ROI【🔏CLASSIFIED CASE FILE】 No. X014 | What is RFM Analysis

📅 2025-06-14

🕒 Reading time: 7 min

🏷️ RFM Analysis 🏷️ Learning 🏷️ 【🔏CLASSIFIED CASE FILE】

- What is RFM Analysis - Case Overview

- Basic Structure of RFM Analysis - Evidence Analysis

- RFM Analysis Implementation Process - Investigation Methods

- The Power of RFM Analysis - Hidden Truths

- Limitations and Cautions of RFM Analysis - Potential Dangers

- Evolution of RFM Analysis and Related Methods - Related Case Files

- Conclusion - Investigation Summary

Detective's Note: A three-letter cipher known as "RFM Analysis" whispered secretly among marketing departments and CRM specialists. This customer analysis methodology, formed by the initials of Recency, Frequency, and Monetary, allegedly possesses the power to discover "truly valuable customers" from vast customer databases. However, reports suggest that many companies remain trapped by misconceptions that "all customers should be treated equally" and "prioritizing premium customers is discriminatory," preventing them from unleashing the true potential of this method. Why is customer "differentiation" crucial, and how do these three metrics expose the essence of customer behavior? We must uncover the scientific mechanisms behind this mysterious phenomenon.

What is RFM Analysis - Case Overview

RFM Analysis (Recency/Frequency/Monetary) - a customer analysis methodology systematized in the direct marketing field during the 1990s. This technique quantitatively evaluates customer purchasing behavior through three metrics, enabling optimal marketing strategies based on customer value. While recognized among our clients as "the foundation of customer segmentation analysis," voices from the field frequently report: "We have the data but don't know how to utilize it" and "psychological resistance to premium customer treatment."

Investigation Memo: Customer value assessment through three numerical indicators. Seemingly simple, yet behind this lies profound insights into human purchasing psychology and behavioral patterns. We must uncover why these three specific metrics and the scientific rationale for customer differentiation.

Basic Structure of RFM Analysis - Evidence Analysis

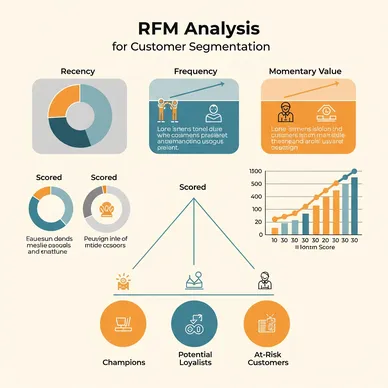

Primary Evidence: The Three RFM Metrics

Recency - Time Since Last Purchase

"When did they last purchase?"

・Days/months elapsed since most recent purchase

・Indicator of purchasing freshness and activity status

・Represents the vitality of customer relationship

・Shorter periods receive higher ratings (high purchase intent state)

Frequency - Purchase Count Within Specific Period

"How frequently do they purchase?"

・Number of purchases within analysis period (typically 1 year)

・Indicator of customer loyalty

・Represents degree of usage habit establishment

・Higher frequency receives higher ratings (heavy users)

Monetary - Purchase Amount Within Specific Period

"How much do they purchase?"

・Total purchase amount within analysis period

・Represents customer's economic value

・Direct contribution to corporate revenue

・Higher amounts receive higher ratings (high-revenue customers)

Evidence Analysis: The brilliance of RFM analysis lies in simultaneously capturing customers' "current state," "behavioral patterns," and "economic value." This three-dimensional combination incorporates a structure capable of predicting future purchasing probability with high accuracy.

RFM Analysis Implementation Process - Investigation Methods

Investigation Discovery 1: Concrete RFM Analysis Example (E-commerce Case)

Case Evidence (Customer Database Analysis):

Customer A:

R: 7 days ago (Score 5) - Recent purchaser

F: 12 times/year (Score 5) - Regular customer with monthly frequency

M: $2,400/year (Score 4) - Good customer spending of $200/month

→ Overall Rating: 554 (Premium Customer)

Customer B:

R: 180 days ago (Score 2) - No purchase for 6 months

F: 2 times/year (Score 2) - Low frequency usage

M: $300/year (Score 2) - Low purchase amount

→ Overall Rating: 222 (Churn Risk Customer)

Customer C:

R: 30 days ago (Score 4) - Relatively recent purchase

F: 4 times/year (Score 3) - Moderate usage frequency

M: $5,000/year (Score 5) - High-value purchaser

→ Overall Rating: 435 (High-Value Low-Frequency Customer)

Investigation Discovery 2: RFM Scoring Methodology

5-Point Scale Classification Example:

Recency (Days since last purchase):

5 points: 0-30 days

4 points: 31-60 days

3 points: 61-120 days

2 points: 121-180 days

1 point: 181+ days

Frequency (Annual purchase count):

5 points: 10+ times

4 points: 7-9 times

3 points: 4-6 times

2 points: 2-3 times

1 point: 1 time

Monetary (Annual purchase amount):

