ROI【🔏CLASSIFIED CASE FILE】 No. X017 | What is Value Chain Analysis

📅 2025-06-17

🕒 Reading time: 9 min

🏷️ Value Chain Analysis 🏷️ Learning 🏷️ 【🔏CLASSIFIED CASE FILE】

- What is Value Chain Analysis - Case Overview

- Basic Structure of Value Chain Analysis - Evidence Analysis

- Value Chain Analysis Implementation Process - Investigation Methods

- The Power of Value Chain Analysis - Hidden Truths

- Limitations and Cautions of Value Chain Analysis - Potential Dangers

- Evolution and Related Methods of Value Chain Analysis - Related Case Files

- Conclusion - Investigation Summary

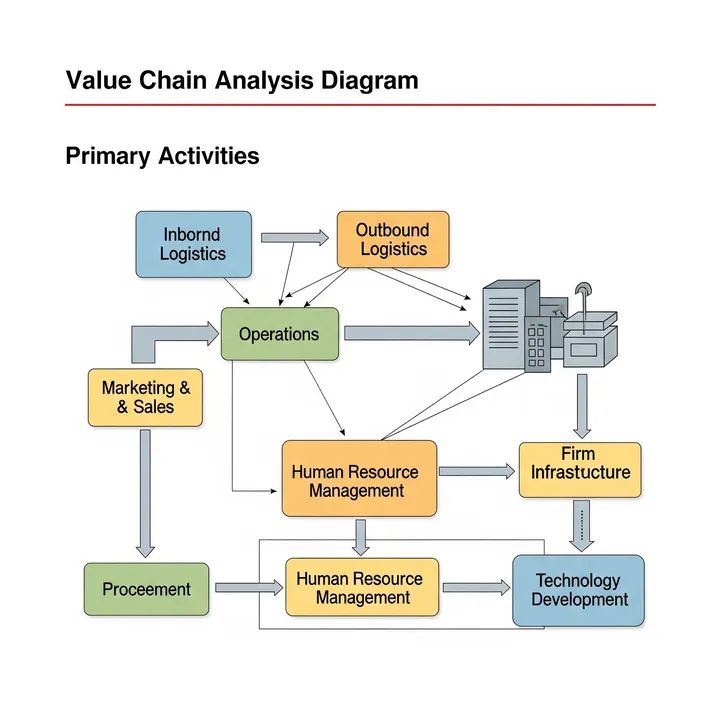

Detective's Note: A methodology frequently observed among strategic consultants and business improvement specialists - "Value Chain Analysis." This theory, proposed by Professor Michael Porter of Harvard Business School in 1985, allegedly possesses the power to decompose all corporate activities into nine components from a "value creation" perspective, identifying sources of competitive advantage. However, reports consistently indicate that many companies merely end with "business activity enumeration," failing to reach strategic insights about "where value should be created and where costs should be reduced." Why is it important to view corporate activities as a "chain"? We must uncover the true identity of the value creation mechanism and how nine activities generate genuine competitive advantage.

What is Value Chain Analysis - Case Overview

Value Chain Analysis - proposed by Professor Michael Porter in his 1985 book "Competitive Advantage." This strategic framework classifies all corporate activities into nine categories: five primary activities and four support activities, analyzing how each activity creates value and contributes to competitive advantage. While recognized among our clients as "a fundamental tool for business analysis," voices from the field frequently report "satisfaction with activity classification" and "utilization only as a cost reduction tool," with insufficient strategic application from a value creation perspective.

Investigation Memo: Structuring corporate activities through nine activities. Seemingly complex, yet behind this lies a clear purpose: optimizing "the entire flow of delivering value to customers." We must uncover why these specific nine activities and how inter-activity relationships generate competitive advantage.

Basic Structure of Value Chain Analysis - Evidence Analysis

Primary Evidence: The Nine Activities of Value Chain

Primary Activities - Direct Value Creation Activities

Inbound Logistics

"Procurement, receiving, and storage of raw materials and components"

・Supplier management and procurement strategy

・Inventory management and quality control

・Receiving inspection and warehouse management

・Procurement cost optimization

Operations

"Production and processing of products and services"

・Production processes and quality management

・Equipment utilization and production efficiency

・Technology and know-how accumulation

・Production cost optimization

Outbound Logistics

"Storage, delivery, and distribution of finished products"

・Inventory management and delivery systems

・Logistics networks and delivery efficiency

・Customer delivery schedule management

・Logistics cost optimization

Marketing & Sales

"Customer acquisition and sales promotion activities"

・Branding and advertising

・Sales activities and sales channels

・Pricing strategy and customer management

・Contribution to revenue expansion

Service

"After-sales service and customer support"

