ROI【🔏CLASSIFIED CASE FILE】 No. X016 | What is 3C Analysis

📅 2025-06-16

🕒 Reading time: 7 min

🏷️ 3C Analysis 🏷️ Learning 🏷️ 【🔏CLASSIFIED CASE FILE】

- What is 3C Analysis - Case Overview

- Basic Structure of 3C Analysis - Evidence Analysis

- 3C Analysis Implementation Process - Investigation Methods

- The Power of 3C Analysis - Hidden Truths

- Limitations and Cautions of 3C Analysis - Potential Dangers

- Applications and Related Methods of 3C Analysis - Related Case Files

- Conclusion - Investigation Summary

Detective's Note: A three-letter cipher that appears first in every strategic meeting - "3C Analysis." This fundamental market analysis framework, formed by the initials of Customer, Competitor, and Company, has reigned as the starting point of strategic planning for approximately 40 years since the 1980s. However, reports consistently indicate that many companies oversimplify this approach, thinking "if we examine these three, we can create strategy," thus overlooking the true power of this methodology: "strategic insights born from the interrelationships among the three elements." Why these specific three "Cs"? We must uncover the mechanism that generates strategic insights beyond mere information gathering. Expose the secrets hidden in this deceptively simple yet profoundly deep origin point of strategic analysis.

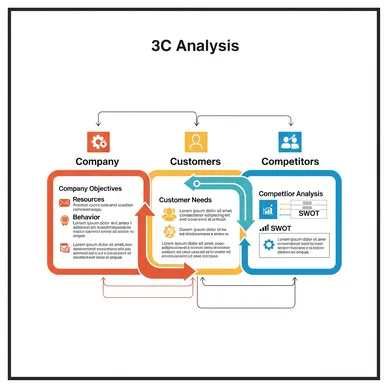

What is 3C Analysis - Case Overview

3C Analysis (Customer/Competitor/Company) - systematized by Kenichi Ohmae of McKinsey & Company in the 1980s. This methodology serves as a fundamental thinking framework for business strategy formulation, utilized worldwide. While recognized among our clients as "introductory strategic analysis," most companies in practice fail to fully leverage its strategic value, with frequent complaints of "just categorizing information into three parts" and "unclear what should be analyzed."

Investigation Memo: Market structuring through three perspectives. Seemingly simple, yet the interaction among these three elements holds the key to strategic success. We must uncover why these specific three elements, and the mechanism for generating insights beyond information collection.

Basic Structure of 3C Analysis - Evidence Analysis

Primary Evidence: The Three C Elements

Customer - Market and Customer Analysis

"Who wants what, and why?"

・Market size, growth potential, segment structure

・Customer needs, purchasing behavior, values

・Purchase decision process, decision factors

・Unmet needs (pain points)

・Future market changes and trends

Competitor - Competitive Analysis

"Who are we competing with, and how?"

・Identification of direct, indirect, and potential competitors

・Competitor strategies, strengths, weaknesses, market position

・Products, services, pricing, sales methods

・Financial situation, investment policies, future plans

・Competitive environment changes, new entrant trends

Company - Internal Analysis

"What can we do?"

・Company strengths, weaknesses, owned resources

・Current business portfolio, market position

・Organizational capabilities, technical skills, brand power

・Financial situation, investment capacity, constraints

・Corporate philosophy, culture, strategic direction

Evidence Analysis: The brilliance of 3C analysis lies in organizing information necessary for strategic planning without excess or deficiency. The three perspectives—customer (source of opportunities), competitor (source of threats), and company (source of capabilities)—comprehensively cover elements required for strategic decision-making.

3C Analysis Implementation Process - Investigation Methods

Investigation Discovery 1: Concrete 3C Analysis Example (New Coffee Chain Market Entry Strategy)

Case Evidence:

Customer Analysis:

・Market size: Domestic cafe market $25B, annual growth 3%

・Main segments: "Time efficiency focused," "Experience focused," "Price focused"

・Unmet needs: "Health consciousness," "Remote work support," "Personalization"

・Purchase behavior: Smartphone ordering proliferation, subscription preference expansion

・Future trends: Personalization, sustainability

Competitor Analysis:

・Starbucks: Experience value and brand power strengths, high price range

・Doutor: Price competitiveness and location number strengths, differentiation shortage

・Tully's: Mid-price range, unclear distinctive positioning

・Convenience store coffee: Price and convenience strengths, experience value shortage

・New entrants: Premium-oriented chains like Blue Bottle emerging

Company Analysis:

・Strengths: IT technology, data analysis capability, financial resources

・Weaknesses: Lack of store operation experience, zero brand recognition

・Owned resources: Excellent engineers, AI technology, VC funding

・Constraints: Lack of physical store know-how, recruitment capacity shortage

・Corporate philosophy: Revolutionize customer experience through technology

Investigation Discovery 2: 3C Interrelationship Analysis

Strategic Insight Extraction:

Customer × Competitor Relationship:

・Existing competitors inadequately address "health consciousness" needs

・Differentiation opportunity through personalization

・Cannot win price competition against convenience stores

Customer × Company Relationship:

・Can provide personalized services through IT technology

・Can predict and propose needs through data analysis

・Lack of store experience critically impacts customer experience

Competitor × Company Relationship:

・Can differentiate from existing competitors through technology

・Lack of brand power is significant handicap

・Can secure opening speed through financial resources

Three-way Integrated Strategic Insight:

"Technology-driven personalization × health consciousness"

strategy targeting unmet market is optimal solution

Investigation Discovery 3: Analysis Depth Levels

Level 1 (Surface Information Gathering):

・Organization and classification of public information

・Basic market data comprehension

・Competitor product and price information

Level 2 (Structural Analysis):

・Background factor analysis of customer behavior

・Estimation of competitor strategic intentions

・Objective evaluation of company capabilities

Level 3 (Insightful Integration):

・Understanding 3C interrelationships

・Discovery of strategic opportunities

・Identification of differentiation points

The Power of 3C Analysis - Hidden Truths

Alert File 1: Strategic Thinking Foundation Construction Provides a strategic thinking foundation by structuring seemingly complex market environments through three basic elements. Functions as a highly versatile thinking framework applicable to any business field.

