changing them to favor one's own company."

Case Closed

Solve Your Business Challenges with Kindle Unlimited!

Access millions of books with unlimited reading.

Read the latest from ROI Detective Agency now!

*Free trial available for eligible customers only