ROI 【🔏CLASSIFIED CASE FILE】 No. X012 | What is PPM

📅 2025-05-30

🕒 Reading time: 7 min

🏷️ PPM Analysis 🏷️ Learning 🏷️ 【🔏CLASSIFIED CASE FILE】

- What is PPM - Case Overview

- Basic Structure of PPM - Evidence Analysis

- PPM Analysis Implementation Procedure - Investigation Methods

- The Power of PPM - Hidden Truths

- PPM Limitations and Precautions - Potential Dangers

- PPM Evolution and Related Methods - Related Case Files

- Conclusion - Investigation Summary

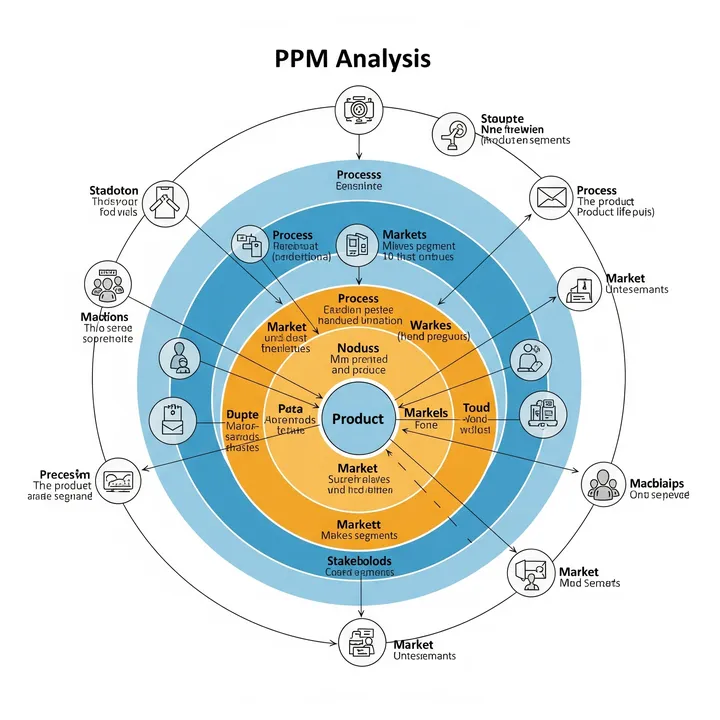

Detective's Note: A three-letter cipher "PPM" revered in boardrooms and strategic planning departments. This method, referring to Product Portfolio Management or formally "Business Portfolio Management," is globally known as the "BCG Matrix" developed by Boston Consulting Group (BCG) in the 1970s. The business classification depicted by four quadrants - Question Marks, Stars, Cash Cows, and Dogs - serves as a powerful guideline for strategic resource allocation in diversified companies. However, reports continue that many companies "classify and feel satisfied" without applying results to actual strategic decision-making. Determine why this 2×2 matrix wields such influence and the identity of its contemporary effectiveness and limitations.

What is PPM - Case Overview

PPM (Product Portfolio Management), commonly known as the "BCG Matrix," is a business portfolio analysis method. This strategic framework, developed by Boston Consulting Group's Bruce Henderson in the 1970s, classifies businesses into four quadrants using two axes - market growth rate and relative market share - and indicates optimal resource allocation for each business. Among our clients, it's recognized as "an essential tool for diversification strategy," yet in actual workplaces, voices saying "too theoretical, lacking practicality" and "doesn't fit modern business environments" are frequently heard.

Investigation Memo: Four-quadrant classification through two axes and strategic implications for each quadrant. Seemingly simple, but deep insights about corporate growth and capital circulation are hidden behind it. We need to clarify why these two axes were chosen and decipher the strategic meaning of each quadrant.

Basic Structure of PPM - Evidence Analysis

Primary Evidence: PPM's Four-Quadrant Classification

Question Mark / Problem Child

"High Growth, Low Share Business"

・Market growth rate: High

・Relative market share: Low

・Characteristics: High cash consumption, low profitability

・Strategic implication: Choice between investment expansion or withdrawal needed

・Typical example: Business in newly entered markets

Star

"High Growth, High Share Business"

・Market growth rate: High

・Relative market share: High

・Characteristics: High profitability but investment also required

・Strategic implication: Continued investment to maintain market position

・Typical example: Leading company in growth markets

Cash Cow

"Low Growth, High Share Business"

・Market growth rate: Low

・Relative market share: High

・Characteristics: Stable high profitability, low investment

・Strategic implication: Utilize as cash generation source

・Typical example: Dominant business in mature markets

Dog

"Low Growth, Low Share Business"

・Market growth rate: Low

・Relative market share: Low

・Characteristics: Low profitability, low investment value

・Strategic implication: Consider withdrawal/divestiture

・Typical example: Declining business that lost competitiveness

Evidence Analysis: PPM's excellence lies in organizing business current status and future prospects through two important indicators and clearly showing strategic responses for each business. Particularly, a structure enabling design of inter-business complementary relationships from a "cash flow" perspective is incorporated.