・Maintenance and service

・Customer support and complaint handling

・Upgrades and additional sales

・Customer satisfaction and loyalty improvement

Support Activities - Indirect Value Creation Activities

Firm Infrastructure

"Management and organizational operations"

・Strategic planning and financial management

・Legal, general affairs, and management

・Organizational structure and governance

・Management quality improvement

Human Resource Management

"Recruitment, development, and management of personnel"

・Recruitment strategy and talent development

・Evaluation systems and compensation management

・Organizational culture and engagement

・Human resource optimization

Technology Development

"Research & development and technological innovation"

・Product development and technical research

・Process improvement and digitalization

・Patent and intellectual property management

・Technology competitiveness enhancement

Procurement

"Purchasing of materials, equipment, and services"

・Purchasing strategy and supplier selection

・Cost management and quality assurance

・Contract management and risk management

・Procurement efficiency optimization

Evidence Analysis: The brilliance of Value Chain lies in viewing corporate activities as a "flow of value creation," emphasizing inter-activity relationships and overall optimization. Primary activities directly connect to customer value, while support activities are clearly designed to enhance efficiency and differentiation of primary activities.

Value Chain Analysis Implementation Process - Investigation Methods

Investigation Discovery 1: Concrete Value Chain Analysis Example (Apparel Company)

Case Evidence:

Primary Activity Analysis:

Inbound Logistics:

・Fabric and accessory procurement (Asia-focused)

・Quality control and inventory optimization

・Supplier relationship building

・Procurement cost: 35% of revenue

Operations:

・Design and pattern creation

・Sewing and finishing processes

・Quality inspection and product completion

・Manufacturing cost: 20% of revenue

Outbound Logistics:

・Distribution center and store delivery

・Inventory management and demand forecasting

・Delivery efficiency and lead time

・Logistics cost: 8% of revenue

Marketing & Sales:

・Branding and advertising

・Store operations and e-commerce sales

・Promotional activities and customer acquisition

・Sales expense: 25% of revenue

Service:

・After-care and repairs

・Customer support and return handling

・Member services and loyalty programs

・Service cost: 3% of revenue

Support Activity Analysis:

Technology Development:

・Product planning and design development

・Material technology and manufacturing technology

・IT systems and digital utilization

・Development cost: 5% of revenue

Human Resource Management:

・Securing excellent designers and merchandisers

・Store staff and headquarters personnel

・Training and evaluation systems

・Personnel cost: 15% of revenue

Firm Infrastructure:

・Management and financial management

・Store expansion strategy and organizational operations

・Governance and risk management

・Indirect cost: 7% of revenue

Procurement:

・Store equipment and IT systems

・External services and consulting

・Capital investment and maintenance

・Other procurement: 2% of revenue

Investigation Discovery 2: Competitive Advantage Source Analysis

Value Creation Point Identification:

Strength Sources:

・Technology Development: Unique material and functionality development capability

・Marketing: Strong brand power and customer base

・Operations: Quality control and short delivery response capability

・Inbound Logistics: Strong relationships with suppliers

Improvement Points:

・Outbound Logistics: Excess inventory and delivery efficiency improvement opportunities

・Service: Digitalization and customer experience enhancement

・Human Resources: Shortage of digital and global talent

Differentiation Opportunities:

・Technology × Marketing: Functionality × Design aesthetics

・Operations × Logistics: On-demand production systems

・Service × Technology: Personalization

Investigation Discovery 3: Inter-Activity Coordination Analysis

Importance of Cross-Functional Coordination:

Technology Development ↔ Marketing:

Synergy between new material development and brand value enhancement

Operations ↔ Outbound Logistics:

Integrated optimization of production planning and delivery planning

Human Resources ↔ Service:

High-quality service provision through excellent personnel

Procurement ↔ Inbound Logistics:

Raw material cost optimization through strategic procurement

The Power of Value Chain Analysis - Hidden Truths

Alert File 1: Competitive Advantage Source Identification Identify specifically which activities generate competitive advantage rather than vague "strengths." Transform abstract expressions like "technical capability" or "sales force" into actual value creation mechanism clarification.

Alert File 2: Cost Structure Visualization Clarify cost allocation for each activity, making cost reduction priorities clear. Achieve value creation efficiency improvement rather than simple cost reduction from an overall optimization perspective.

Alert File 3: Business Process Optimization Guidelines Enable overall optimal business process design rather than partial optimization by analyzing inter-activity coordination. Eliminate silo organization disadvantages and build cross-functional value creation systems.