Alert File 2: Balanced Analytical Perspective Prevents biased analysis from companies overly focused on customers, competitor analysis, or inward thinking. Forces balance among three perspectives to prevent oversights.

Alert File 3: Strategic Opportunity Discovery Analyzing interrelationships among three elements reveals strategic opportunities invisible individually. Identifies blank zones like "customers seek but competitors don't provide" or "company excels but market underutilizes."

Alert File 4: Foundation for Other Analytical Methods Functions as starting point for more detailed analytical methods like SWOT, PEST, and 5F analysis. Enables efficient approach of grasping overall picture through 3C before proceeding to specialized analysis as needed.

Limitations and Cautions of 3C Analysis - Potential Dangers

Alert File 1: Surface Information Gathering Syndrome Most frequent problem. Cases where satisfaction with organizing information about three elements prevents reaching strategic insight extraction. Risk of illusion that "investigating" equals "analyzing."

Alert File 2: Static Analysis Limitations Confined to single-point 3C analysis, unable to capture dynamic changes. Particularly in digital era's rapid environmental changes, risk of analysis results quickly becoming obsolete.

Alert File 3: Qualitative Information Bias Tendency toward qualitative over quantitative data, making objective evaluation and comparison difficult. Risk of flowing into intuitive judgment.

Alert File 4: Analysis Scope Ambiguity Risk of reaching inconsistent conclusions when proceeding with analysis while definitions of "customer," "competitor," and "market" remain vague. Clarifying analytical prerequisites and scope is essential.

Alert File 5: Company Analysis Subjectivity Particularly in Company analysis, wishful thinking and underestimation easily infiltrate. Objective third-party perspective and quantitative data support are crucial.

Applications and Related Methods of 3C Analysis - Related Case Files

Related Evidence 1: Integrated Use with SWOT Analysis

3C Analysis → SWOT Analysis flow:

Customer/Competitor → Opportunities (O) and Threats (T)

Company → Strengths (S) and Weaknesses (W)

More detailed and structured analysis possible

Related Evidence 2: Integration with PEST Analysis

PEST Analysis (Macro Environment) → 3C Analysis (Micro Environment)

Analyzing impact of environmental changes on 3C

Strategic response planning for environmental changes

Related Evidence 3: Combination with 5F Analysis

3C → Basic market structure understanding

5F → Detailed analysis of industry profitability and competitive structure

Comprehensive strategic analysis through integration

Related Evidence 4: Digital Era 3C Evolution

・Customer: Digital behavioral data utilization

・Competitor: Platform companies and ecosystem competition

・Company: Digital asset and AI capability evaluation

・Real-time analysis and continuous monitoring

Related Evidence 5: Development into 4C Analysis

3C + Channel (Distribution) = 4C Analysis

Distribution strategy importance in omnichannel era

Integrated analysis of digital and physical channels

Related Evidence 6: Startup-focused 3C

・Customer: Persona and Jobs-to-be-Done theory utilization

・Competitor: Analysis of alternative solutions, not just direct competitors

・Company: Integration with MVP and Lean Startup

・Integration with high-speed hypothesis validation cycles

Conclusion - Investigation Summary

Final Investigator Report:

3C Analysis represents "the eternal standard of strategic analysis." Market structuring through three basic elements—Customer, Competitor, and Company—has functioned as the starting point of strategic planning for over 40 years from the 1980s to present. This is not coincidental but results from high theoretical completeness that covers necessary elements for strategic decision-making without excess or deficiency.

The most important discovery in this investigation is that the true value of 3C analysis lies not in "information gathering" but in "insight generation through interrelationship analysis." While many companies are satisfied with organizing information about each C, true strategic value emerges from the interaction among the three elements. The discovery of strategic opportunities invisible through individual analysis—such as "areas customers seek but competitors don't provide" or "untapped markets where company strengths can be leveraged"—represents the essential value of this methodology.

The "foundational nature" of 3C analysis also emerged as an important characteristic. It functions as the starting point for more specialized analytical methods like SWOT analysis, PEST analysis, and 5F analysis. The staged approach of first grasping the overall picture through 3C, then proceeding to detailed analysis as needed, enables efficient and systematic strategic analysis.

However, the "necessity for evolution" in the digital age also became apparent. Response to elements unimaginable in the 1980s—platform competition, ecosystem strategies, real-time data utilization—is now required. Yet the value of 3C as a fundamental thinking framework remains unchanged. What's important is reinterpreting this classical framework in contemporary context while incorporating new elements.

Strategic Analysis Maxim: "Superior strategy means understanding customers' true needs, differing from competitors' methods, and maximizing company strengths."

Case Closed