PPM Analysis Implementation Procedure - Investigation Methods

Investigation Finding 1: Concrete PPM Analysis Example (Integrated Home Appliance Manufacturer)

Case Evidence:

Question Mark:

・AI home appliance business: IoT/AI market shows high growth,

but company share is low due to strong competitors like Amazon, Google

・Investment decision: Choice needed between large-scale investment

in technology strengthening or specialization in niche areas

Star:

・EV battery business: High market growth rate due to rapid EV market growth,

high share achieved through technological capabilities

・Strategy: R&D and production capacity expansion to maintain market position

Cash Cow:

・White goods business: Maintains stable high share through brand power

in mature markets like refrigerators and washing machines

・Strategy: Cash generation through efficient operations,

utilize as funding source for other businesses

Dog:

・Conventional TV business: Profitability deteriorated due to LCD TV

market maturation and price competition from Korean/Chinese competitors

・Strategy: Consider business sale/withdrawal,

specialization in high-value areas like OLED also an option

Investigation Finding 2: Inter-Business Capital Circulation Design

Cash Flow Optimization:

Cash Cow → Star:

Allocate stable revenues from mature businesses to growth business investment

Cash Cow → Question Mark:

Utilize as investment funds for future Star candidates

Star → Cash Cow:

Anticipate conversion to stable revenue source after market maturation

Capital recovery from Dogs:

Secure investment funds for other businesses through withdrawal/sale

Investigation Finding 3: Time-Series Business Movement Patterns - Question Mark → Star: Growth pattern of successful new businesses - Star → Cash Cow: Transition pattern accompanying market maturation - Question Mark → Dog: Typical example of failed investment businesses - Cash Cow → Dog: Decline pattern due to competitiveness deterioration

The Power of PPM - Hidden Truths

Critical File 1: Strategic Resource Allocation Optimization Can optimally allocate limited management resources according to each business's growth stage and competitive position. Enables objective investment decisions rather than emotional/political judgments.

Critical File 2: Inter-Business Synergy Visualization Rather than viewing each business independently, can design complementary relationships across the entire portfolio. Overall optimization through cash flow circulation becomes achievable.

Critical File 3: Long-term Growth Strategy Foundation Provides investment decision criteria not just for short-term profits but for businesses that will become future growth engines. Promotes strategic thinking for sustainable growth.

Critical File 4: Withdrawal Decision Objectification Enables objective withdrawal decisions even for businesses that are emotionally difficult to abandon. Contributes to effective resource utilization and improved organizational decision-making.

PPM Limitations and Precautions - Potential Dangers

Warning File 1: Oversimplification Risk Limitations of analyzing complex business environments through only two axes. Risk that many important factors like technological innovation, regulatory changes, competitor strategy changes aren't considered.

Warning File 2: Relative Market Share Measurement Difficulty Ambiguity of "market" definition in the digital age, difficulty applying "share" concepts in new business models. Setting objective measurement criteria becomes difficult.

Warning File 3: Self-Fulfilling Prophecy Danger Possibility that investment reduction in businesses classified as "Dogs" causes actual competitiveness decline. Risk that analysis results determine business future prospects.

Warning File 4: Static Analysis Limitations Remains at one-point analysis with insufficient response to rapid environmental changes. Particularly unable to capture sudden market structure changes due to digitalization.

Warning File 5: Synergy Effect Neglect Risk that technological and sales synergies between businesses aren't sufficiently considered. Risk of overlooking value creation opportunities beyond simple fund transfers.

PPM Evolution and Related Methods - Related Case Files

Related Evidence 1: GE-McKinsey Matrix

Nine-quadrant analysis of Market Attractiveness × Business Competitiveness

More detailed analysis through multifaceted evaluation axes

Countermeasure for PPM's simplification problems

Related Evidence 2: ADL Matrix

Analysis of Market Maturity × Competitive Position

Strategic planning emphasizing industry lifecycle

Development toward dynamic analysis considering time axis

Related Evidence 3: PPM Evolution Theory for Digital Age

・Considering platform business specificity

・Rapid market changes due to network effects

・Data/AI asset value evaluation

・Competitive advantage across entire ecosystems

Related Evidence 4: Integration with ESG Investment

Incorporating environmental, social, governance factors

Portfolio design considering sustainability

Ensuring consistency with long-term value creation

Related Evidence 5: Integration with Real Options Theory

Investment decision methods under uncertainty

Ensuring flexibility through staged investment

Developing PPM's static analysis into dynamic investment strategy

Conclusion - Investigation Summary

Detective's Final Report:

PPM (BCG Matrix) is "a classic yet currently effective foundational theory for business portfolio management." Nearly 50 years have passed since its development in the 1970s, yet its fundamental thinking framework continues to be utilized in strategic planning by many companies. This is because analysis through two axes - market growth rate and relative market share - captures essential business characteristics.

The most impressive finding in this investigation was PPM's excellence in "capital circulation design." The structural thinking enabling portfolio-wide optimization through fund transfers from Cash Cows to Stars and Question Marks and building inter-business complementary relationships is nothing short of brilliant. The design philosophy achieving overall optimization through combinations of multiple businesses rather than single business optimization maintains value that doesn't fade even today.

However, "application limitations" in the digital age also became clear. Response to elements not anticipated in the 1970s - market boundary ambiguity, rapid structural changes, platform economy specificity - is insufficient. As countermeasures for this problem, realistic solutions involve maintaining PPM's basic thinking framework while utilizing evolved forms incorporating contemporary elements.

It also became evident that PPM's true value lies not in "classifying" but in "applying to strategic decision-making." True value is demonstrated by clarifying each business's strategic role and designing resource allocation achieving overall optimization, rather than mechanical classification work.

Business Portfolio Maxim: "Excellent management means understanding each business's characteristics and designing resource allocation that achieves sustainable growth overall."

Case Closed

Solve Your Business Challenges with Kindle Unlimited!

Access millions of books with unlimited reading.

Read the latest from ROI Detective Agency now!

*Free trial available for eligible customers only