5 points: $2,000+

4 points: $1,000-1,999

3 points: $500-999

2 points: $200-499

1 point: Under $200

Investigation Discovery 3: Customer Segment Classification

Primary Customer Segments:

Champions (555, 554, 544, 545):

・High scores across all metrics

・Most valuable customer group

・VIP treatment, exclusive product notifications

Loyal Customers (543, 444, 435, 355):

・High frequency or high monetary value

・Relationship maintenance focused strategies

New Customers (512, 511, 422, 421):

・Recent purchases but low frequency/monetary

・Development and retention strategies crucial

At-Risk (155, 144, 214, 215):

・Low scores across all metrics

・Emergency churn prevention strategies needed

The Power of RFM Analysis - Hidden Truths

Alert File 1: Customer Value Visualization Transform intuitive judgments of "good customers" vs "bad customers" into objective, data-driven quantification. Marketing investment priorities become clear, enabling improved ROI expectations.

Alert File 2: Enhanced Future Behavior Prediction Accuracy High-precision prediction of future purchasing probability based on past purchasing patterns. Identification of "customers likely to purchase next" and "customers at risk of churn" enables timely strategic execution.

Alert File 3: Marketing Strategy Optimization Design optimal product recommendations, pricing, and communication methods for each customer segment. Escape from uniform mass marketing and achieve individually optimized approaches.

Alert File 4: Efficient Resource Allocation Concentrate marketing budget and human resources on customer groups with highest expected returns. Practical application of the 80:20 rule (Pareto Principle) becomes possible.

Limitations and Cautions of RFM Analysis - Potential Dangers

Alert File 1: Historical Data Dependency Limitations RFM analysis relies on past purchase history, making it unable to predict sudden customer behavior changes or external environmental shifts. Analysis accuracy may significantly decline during environmental upheavals like the COVID pandemic.

Alert File 2: Industry and Product Characteristic Ignorance For high-value products (automobiles, real estate) or low-frequency purchase items, Frequency metrics lose meaning. Uniform application without considering industry or product category characteristics leads to erroneous conclusions.

Alert File 3: New Customer Undervaluation New customers with short purchase histories inevitably receive low scores. Risk of overlooking potential future premium customers and losing them to competitors.

Alert File 4: Customer Experience Neglect Excessive focus on numerical data may neglect customer satisfaction and emotional loyalty. Balance between quantitative and qualitative analysis is crucial.

Alert File 5: Segment Fixation Trap Tendency to view customer segments as fixed after classification, potentially overlooking customer growth and changes. Dynamic customer management system construction is essential.

Evolution of RFM Analysis and Related Methods - Related Case Files

Related Evidence 1: RFM-D Analysis (Adding Diversity)

Diversity = Breadth of purchased product categories

Cross-sell and up-sell possibility assessment

Quantification of customer interest area breadth

Related Evidence 2: LRFM Analysis (Adding Length)

Length = Duration of customer relationship

Distinction between new and existing customers

Correlation analysis with Customer Lifetime Value

Related Evidence 3: Integration with CLV (Customer Lifetime Value)

RFM → Current customer value

CLV → Future customer value

Comprehensive customer evaluation through integration

Related Evidence 4: Machine Learning Integration

・Automatic segmentation through clustering (K-means, etc.)

・Purchase prediction models using decision trees

・Integration with recommendation engines

・Dynamic segment updates through real-time analysis

Related Evidence 5: Digital Era RFM Evolution

・Integration of website visit history

・Correlation analysis with social media engagement

・Omnichannel integrated analysis

・Real-time marketing automation

Conclusion - Investigation Summary

Final Investigator Report:

RFM Analysis represents "a detective methodology for scientifically uncovering true customer value." The quantitative analysis through three metrics—Recency, Frequency, and Monetary—possesses the power to transform intuition and experience-dependent customer understanding into objective, reproducible knowledge.

The most impressive aspect revealed in this investigation was the remarkable "predictive accuracy" of RFM analysis. Why is this seemingly simple approach of predicting future behavior from past purchasing patterns so effective? Because human purchasing behavior follows certain patterns, and these three metrics accurately capture those patterns.

However, the "psychological resistance" harbored by many companies also emerged clearly. The misconception that "all customers should be treated equally" obstructs efficient customer management. Yet true customer focus means providing optimal approaches suited to each customer's situation and needs, not uniform service.

It also became evident that RFM analysis should be viewed not as "analysis for analysis' sake" but as "a tool for practical marketing strategy implementation." The design of specific actions following customer segment identification determines the true value of this methodology.

The potential for evolution in the digital age is immense. Integration with machine learning, real-time analysis, omnichannel compatibility—development toward more precise and dynamic customer understanding systems is anticipated while maintaining RFM analysis' fundamental philosophy.

Customer Analysis Maxim: "Superior customer understanding means not treating all customers the same way, but providing optimal value to each individual customer."

Case Closed