Alert File 4: Outsourcing Decision Criteria Provide strategic decision criteria for which activities to internalize and which to outsource. Determine optimal business scope based on core competence relationships and competitive advantage contribution.

Limitations and Cautions of Value Chain Analysis - Potential Dangers

Alert File 1: Manufacturing-Centered Design Limitations As a 1985 theory premised on manufacturing, activity classification has limitations when applied to service industries or digital companies. Forced application risks reducing analysis accuracy.

Alert File 2: Static Analysis Constraints Confined to single-point activity analysis, unable to capture dynamic changes or time-series value creation processes. Particularly difficult to address iterative processes like agile development or design thinking.

Alert File 3: Quantification Difficulties Accurate measurement of each activity's value contribution and cost allocation is often difficult. Tendency to rely on subjective judgment, risking objectivity of analysis results.

Alert File 4: Organizational Boundary Ambiguity In digital era ecosystem-type businesses, enterprise boundaries become ambiguous, increasing value creation that traditional Value Chain concepts cannot capture.

Alert File 5: Activity Classification Rigidity Risk of mechanically adhering to nine-activity classification, overlooking company-specific important activities or new value creation activities. Risk of losing essence by forcing into frameworks.

Evolution and Related Methods of Value Chain Analysis - Related Case Files

Related Evidence 1: Digital Era Value Chain Evolution

・Activity sophistication through data and AI utilization

・Real-time optimization through IoT and sensors

・Platform-type business model adaptation

・Customer co-creation and open innovation integration

Related Evidence 2: Service Industry Value Chain

Primary Activity Reinterpretation:

・Input → Output → Delivery

・Customer touchpoint and experience design emphasis

・Intangible asset and human resource value evaluation

・Service quality and customer satisfaction measurement

Related Evidence 3: Value Network Theory

Chain (unidirectional) → Network (multidirectional)

・Value co-creation among multiple companies

・Value optimization across entire ecosystems

・Platform and multi-sided markets

・Value analysis across all stakeholders

Related Evidence 4: Integration with 3C Analysis and 4P analysis

3C Analysis → Value Chain Analysis flow:

・Customer: Customer value contribution analysis for each activity

・Competitor: Competitive Value Chain comparison

・Company: Activity-specific competitive capability evaluation

Integration with 4P [4P analysis](/behind_case_files/articles/X007_4P):

・Product: Technology development and operations activities

・Price: Cost structure and pricing activities

・Place: Outbound logistics and sales channel activities

・Promotion: Marketing and sales activities

Related Evidence 5: Combination with VRIO Analysis

Value Chain → Activity identification

VRIO Analysis → Competitive advantage evaluation of each activity

・Rarity and inimitability analysis of value creation activities

・Relationship analysis between organizational capabilities and activity efficiency

・Sustainable competitive advantage activity foundation identification

Conclusion - Investigation Summary

Final Investigator Report:

Value Chain Analysis represents "a precision surgical knife for dissecting corporate activities from a value creation perspective." Nearly 40 years have passed since Professor Michael Porter proposed it in 1985, yet its fundamental value of systematically analyzing corporate activities and identifying sources of competitive advantage remains undiminished.

The most impressive aspect of this investigation was Value Chain analysis's "overall optimization thinking." Rather than merely analyzing nine activities individually, it possesses the power to guide organizational management prone to partial optimization toward overall optimization by focusing on inter-activity coordination and synergy effects. The insight that coordination between activities—such as "Technology Development × Marketing" or "Operations × Logistics"—generates true competitive advantage remains extremely effective today.

However, "application limitations" in the digital age also became clear. The 1985 manufacturing-centered design often cannot adequately analyze service industries, platform companies, or ecosystem-type businesses. To address this challenge, evolution that maintains Value Chain's basic philosophy (structuring value creation processes) while adapting to contemporary business models is necessary.

It also became evident that Value Chain analysis demonstrates its true value through integration with other strategic analysis methods. Understanding market structure through 3C analysis, evaluating competitive advantage of each activity through VRIO analysis, and implementing through 4P analysis for marketing strategy. This series of flows enables consistent strategic planning from analysis to execution.

The most important discovery is that Value Chain analysis's true value lies not in "activity classification" but in "understanding value creation mechanisms." Deep understanding of which activities generate customer value and contribute to competitive differentiation dramatically improves strategic decision-making quality.

Value Creation Maxim: "Superior companies do not optimize all activities individually, but create maximum value as a whole through inter-activity coordination."

Case Closed

Solve Your Business Challenges with Kindle Unlimited!

Access millions of books with unlimited reading.

Read the latest from ROI Detective Agency now!

*Free trial available for eligible customers only